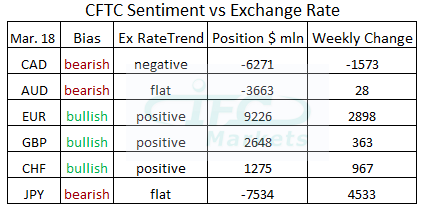

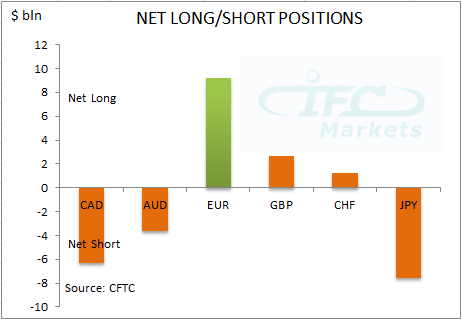

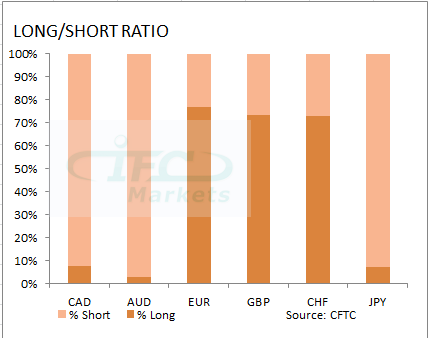

The latest report by Commodity Futures Trading Commission (CFTC) covering data up to 18th of March displayed that bullish sentiment continue to strengthen towards the Euro. In addition the Swiss Franc net long is increasing for another week. At the same time the negative bias enhanced for the Canadian Dollar to minus $6.3 billion against the US Dollar with the exchange rate breaching cap at 1.1222.

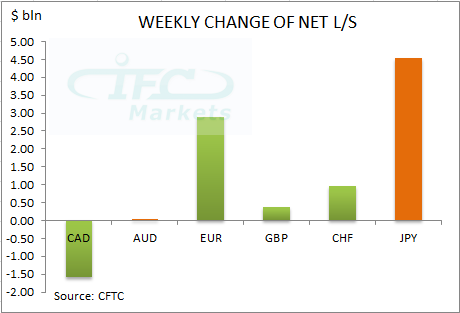

Moreover, the Japanese Yen negative bias was significantly unwound by $4.5 billion to minus $7.5 billion due to risk aversion up to the time of data release. The British Pound bullish bias did not change much against the US Dollar. Lastly, bearish sentiment remained steady with the Australian Dollar, without any significant weekly change taking place.

The Japanese Yen had the biggest weekly change this time. The net short position decreased to $-7.5 billion, which is the lowest net short amount since October 2013. The USDJPY attempted to drop below support at 101.21 by 18th of March but failed and consequently clawed back losses to 102.68, thus negative bias could resume by the next CFTC report.

The biggest negative weekly change took place on the Canadian Dollar reflecting the bullish trend of the USDCAD. Moreover, the USDCAD continues its bullish development followed consistently by market sentiment which is negatively building on the Canadian Dollar.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.