The EURUSD has surrendered its gains from yesterday after the euro bears were provided with encouragement following Mario Draghi repeating his dovish view on the Eurozone economy during his conference in Frankfurt. The ECB president once again made clear the possible need for increased stimulus to support the European economy which encouraged sellers and sent the EURUSD back below 1.07. Investors in particular saw Draghi’s remarks about the central bank doing what it must to boost dangerously low inflation in Europe as an indication that the ECB are likely to further monetary easing. With expectations increasing that the ECB is close to taking further action, the EURUSD is likely to remain depressed and opened to further losses.

Technically the EURUSD is bearish and the continual strong divergence in both monetary and economic sentiment between the United States and Europe has consistently encouraged sellers to harass this pair. Prices are trading below the daily 20, 50 and 200 SMA and the MACD has crossed to the downside. The previous resistance at 1.075 may invite an opportunity for sellers to send prices towards 1.055.

Dollar weakness offered Gold bulls a false lifeline and as a result the commodity appreciated almost $20 from its five year lows this week. This yellow metal remains fundamentally bearish and completely dictated by US interest rate expectations in which the Fed futures predict a near 70% likelihood of the Fed acting in December. Gold remains vulnerable and open to further losses as expectations mount on the Fed taking action next month, and if these expectations materialize then this zero yielding metal may decline back towards $1050 and lower.

Next week the focus will likely be directed towards the European PMI releases which may offer clarity on the level of optimism purchasing managers have on the economic health of the European manufacturing sector. The PMI results have been following a downwards trajectory and if this pattern follows, then more pressure may be directed on the ECB to provide further monetary easing as a means of boosting European economic growth and optimism.

NZDCHF

The NZDCHF is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. A breakout above the 0.6700 resistance may open a path to the next relevant level at 0.6850.

GBPSEK

The GBPSEK is technically bullish on the daily timeframe as there have been higher highs and higher lows. Prices are trading above the daily 20 and 50 SMA with the MACD pointing to the upside. A solid break above 13.300 may invite an opportunity for a further incline towards 13.400.

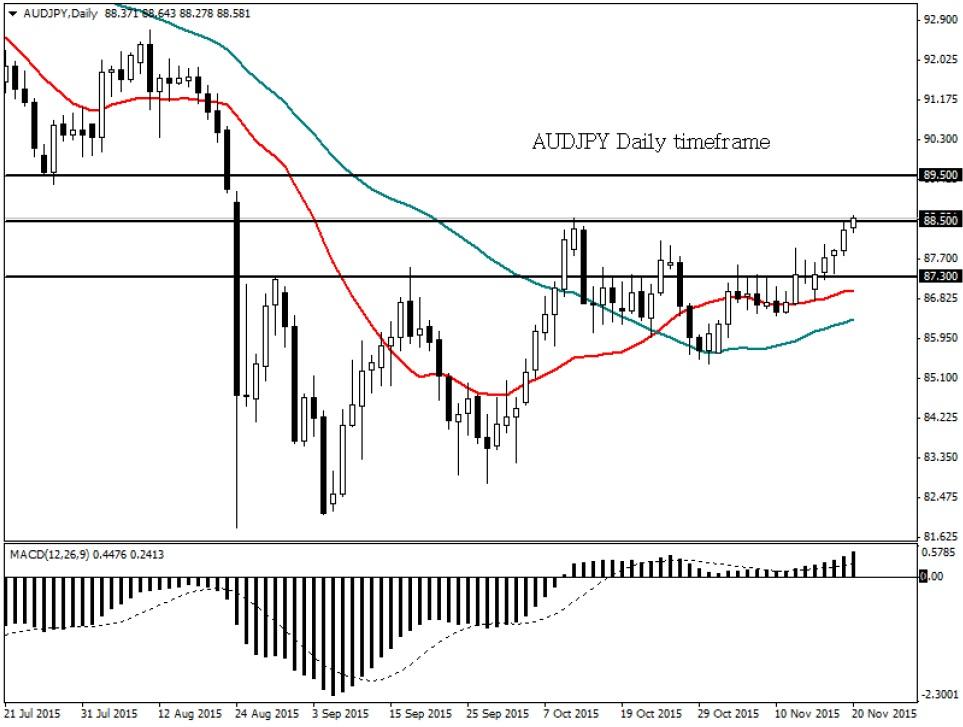

AUDJPY

The AUDJPY is technically bullish on the daily timeframe. Prices have hit the 88.50 resistance and a breakout above this level may open a path to 89.50.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.