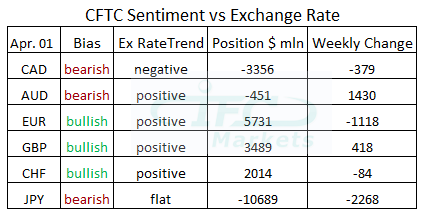

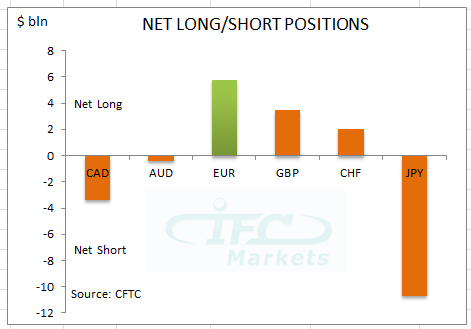

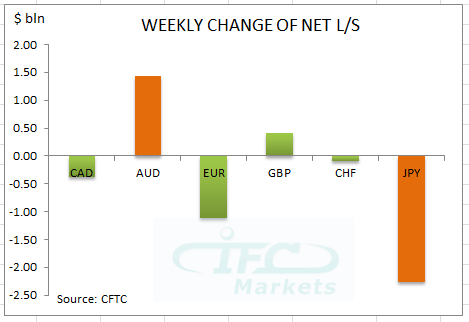

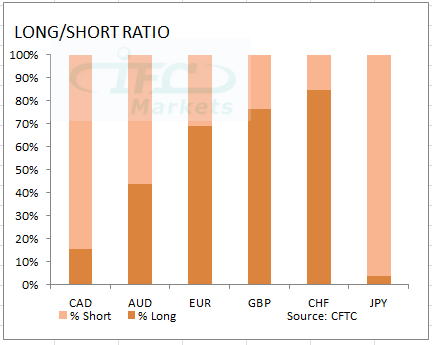

The latest report by Commodity Futures Trading Commission (CFTC) covering data up to the 1st of April revealed that the trend of currencies’ sentiment remained mostly the same compared to the previous report. The Euro bullish sentiment moderated against the US dollar for one more week on Euro-zone deflation risks. Despite that Euro weekly change has been the second largest negative change among major currencies, the common currency still maintains the greatest net long position against the US dollar. At the same time the Japanese Yen net short position remains the biggest for another week at minus $10.68 billion, increasing weekly by $2.27 billion. Moreover, the samurai currency had the lowest long/short ratio indicating that negative bias is strong however triggering some contrarian feelings.

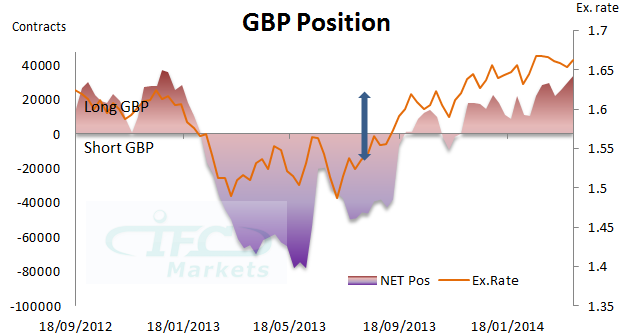

Furthermore, the Canadian dollar negative bias resumed with net short increasing by $0.38 billion to minus $3.35 billion. On the other hand the British pound bullish bias increased slightly by $0.42 billion against the US dollar. Lastly, bearish sentiment remains with the Australian dollar though it can be easily changed given that net short stands at minus $0.45 billion. In the reporting week the kangaroo currency weekly change has been the strongest and that could be an early signal for negative bias reversing.

Lastly, the biggest long/short ratio was built by the Swiss franc according to the latest report. This dynamic has been the same like the previous report but the CHF net long has been around $2.01 billion in the last three CFTC reports. The second largest long/short ratio is with the British pound which is gradually building its bullish sentiment in recent weeks. The net long at GBP is making a new high but exchange rate failed to rise to new high as it is indicated by GBP position chart.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.