Crude

The oil price fell by about 2% on Monday as jitters related to situation in Greece weighed on overall market sentiment. Price of the front-month contract on Brent therefore fell to a four-week low. Meanwhile, Reuters physical oil market data have confirmed earlier news about persisting overhang of supply in the Atlantic Basin as both CFD’s and Forties differentials are seen close to a multi-year lows.

Apart from Greece, the market focuses on possible signs of agreement between P5+1 countries and Iran on its nuclear program. Though no details are known yet (or at least we are unaware of any), the general conclusion is that the talks are likely to extend beyond the self-imposed deadline of 30th June. Let us recall that if the deal was reached, Iran could export as much as 30 – 40 million barrels of oil that is said to be kept in floating storage and could in the short term increase its oil production by more than 500 thousand barrels per day.

Both Greek debt saga and Iranian nuclear talks thus in our view pose a downside risk for oil prices. Moreover, a fresh round of negotiations between Libya’s internationally recognized government and self-declared one about reopening of pipelines blocked by protesters could support oil bears even further.

Metals

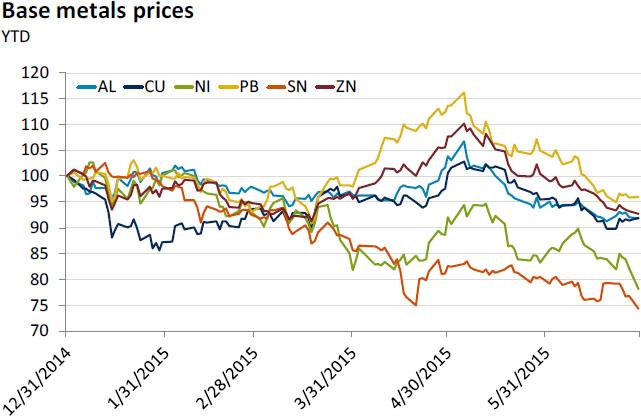

Base metals prices fell by about 1.3% on average on Monday, mainly thanks to a slump in nickel prices.

Moreover, the price of nickel fell even to a six-year low today in early trading as the Shanghai Exchange said it would accept nickel from Russian producer Norilsk to be delivered against its futures contracts.

Sharp decline in nickel prices is one of the surprises as the markets anticipated there would be a shortage of the metal, especially in China, due to a ban on exports of ores from Indonesia (which had, however, been to a large extent offset by imports of the ores from Philippines).

Chart of the day:

The price of nickel hit a sixyear low…

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.