Global Market

WTI bulls gained inspiration during Tuesday’s trading session when US government data suggested that the global oil supply glut could be diminishing. This unexpected news resulted in the commodity not only advancing $2 but achieving its highest value in over a month at $49.00. This stronger oil price should provide strength to currencies with export linked commodity exports. Despite the inspiration gained by WTI bulls, the global themes concerning the decline in commodity prices, the slowdown in Asia and continual concerns over the pace of growth in Europe and Japan have not changed. Any elevated concerns over the global economy may lead to fears that there will be less demand for oil, which could act as a major catalyst to quell any upside momentum.

Economic data released in early October from the United States offers a valid reason for the Fed to hold off a US rate hike until 2016. Dollar weakness continues to be the theme that runs the global currency markets. Anxious market participants have reduced their bets on a 2015 US rate hike, which has exposed the USD to vulnerability throughout the currency markets. With sentiment turning bearish on the Dollar, the USD index may decline to the next relevant support based at 94.00.

It seems that the increasing speculation that further monetary stimulus is on the way from China has led equity markets higher at the beginning of the week. Although the China markets are closed for the week-long national day holiday, speculation is mounting that the PBoC are about to unleash further stimulus, and this could result in a sharp bounce when the Shanghai Composite Index reopens. While the global equity markets suffered throughout the previous quarter, they have begun the final quarter far more positively and are currently recording strong gains.

USDZAR

The USDZAR remains technically bearish on the daily timeframe as long as prices can keep below the 14.050 resistance. Prices are trading below the 20 Daily SMA and the MACD has crossed to the downside. The next relevant support is based at 13.200.

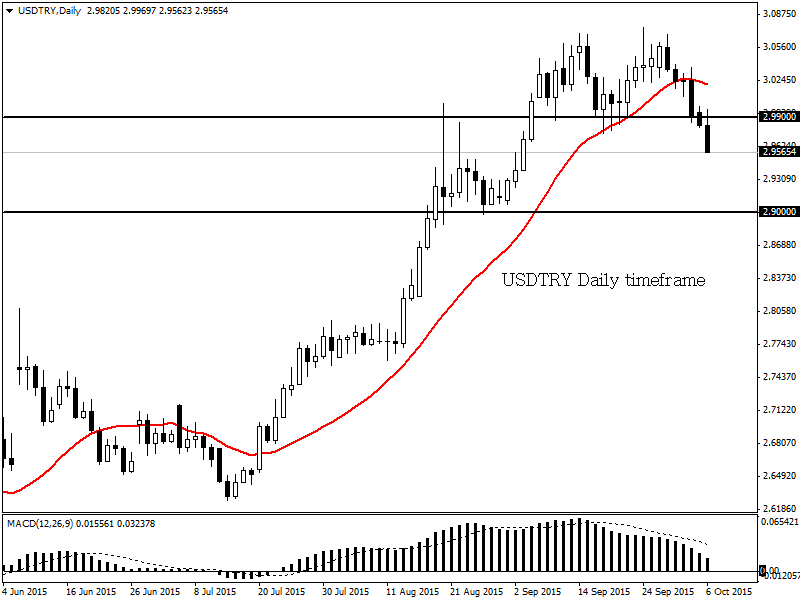

USDTRY

The USDTRY is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD is in the process of crossing to the downside. Previous support at 2.990 may become dynamic resistance which should aid a move to the next relevant support based at 2.900.

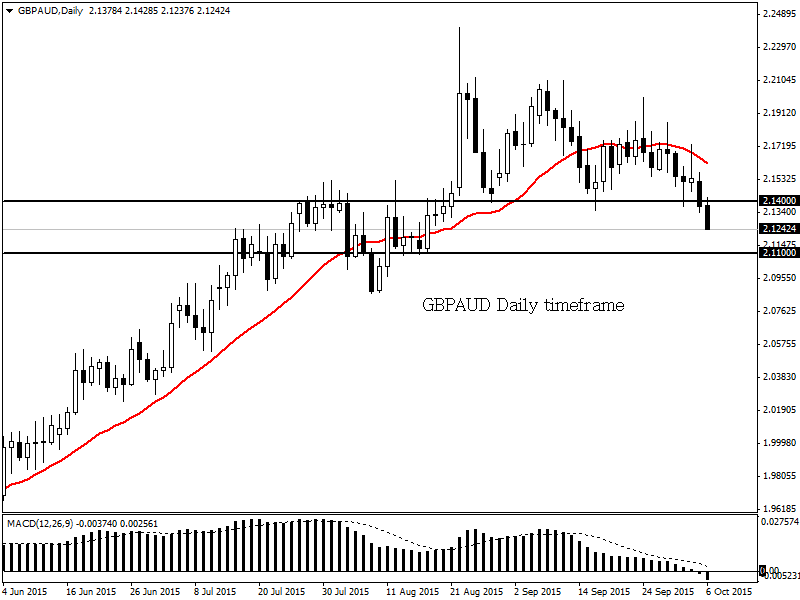

GBPAUD

This pair remains technically bearish on the daily timeframe. Prices have breached the 2.1400 support with the next relevant support based at 2.1100. Prices are trading below the 20 SMA and the MACD has crossed to the downside.

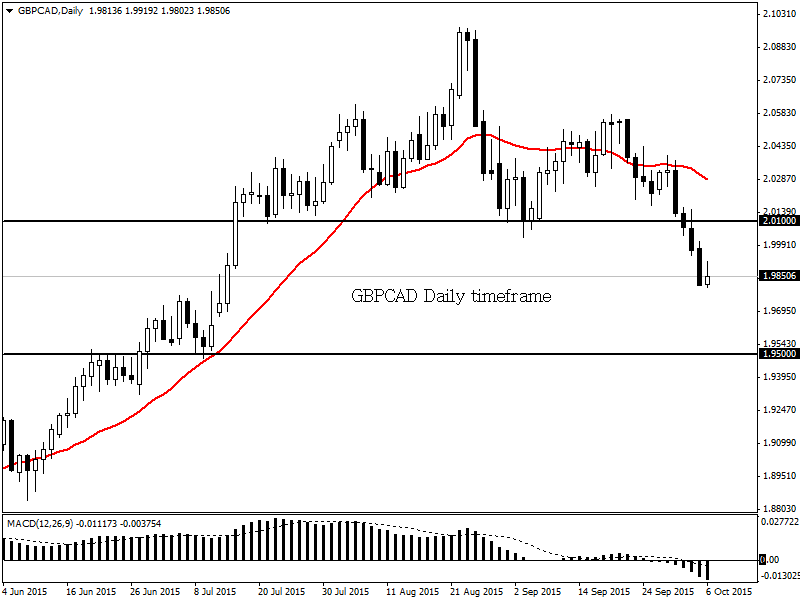

GBPCAD

The GBPCAD remains technically bearish on the daily timeframe as long as prices can keep below the 2.0100 level. The next relevant support is based at 1.9500. Prices are trading below the 20 Daily SMA and the MACD has crossed to the downside.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.