Global Market

Friday’s unimpressive NFP release from the States dealt a sharp blow to the global markets which resulted in the renewal of investor concerns. Sentiment has weakened and this may ripple into equity markets as the prospects of a US rate hike in 2015 slowly diminish. A great deal of anxiety continues to cloud the financial markets including the slowing growth in China, emerging market weakness, stagnant growth in Europe and Japan, and falling commodity prices. This unexpected lower number of jobs created in the United States will encourage anxiety that the US economy might be slowing down, which would weigh heavily on already continual concerns over the global economy.

With US interest rates being left unchanged in September and this NFP hurting investor sentiment, most participants think that the ship has sailed for any US interest rate rise in 2015. The USD is now in a state of heightened sensitivity and any pushed US interest rate expectations will leave the USD exposed and vulnerable to further losses. The Dollar Index which has meandered around the 96.50 regions plummeted to the lows of 95.21 on Friday before clawing back some losses. Additional USD weakness may inspire a bearish move within the Dollar Index to trade to the next relevant support based at 94.00.

Gold was provided with a substantial level of bullish momentum as a result of the USD vulnerability on Friday. This precious metal which had previously been exposed to an extended period of pressure from the prospect of a US rate hike in 2015, surged with aggression clipping above the 1140.0 level. Investor anxiety and renewed concerns about the global markets may aid this yellow metal not only to regain some of its previously lost safe haven glimmer, bur provide a foundation for bulls to send prices to the next relevant resistance at 1154.0.

In the commodities arena, WTI continues to meander within a zone of consolidation with support at $44.00 repelling any attempt for a decline to the downside. The $44.00 support has held since the start of September as the market awaits the next major economic data release or theme. The elevated concerns over the global economy could lead to fears that there will be less demand for oil, which may act as the next major catalyst for a major selloff.

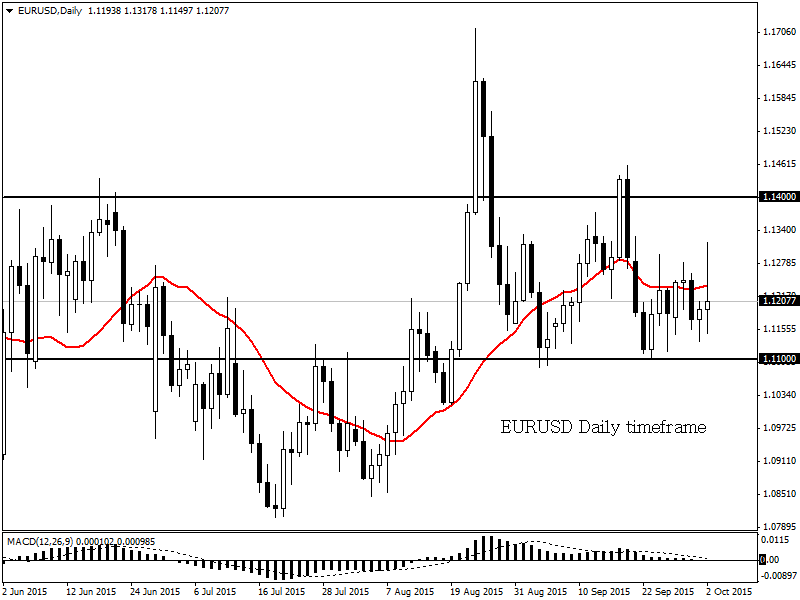

EURUSD

A weak NFP release on Friday has resulted in USD weakness. The EURUSD experienced an upsurge on Friday before gains were taken back before the end of the session. EURUSD must keep above the 1.1100 support for a bullish move to the next relevant resistance at 1.1400.

GBPUSD

Dollar weakness resulted in an upsurge within the GBPUSD on Friday. GBPUSD remains technically bearish on the daily timeframe as long as prices can keep below the 1.5250 resistance. Prices still remain below the 20 daily SMA and the MACD trades to the downside.

AUDUSD

The AUDUSD remains technically bearish on the daily timeframe as long as prices can keep below the 0.7150 resistance. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. The next relevant support is based at 0.6950.

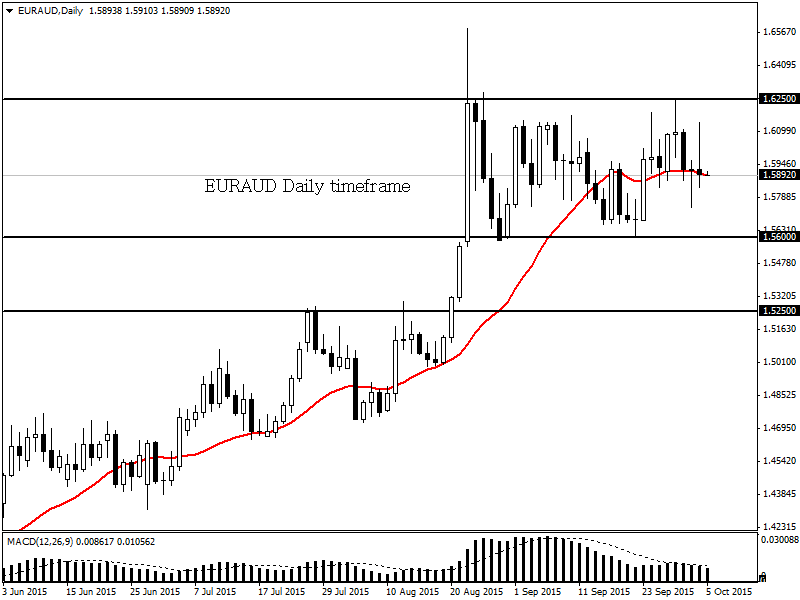

EURAUD

The EURAUD currently trades within a range with support at 1.5600 and resistance at 1.6250. The MACD trades to the upside, but prices marginally trade between the daily 20 SMA. A breakdown below 1.5600 may open a path to the next relevant support at 1.5250.

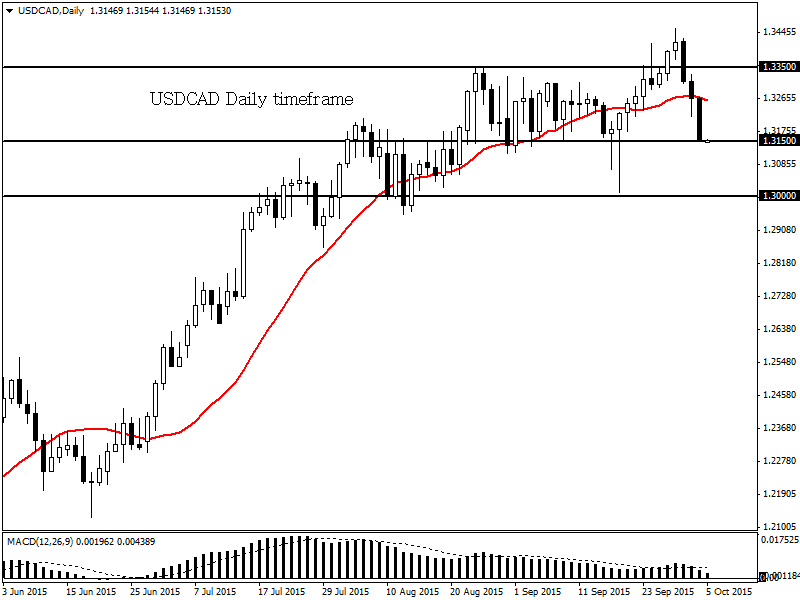

USDCAD

The USDCAD is technically bearish on the daily timeframe. Prices are trading below the 20 daily SMA and the MACD has crossed to the downside. A solid daily close below the 1.3150 support may open a path to the next relevant support based at 1.3000.

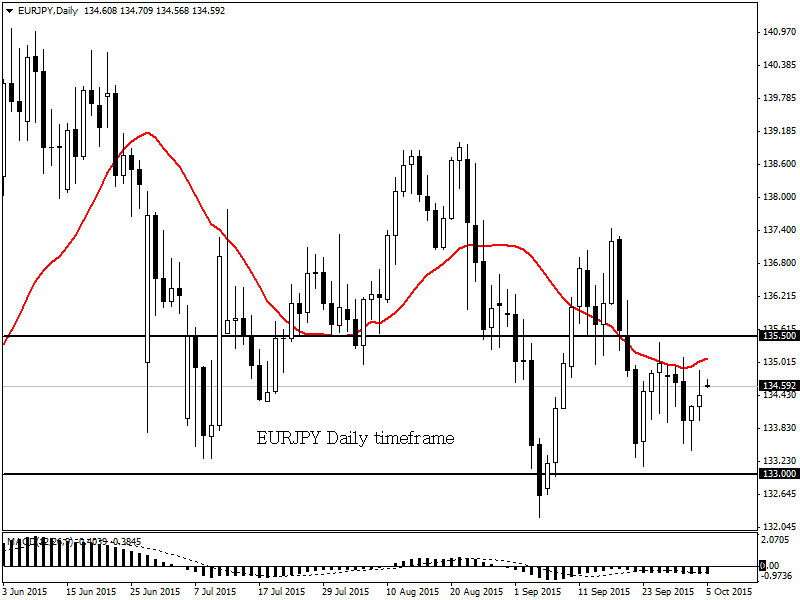

EURJPY

The EURJPY remains technical bearish on the daily timeframe as long as prices can keep below the 135.50 resistance. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. The next relevant support is based at 133.00.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.