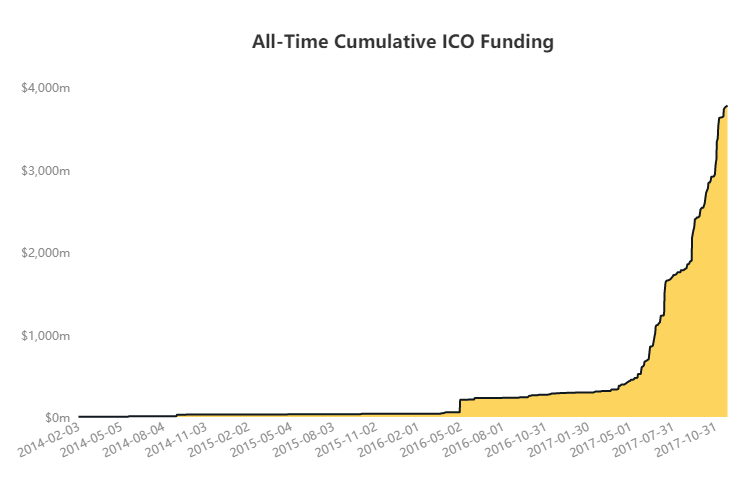

2017 was the mania year of cryptocurrencies without a doubt, ICOs (Initial coin offering) exploded in 2017 raising more then $3.5 billion in cryptocurrency and currently there are more then 1,400 new coin in the market compared to six years ago as bitcoin was the only cryptocurrency people talked about.

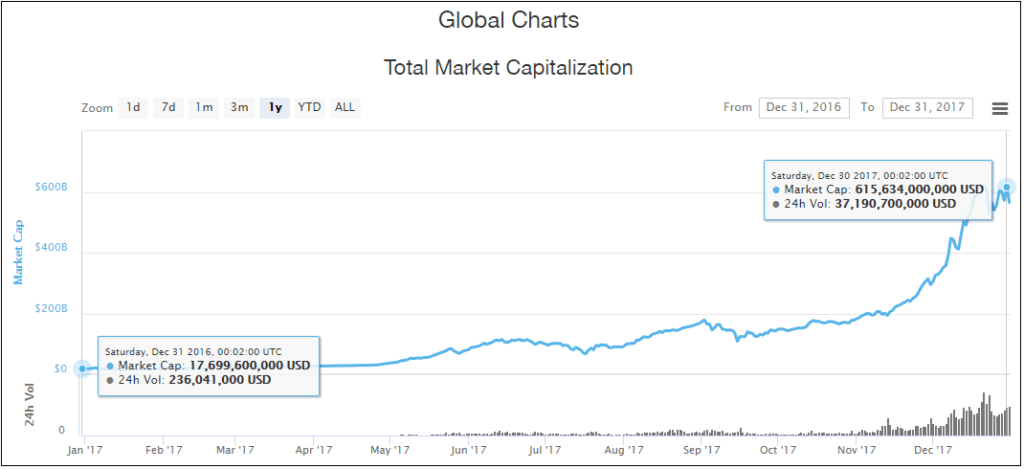

The cryptocurrency market continued its growth in 2017 as the total market capitalization grew from 17 billion to 600 billion with prices surging to record new highs during the whole year.

Cryptocurrencies Market Capitalization in 2017

Bitcoin had a very good year up more than 1,300% and its price reached $19.500. However, despite its headline-grabbing performance, Bitcoin was one of the worst performers among the top 10 cryptocurrencies by market capitalization compared to the +9.000% gains achieved by Ethereum and the outstanding +35.000% done by Ripple.

Cryptocurrencies Return in 2017

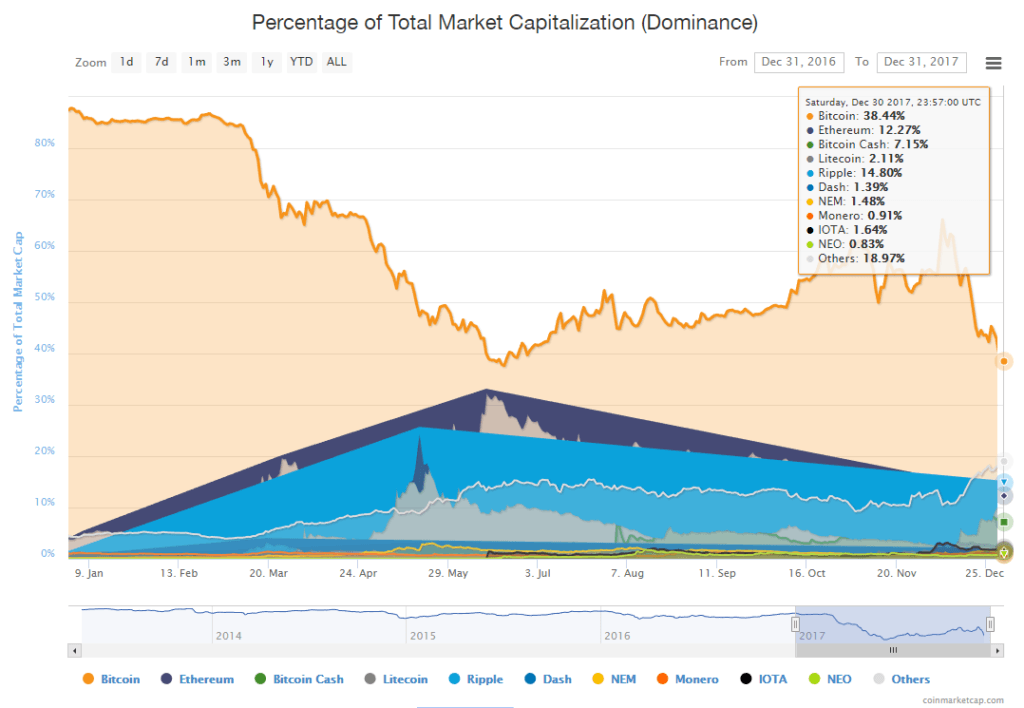

At the beginning of 2017, bitcoin had an 88% share of the cryptocurrency market. Ethereum had only four percent, and bitcoin cash was non-existent. As 2017 come to an end, the market share of bitcoin shrunk by more then half to 38% percent reflecting the shift in the digital market.

The latest news by the end of 2017 was about Bitcoin entering Wall Street as it become accessible for trading on two futures exchanges which opens the door for institutional investors and new type of traders to enter the market.

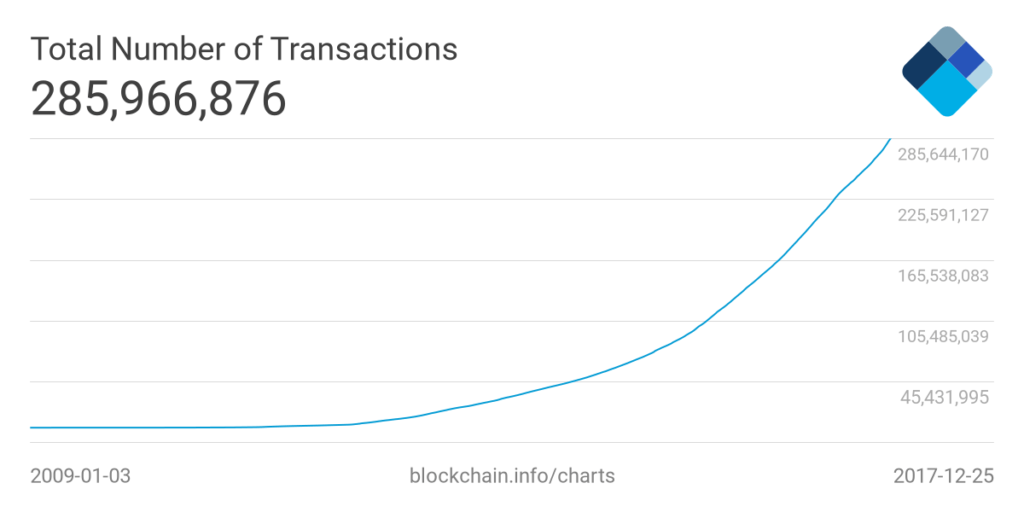

The higher demand for the digital currency in the world is one of the main reasons driving the prices higher as this is a basic economic fact. The below chart showing total number of Bitcoin transaction since 2009 shows the exponential growth seen in the crypto-world as more people started using Bitcoin for many different reasons.

Bitcoin Total Number of Transactions

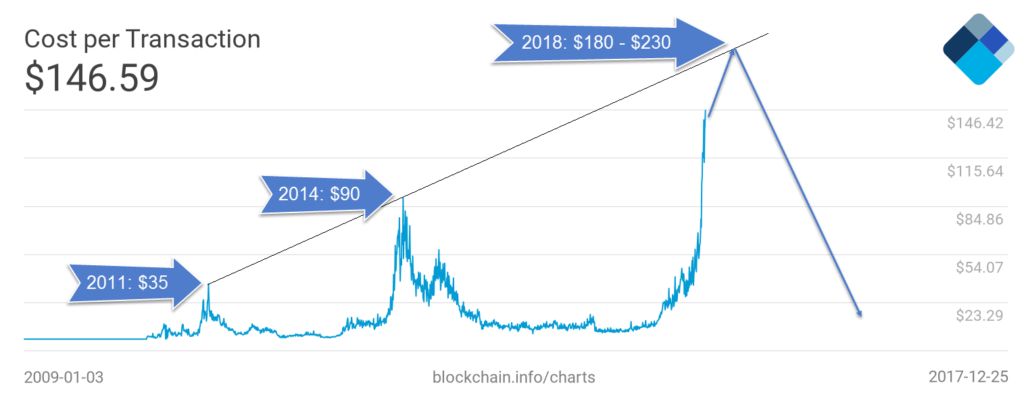

The chart below is showing miners revenue divided by the number of transactions which gives the cost per transaction for Bitcoin which is one of the disadvantage facing users and most likely the fees will keep rising during 2018 to reach new levels around ( $180 – $230 ).

Bitcoin Cost per Transactions

Recap:

Cryptocurrencies are entering an important era with the recent introduction of Bitcoin into the futures market and the prices of alt-coins exploding to the upside driving the market capitalization higher which can reach 1 Trillion during this year.

Become a Successful Trader and Master Elliott Wave like a Pro. Start your Free 14 Day Trial at - Elliott Wave Forecast.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.