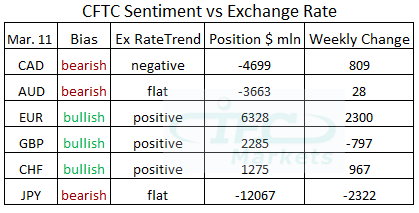

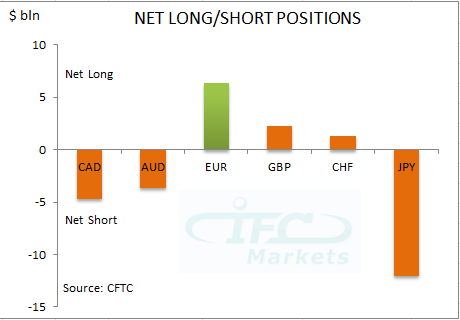

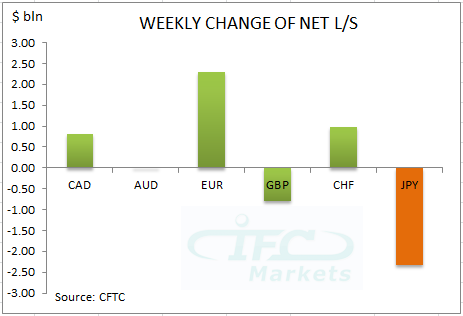

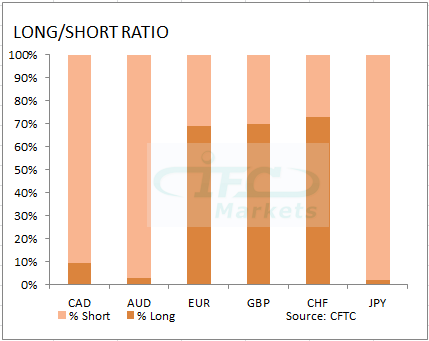

The latest report by Commodity Futures Trading Commission (CFTC) covering data up to 11th of March displayed that bullish sentiment continue to strengthen towards the Euro. In addition the Swiss franc bullish bias is building for another week. At the same time the positive bias moderated with the GBP to $2.3 billion against the US dollar, after finding resistance at 1.6777.

Moreover, Japanese Yen negative bias expanded to $12.07 billion. The Canadian dollar net short position against the US dollar, on the other hand, reduced according to the latest data. Lastly, bearish sentiment remained steady with the Australian dollar, without any significant weekly change taking place.

The Euro had the biggest weekly change for one more week. The net long position increased to $6.3 billion, following the European Central Bank decision to hold key rates steady. Also the EURUSD breached key upside hurdle at 1.3832 increasing bullish potential.

The biggest negative weekly change on the Japanese Yen reflects the improvement of traders’ risk appetite sentiment due to shining US jobs report for January. The USDJPY inched to resistance at 103.74 but now has dropped back to 101.20 and for that reason we would expect the net short position to narrow at the next report. Lastly geopolitical risk due to Ukraine crisis is likely to have increased demand for the samurai currency.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.