Whilst EURUSD is within a clear downtrend it is approaching several key levels if support, after having seen a reduction in Net Short positioning according to data supplied by CFTC.

Technicals:

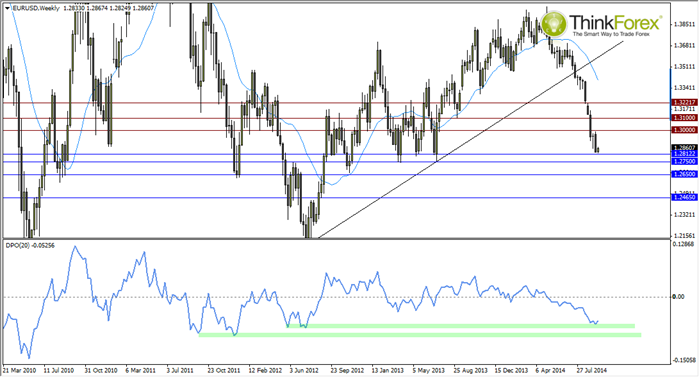

The Weekly Chart is within a clear downtrend but has not witnessed a decent retracement sinze the 1.40 highs. The daily charts show that the bearish momentum is beginning to slow which raises the potential for a snapback. Also take note of the DPO (Detrended Price Oscillator) which shows price could be a little over-extended from it's 20-week MA. It does however provide a little extra room of downside before a smap-back.

COTS data suggests a reduction of Shorts as the Net long/short indicator has edged up towards zero, whilst Open Interest has reduced from last week. We also have to remember that we are at significantly high levels on NET short and have to wonder if too many traders are on the same side of the market, which would result in a reversal regardless of the fundamentals.

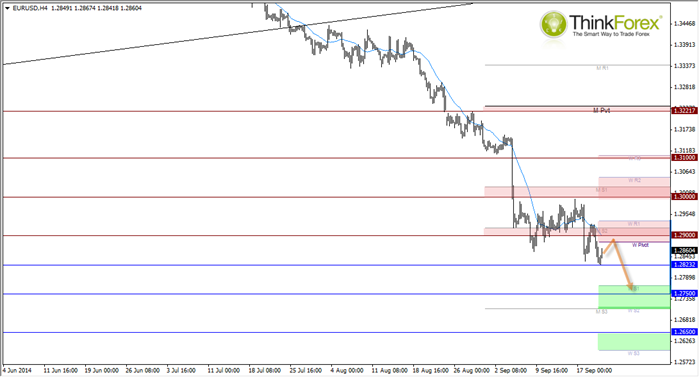

1.29 houses several confluences of resistance which I expect to be quite reliable. Any break above here should target 1.30, which itself could see prices capped and for price to range between 1.282-30.

The Strategy:

I'll be seeking bearish setups on any rallies towards 1.29 to target 1.275 and try not to 'outstay my welcome' on any short positions. I am on the lookout for a firm rejection of support and for a sizeable retracement ot occue. The US Index could do with a retracement which would help support AUDUSD, EURUSD and GBPUSD.

Potential Catalyst:

Draghi is set to testify tonight. With the talk of QE, as expected, theere are more questions than answers. At present it is not known when it willeven launch the QE program, let alone whch assets (or how much of them) will be purchased. There is a string argument for Euro strength once QE is launched which will have the unfortunate side effect (for Draghi) of seeeing money flow into the Eurozone, despite negative interest rates. Even if this does not create a new bullish run it would at the very least slow the EURUSD decline down.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.