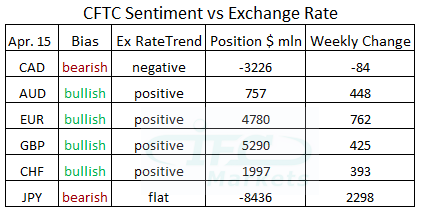

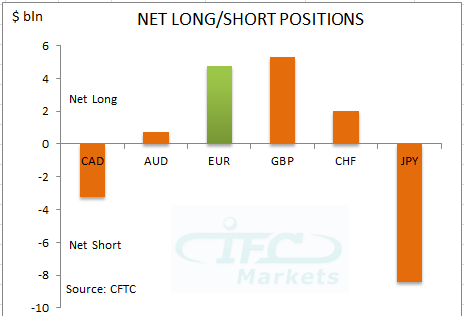

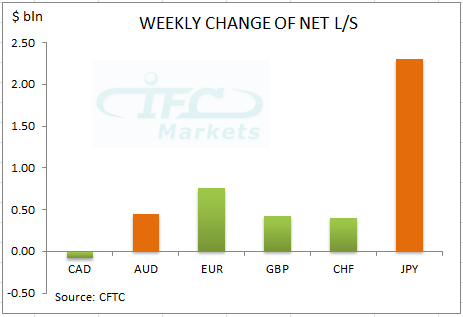

The latest report by Commodity Futures Trading Commission (CFTC) covering data up to the 15th of April showed that the investor’s bias for the most of the currencies remains the same although the sentiment is gradually transforming. The Euro bullish sentiment strengthened against the US dollar this week. The Euro weekly change has been the second largest positive change among major currencies. At the same time the Japanese Yen negative bias declined significantly on risk averse sentiment on the respective week but remains the largest net short position at minus $8.44 billion. Moreover, the samurai currency had the greatest weekly positive change of $2.29 billion confirming our previous week expectation of a positive week transformation.

Furthermore, the Canadian dollar was the only one with negative weekly change. Bearish bias increased slightly with the net short increasing to minus $3.22 billion. On the other hand the British pound bullish bias increased by $0.42 billion against the US dollar to $5.29 billion net long position and we expect that tendency to continue due to recent positive employment data. The Australian dollar bias remains bullish with net long position climbing to $0.75 billion. In the reporting week the kangaroo currency continues to build its positive bias and it is coupled with uptrend price pattern.

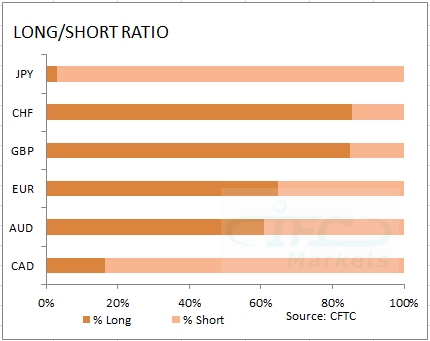

Lastly, the biggest long/short ratio was built by the Swiss franc according to the latest report. The second largest long/short ratio is with the British pound which is gradually building its bullish bias in recent weeks and at next week’s report could establish the largest long/short ratio.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.