The flailing Aussie Dollar now looks to China and the US to throw it a lifeline, or seal its fate.

Iron ore continues to weigh on the Australian Dollar as it prints fresh 5-year lows. China Manufacturing remains stagnant at 50 to show it neither contracted or expanded. However with a consensus of 50.4 and falling short of expectations it saw the Aussie react and quickly to break below yesterday’s lows.

HSBC Flash Manufacturing PMI has itself lost volatility of late, remaining between 50 - 50.5 for the past 3 months. If this trend continues then it is likely it is more likely to be whether it can remain above 50 to drive the Aussie, over how far it deviates away from expectations.

However if we return to the previous volatility and see numbers of 1 to 1.5 away from expectations (either above or below consensus) then we can certainly expect some fireworks.

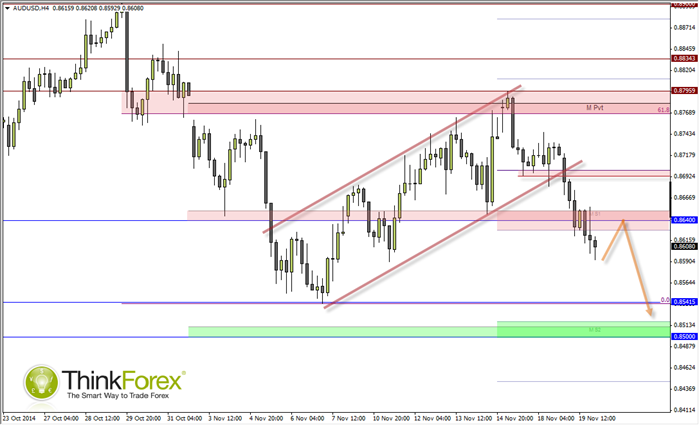

Technically the 0.879 swing high is a significant top which I do not expect the Aussie to recover to this week, however 0.854 is unlikely to break on the first attempt. Even if it does there are several key technical levels around 0.85 which I also expect to hold. I think it is more likely we will remain between 0.845 and 0.864 for the remainder of the session. A break above 0.864 opens up 0.87, with a break below 0.845 targeting 0.85.

It will then be over to the US to dictate the Aussie with Inflation and Employment data. With these two data sets at the forefront of the FED's attention we can safely assume the markets will been keeping close tracks of these releases. Strong CPI and employment could even see AUD break below 0.850, but any softness in Employment or inflation should see it back above 0.864. I suspect numbers will come in around consensus, keeping the Aussi ranging between 0.854 and 0.864.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.