Crude

The oil price hit yet-another 2015 high on Thursday. The front-month contract on Brent settled at 64.85 USD/bbl and at the time of writing of this note is even trading above 65 USD/bbl.

Although Saudi-led-coalition air strikes in neighbouring Yemen may have supported the oil price, we think that the most recent increase has stemmed rather from the latest set of EIA weekly data released on Wednesday. Apart from that, slightly disappointing data from the US labour and housing market and consequent depreciation of the US dollar may also have contributed to the price increase yesterday.

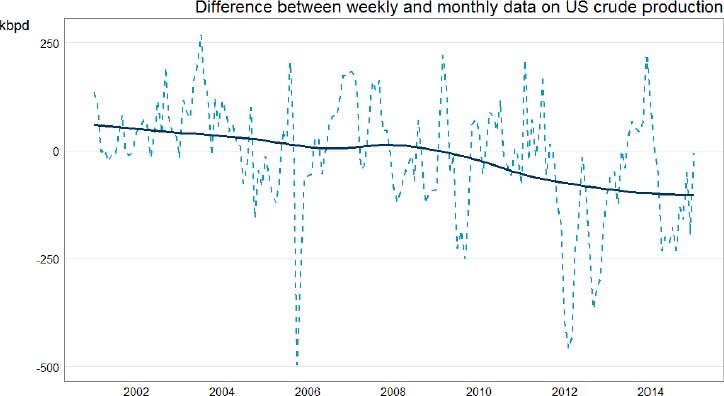

Regarding the EIA data, crude inventories surprised significantly to the upside while gasoline stocks again fell quite sharply as the refinery utilization declined (it however remains relatively high in comparison with previous years). A bullish reaction to the release may be partially explained by a relatively sharp decline of domestic crude oil production. Rather than “hard data”, this category however contains model estimates of the production. The actual oil production may thus eventually prove to be different than that indicated by weekly data. In fact, over the past couple of months, the difference between first estimates contained in the Weekly petroleum status report and more accurate figures from Petroleum Supply Monthly report has been permanently negative (see the chart below). In other words, the actual oil production could in fact be higher than indicated by weekly production data.

Chart of the day:

Over the past couple of months, the difference between first estimates contained in the Weekly petroleum status report and more accurate figures from Petroleum Supply Monthly report has been permanently negative.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.