US employment figures are finally out, giving the EUR a onetime chance to recover the ground lost since the year started: the US created just 74K new jobs, and while unemployment rate decreased to 6.7%, closing in on the 6.5% FED’s threshold to consider raising the Fed funds rate, dollar fell down across the board.

Why? Because the decreasing unemployment rate, is a consequence of the labor force participation rate tumbling to 62.8%, its worst level since January 1978. And despite the FED has been firmly ignoring the number, market players can’t see how, now, the Central Bank will be willing to continue removing facilities programs.

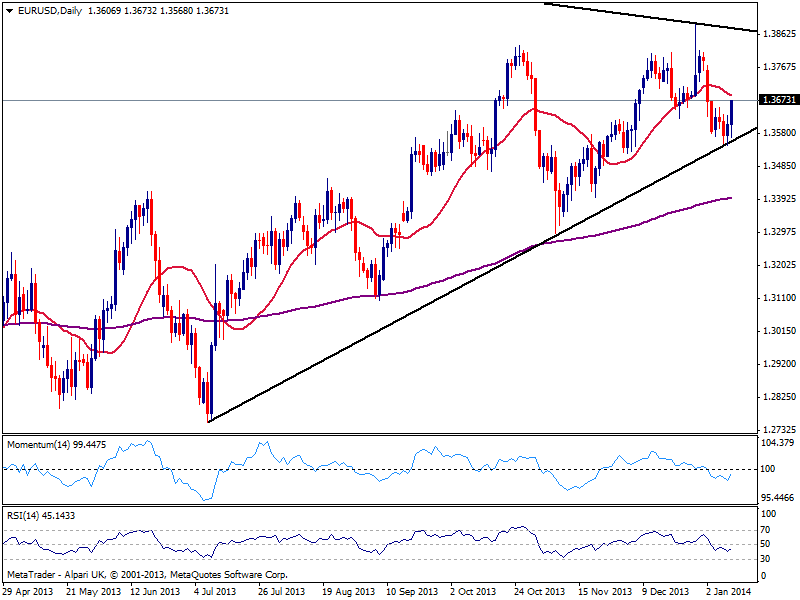

The EUR then, can blossom again, particularly as this week low against the dollar found support to the tip in a still bullish 20 SMA. Also, the daily chart shows price managed to held this week above a daily ascendant trend line coming from past July low at 1.2754, now around 1.3560. In this same time frame, indicators hold below their midlines, albeit lost their downward potential and turned higher, approaching their midlines, while 20 SMA offers now dynamic resistance around 1.3690: this is then the first level to overcome to confirm more EUR/USD gains, looking for a probable retest of the monthly descendant trend line coming from its all time high of 1.6038, now around 1.3860.

As for the downside, as long as the mentioned ascendant trend line holds, buyers will dominate the scene, maintaining the buy-the-dips game alive.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.