Consumer Sentiment Remains Low

According to the most recent Thomson Reuters/University of Michigan preliminary index of consumer sentiment, US consumers remained widely cautious of the US economy’s near term future. Incidentally, sentiment seems to be exacerbated by recent increases in payroll taxes – a result of recent Fiscal Cliff resolutions.

Headline readings for the January report dipped to 71.3, against estimates of a rise to 75.1. The figure was a declining continuation from December’s 72.9 and the second monthly plunge since the survey hit 84.9 back in November – a 2012 high.

Subindex readings weren’t that much better as futures expectations continued to lose ground, dipping to the lowest in over a year. Meanwhile, current conditions remain comparatively stable, losing a few points to print at 84.8.

Overall the report remains bullish for the US Dollar as it reinforces the argument for continued Fed monetary assistance throughout the next 11 months – bucking previous contention that the world’s largest economy was well on its way to recovery.

Congressional Stalemate Forcing a Deal?

With Treasury officials noting the near term breach of the looming debt ceiling, speculation has surfaced of a potential short term deal that would allow for extensions in the debt limit for another two months. With the government en route to exceed the $16.4 trillion levels in mid-February, and both political sides still reeling from the Fiscal Cliff debate, political leaders are floating the idea of delaying the ultimate decision till April. The month coincides with a vote on the Senate’s budget hearing.

Although not as bullish as one would hope for, the news tidbit does alleviate some impending pressure from US dollar bears as the measure will allow both sides more time in forming a resolution.

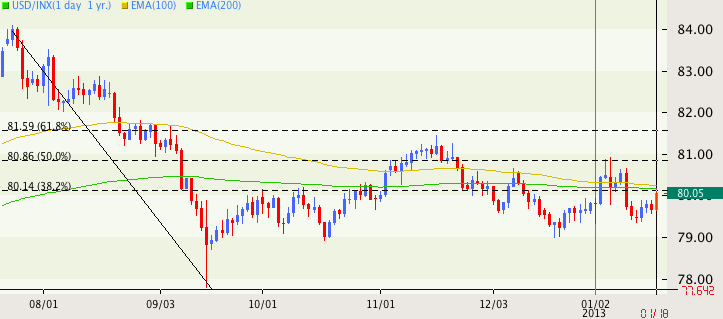

USD Index Runs Into Resistance

Now bouncing off of support via the 79.56 figure, the US Dollar Index has advanced on major resistance at 80.14. The figure is being reinforced by the 38.2% fib resistance figure and a confluence of both the 100 and 200 EMAs. Failure to rise above would force a test of 79.49 support.

Source: FXTrek Intellicharts

Source: FXTrek Intellicharts

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.