The increased confidence investors acquired from the FOMC minutes regarding the high possibility of a US rate rise in December has led to investors unwinding their Dollar positions. While the unwinding of the USD may continue to encourage others to loosen USD positions, the fundamental case for USD strength remains supported, as long as the Federal Reserve raises US interest rates next month.

With the Fed moving closer to raise US rates in the near future, this short term USD weakness may provide an opportunity for devoted bullish investors to reinvest at a reduced price, especially if other central banks such as the Bank of Japan (BoJ) and European Central Bank (ECB) ease monetary policy further. The noticeable depreciation of the USD across the board has offered a false lifeline to assets that were previously being oppressed by Dollar dominance, such as an unexpected Euro that has risen to 1.0762 against the USD.

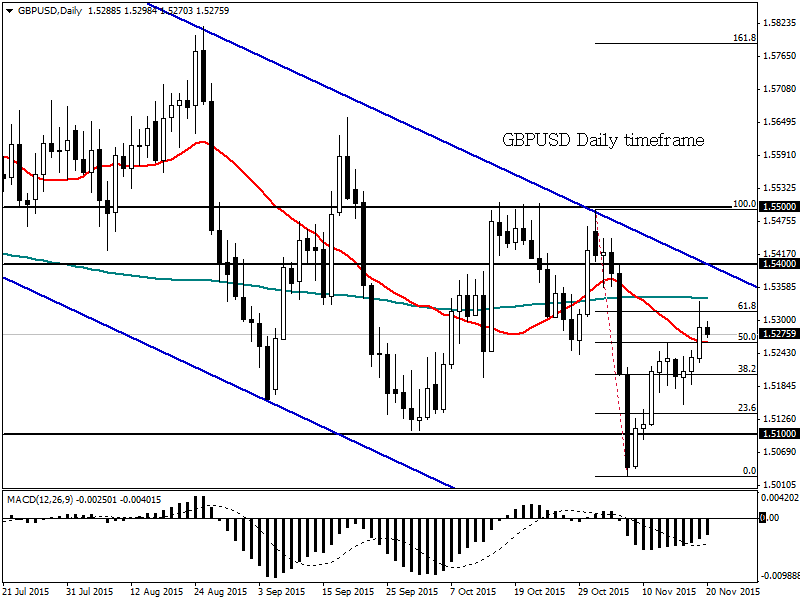

The GBPUSD has appreciated to weekly highs of 1.5335, which has been highly motivated by the unwinding of USD positions and has little to do with improved sentiment towards the Sterling. Recurrent fears over a potential slowdown in economic momentum in the UK economy complimented with the Bank of England’s hesitance towards committing itself to raising UK interest rates will encourage some profit-taking on the GBPUSD. With UK interest rate rise expectations pushed deep into 2016, this relief rally observed in the GBPUSD may offer an opportunity for sellers to send prices back lower.

Technically speaking the GBPUSD remains bearish on the daily timeframe and this rebound may extend to the 61.8% Fibonacci retracement level around 1.53 before sellers bring prices back down towards the relevant 1.5100 support.

Commodity spotlight – WTI

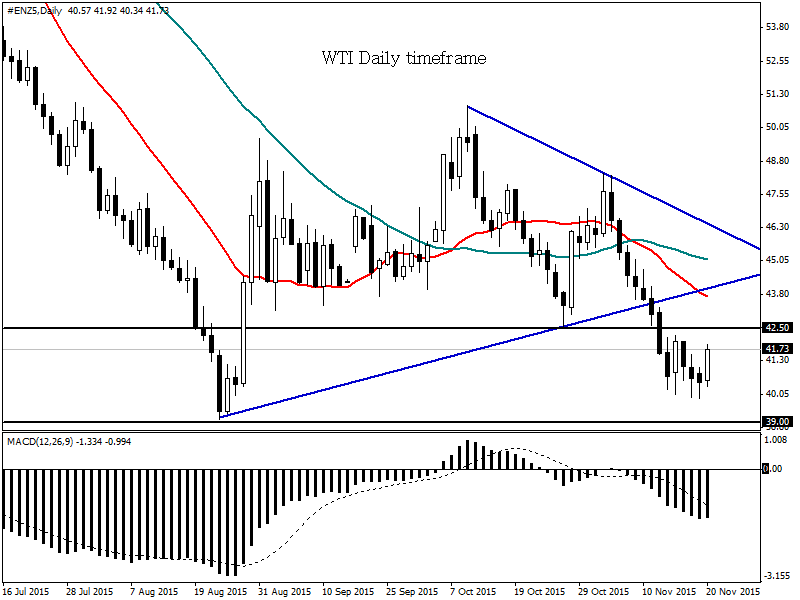

The combination of the persistent and clear signs of there being an aggressive oversupply in the markets and sluggish demand for the commodity due to global concerns have consistently punished the value of WTI oil sending it two month lows below $40. Investor sentiment towards WTI is weak and this relief rally may offer an opportunity for bearish investors to send prices back below $40.

Technically WTI is bearish on the daily timeframe the previous support at $42.50 may act as a dynamic resistance which should invite and opportunity for sellers to send price back down towards $39.00.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.