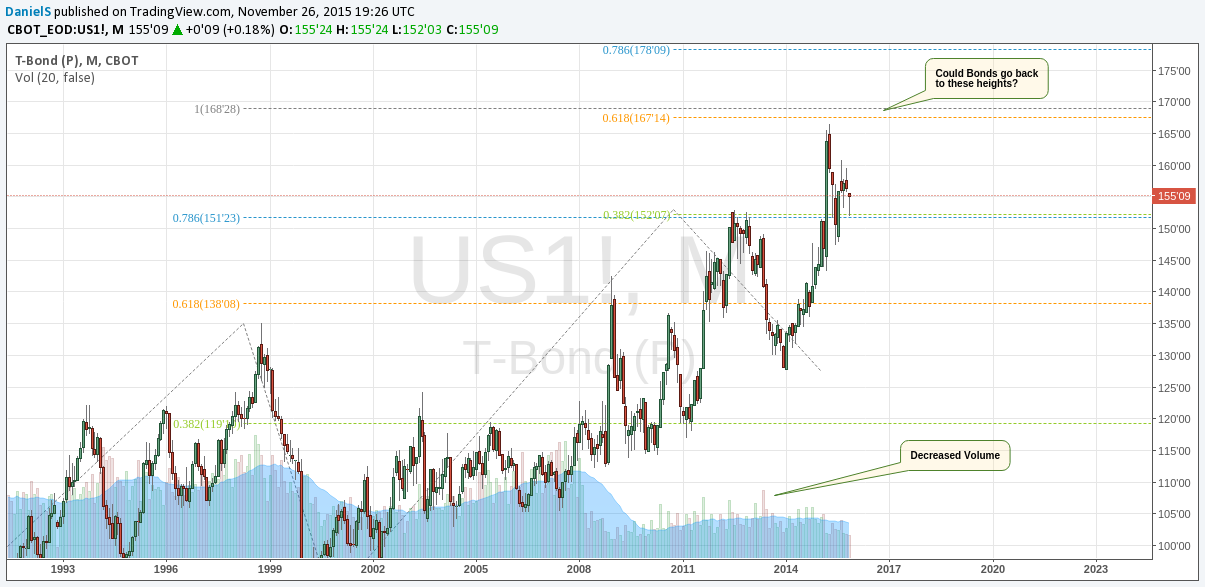

While the story for Europe is quite clear, the US treasury market should not be displaying the same symptoms. The lower futures market volume suggests a price move with no substance. That always brings a disturbing feeling in my gut. The truth is that despite the raging battle in Syria, investors are relatively confident that all hell does not break loose, no matter how many jets Turkey shoots down. As the Federal reserve meeting draws ever closer, the bond markets remain on high alert.

It is Thanksgiving in the US, the market is out of action as US traders take out their frustration on Turkeys. It will be interesting to see if all hell breaks loose on the FED interest D-day for bonds, but truth be told, even a 10 basis point hike will be enough to send bonds to the floor. US T-Bond futures are at their highest price since 1978 with no volume in sight. I wonder who is buying all those futures? Bonds away!!

Future stocks and stocks currently trending have large potential rewards but also large potential risk. You must be aware of the risk and be willing to accept them in order to invest in future stocks & FX markets. Don't trade with money you can't afford to lose. This video is neither a solicitation nor an offer to buy/sell future stocks or FX. No representation is made that any account will or is likely to achieve profits or losses similar to those discussed here. Past performace of indicators or methodology are not necessarily indicative of future results.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.