Outlook:

Tr ader s went over boar d inter pr eting Yellen's statement and Fischer 's back -up as a rate hike promise before year-end. Yellen said the case for a hike has strengthened and Fischer said a hike is data-dependent—not the same thing as a commitment. But both speakers are experienced in the ways of the market. Without making an explicit promise, they tilted expectations where they wanted them to go. Now the die is cast. There is no way for the Fed to retreat from one hike this calendar year unless incoming data, such as Friday's payrolls, is simply awful—or we get a new global crisis from China or somewhere.

It's interesting that the charts hinted at this outcome (and accordingly, we were long dollars going into the speech), even though we are surprised Yellen and Fischer spoke the way they did. The tone has changed. It remains to be seen whether confidence in the Fed will change, too. On Friday we saw again that the FX rates tracked the fixed income market on a minute-to-minute basis. We now need to watch the bond gang like a hawk.

But wait, there's more. Yellen's topic at Jackson Hole was the central bank toolkit. Based on Fed research, she expressed a preference for more bond-buying programs, a rate cut back to zero and forward guidance, if needed, and declined to name negative rates at all. She brushed off wildcard ideas like raising the inflation target or linking policy to growth or another metric. She also said that monetary policy could use some help in steering the economy and measures outside the Fed's purview that would be welcome include "improving our educational system and investing more in worker training; promoting capital investment and research spending, both private and public; and looking for ways to reduce regulatory burdens while protecting important economic, financial, and social goals."

Of these remarks, the most important are the absence of consideration of negative rates and promoting capital investment, something that can easily be done via tax policy. When Yellen was the San Francisco Fed chief, she was the most straight-talking of all the Feds. She has dialed back her forthrightness as Fed chief, especially after making a rookie mistake or two early on in her tenure, but we have no reason to believe she is misrepresenting the Fed's toolkit stance—no negative rates. At a guess, this is a solid commitment.

And we will probably hear more about goosing capital investment to improve labor productivity, which is needed to get serious wage increases. Yellen was not alone in calling for action on the fiscal side from elected officials. The ECB's Coeure and BoJ chief Kuroda also called for reform, Coeure in order to flip inflation expectations to the upside (but Kuroda having a better chance of getting some real action).

Meanwhile, Bundesbank chief Schaeuble said Germany must not consider taking on new debt after the 2017 election and needs to stick to a balanced budget over the next 4 years to reach the Stability Pact goal of no more than 60% debt-to-GDP. Germany has not met the target since 2002. But austerity was never, ever the right way to overcome deflation and the deflationary mindset, let alone get growth (see Greece).

Here's the question: will the dollar retreat after a too-optimistic rally on the Yellen news? You bet. No market overshoots as much as the FX market. We expect a classic Tuesday pullback as traders see that any Fed funds probability under 50% for a Sept hike is just not convincing. If so, this implies yields will slide back down and one last gasp for the equity market.

But a pullback may not be lasting. The next big data point is Friday's payrolls. We don't have estimates yet but a really big number could keep the ball rolling. And we get personal income and consumption today, along with the PCE version of inflation. Personal income is expected high, 0.4% after 0.2% in June, with consumption in line. We also get Cas*e-Shiller tomorrow and consumer confidence, with productivity and construction spending on Thursday. Analysts will be watching the consumer, over two -thirds of the US economy—his income, his spending, his attitudes.

This week we also get data from Japan, including unemployment, household spending, retail sales and industrial production. We also get the final manufacturing PMI's everywhere and European unemployment. But nobody will pay much attention until the new Abe-Kuroda initiative is unveiled later in September.

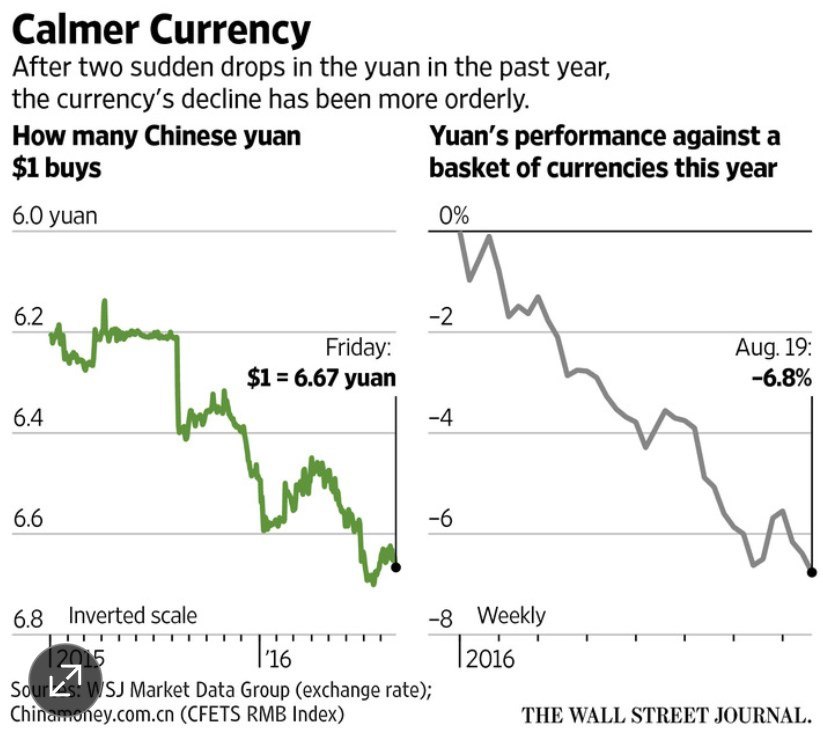

And off on the side, like a hurricane building in the Atlantic, lies China and all its woes. Reuters reports that Chinese consumers and businesses alike are in a limbo state, sitting on a ton of cash but undecided what to do with it. This means that rate-cutting or other central bank initiatives are not in the cards even though they seem obvious. The WSJ notes that another yuan devaluation is widely expected. "Since its devaluation in August 2015, the yuan has depreciated 6.9% against the dollar, less than the British pound and the Mexican peso. After losing about $800 billion of its foreign reserves, China has managed recently to slow capital flight." But stability comes "at the cost of delaying reforms," like overhauling state enterprises.

Reuters reports state enterprises account for 66.5% of total debt defaults so far this year. It's only 6 names but ¥16.5 billion. "China could allow industrial firms to convert their debts into equity stakes as early as next month, with the government now putting the finishing touches to a new plan, the official China Securities Journal reported on Monday." China promises not to keep zombie companies alive with debt-to-equity schemes. Last spring the IMF warned that the high corporate debt ratio (145% of GDP) could damage growth. "But China has grown more reliant on often bloated and inefficient state firms to generate economic growth as private investment rapidly cools, raising concerns over whether it will press ahead with reforms."

It may seem inhumane to look at it this way, but China is the main roadblock to the Fed merrily hiking. We have already had two China-inspired market crises this year. China doesn't want to be seen as the Great Global Disrupter but may not be nimble enough to deliver the fixes that are needed. Yellen and Fischer have stopped talking about external events as influencing Fed policy decisions, but don't kid yourself—a new China crisis would have exactly that effect.

We like the dollar going forward, whatever slips and slides another real rally must entail.

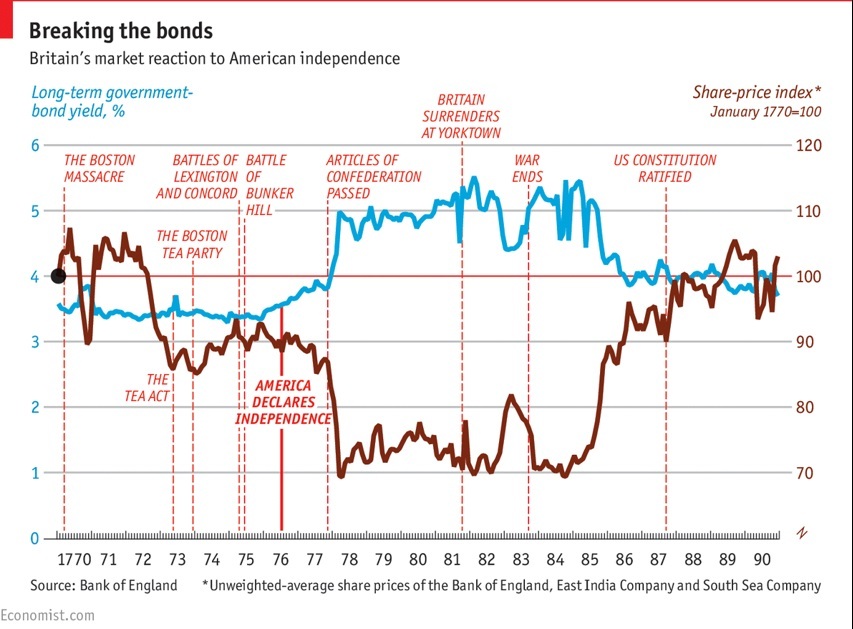

Tidbit: The Economist, as ever with tongue in cheek, has a dandy char t of what happened in London markets when America "exited" Britain. Exchange rates don't come into it but see how equities recovered smartly after US independence while bond yields slid downward. The chart has no meaning at all to current conditions for about a thousand reasons, but it's fun.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 192.13 | LONG USD | NEW*WEAK | 08/29/16 | 102.13 | 88.12% |

| GBP/USD | 1.3101 | SHORT GBP | STRONG | 07/20/2016 | 1.3101 | 0.00% |

| EUR/USD | 1.1182 | SHORT EUR | NEW*WEAK | 08/29/16 | 1.1182 | 0.00% |

| EUR/JPY | 114.20 | SHORT EURO | WEAK | 05/02/2016 | 122.33 | 6.65% |

| EUR/GBP | 0.8535 | LONG EURO | STRONG | 06/24/2016 | 0.8006 | 6.61% |

| USD/CHF | 0.9777 | LONG USD | STRONG | 08/08/2016 | 0.9817 | -0.41% |

| USD/CAD | 1.3012 | LONG USD | WEAK | 06/27/2016 | 1.3010 | 0.02% |

| NZD/USD | 0.7252 | LONG NZD | WEAK | 08/02/2016 | 0.7204 | 0.67% |

| AUD/USD | 0.7559 | LONG AUD | WEAK | 08/02/2016 | 0.7576 | -0.22% |

| AUD/JPY | 77.21 | SHORT AUD | STRONG | 08/02/2016 | 77.02 | -0.25% |

| USD/MXN | 18.6202 | LONG USD | WEAK | 05/06/2016 | 17.9418 | 3.78% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.