Sentiment Surprise

European Commission surveys showed that morale remained uplifted in the month of January. According to the commission’s survey on consumer sentiment, optimism over the fading European Union fiscal crisis added 1.4 points to the overall reading of 89.2 – a six-month high. Subsequently, the tick higher is serving as confirmation, once again, that a silver lining is being presented despite anticipated lower growth in the first three months of the year. The brighter results are being coupled with a 2.5 point recovery in the Eurozone PMI survey, which now stands at 48.2 for the same month.

Although still widely contractionary, the improvement in the PMI survey is helping to reinforce the notion that underlying fundamentals are forming a base of sorts, lending to speculation of a EU recovery in the second half of 2013.

Dropping Debt Costs

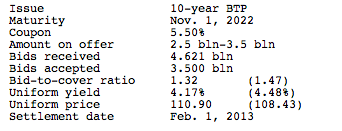

Debt yield costs continued their downward spiral as the Italian Treasury held its 10-year benchmark bond auction earlier today. Selling the maximum 6.5 billion euros offering, the Treasury saw tepid demand as the bid to cover ratio stood at 1.32. Although not all too bad, the lower figure simply reflects thinning demand on the heels of the nation’s second major auction this week. As a result of the auction target being reached, yields on the 10-year note fell to 4.17% compared to 4.48% in a previously similar auction – the lowest since 2010.

All in all, the bond auction can be considered a success as it bolsters the notion that market concern is dissipating on evidence that the EU has stabilized – albeit for now. The sentiment additionally supports the notion that Mario Monti may be set to take the limelight as Italy’s PM once again when national elections are held next month – considered Euro bullish.

What To Watch Out For

With the EURUSD now higher above the 1.3550 figure, it’s plausible that the single currency will be able to advance towards near term resistance at 1.3716. A break higher through the figure would prompt a likely test of medium term targets at 1.3890.

Source: Dow Jones Newswire

Source: Dow Jones Newswire

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.