Crude

Oil is set to post first weekly gain since the end of September on news that Saudi Arabia supplied less oil to the market in September than in previous month. An industry source said that the largest producer among OPEC members supplied by about 330 thousand barrels per day (kbpd) of oil less than in August which caused market jitters as some oil market participants (and some members of the OPEC) have suggested that the cartel may cut its production target at its November meeting.

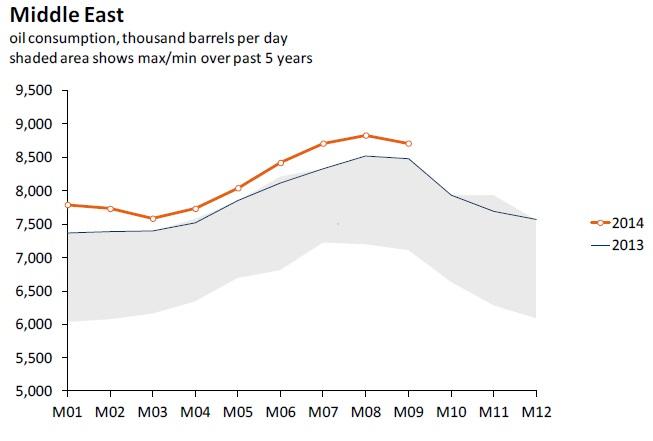

We think that possible decline in oil supply could rather be attributed to oil stockpiling and lower domestic demand (see the chart below) as, according to the most recent EIA figures, crude oil production in Saudi Arabia fell by only 100 kbpd in September vis-à-vis August. Moreover, domestic demand usually tends to fall over the winter. We therefore do not see the news as an evidence of any material change in Saudi’s policy that could lead to more significant tightening of the oil market.

Overnight, oil price erased some previous gains and at the moment of writing of this note, the front-month contract on Brent is trading at 86.3 USD/bbl.

Base Metals

Base metals prices fell almost exclusively on Wednesday. The only exception was copper; the price of the three-month contract gained nearly one percent yesterday. Copper price may have been supported by slightly better than expected results of China’s HSBC PMI index for October as well as the fact that LME copper inventories remain relatively low. The latter factor also continues to push price of LME cash contract above that of the three-month contract.

Chart of the day:

Middle East oil consumption tends to fall significantly over the winter.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.