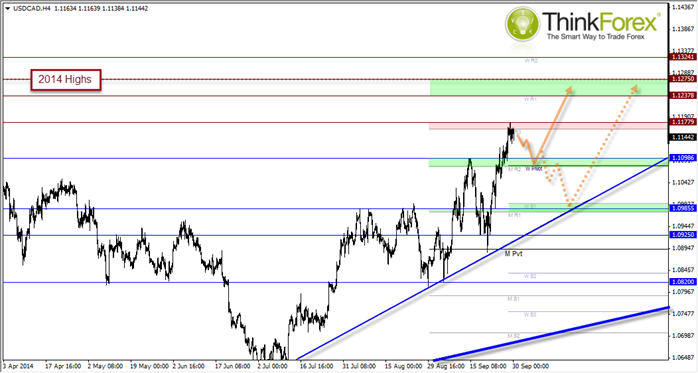

USDCAD continues to grind higher in line with the weekly bullish trend, and now seems on track to test 2014 highs.

Last week we saw it close to a 6-month high whilst remaining comfortably above the primary bullish trendline (from 2012 lows) with the 50 week MA also pointing upwards to confirm bullish momentum.

We have seen mild losses during Asia today but there are plenty of support levels for bulls to consider bullish setups in liken with this strong bullish trend.

With Canadian GDP is out today and an expectation of 0.2% growth m/m any upside surprise here should see USCAD retreat from the current highs. Friday also has Trade Balance figures but the data set is likely to be overshadowed by US Nonfarm Payroll and ISM Manufacturing Data.

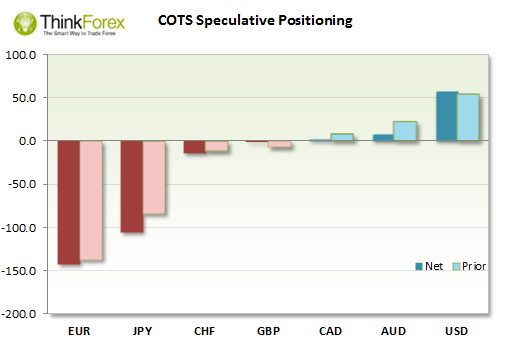

Anyone considering picking any tops against the Greenback should also keep in mind that the USD has just seen 11 straight weeks of gains (a 4-decade record) and Large Speculative Net longs are also at a record highs. Conversely Canadian Dollar Futures are on the brink of hitting Net short after seeing further longs closed last week. Whilst this data is only released weekly and lags by 3-days, this is a lot of deep pockets to be betting against.

Therefor traders may be wise to see any weak US data (or strong CAD) as a gift for bulls to jump back on board the bullish trend at a 'better' price.

Yesterday produced a Spinning Top Doji below 1.118 resistance to suggest a weakness to the D1 move. At this stage a favour a pullback with 1.109 and 1.010 housing several levels of technical support. If we do see the pullback then I will be seeking bullish setups around these levels to trade in the direction of the dominant trend.

A break above this week’s highs should see direct gains towards 1.123 and 1.1275 (2014 highs). I don’t expect this level to break upon first attempt as we're likely to see profit taking, but overall I favour an upside break of this level sooner than later.

Only a break below 1.09 brings into question a much deeper retracement for the weekly chart.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.