The Greenback has seen significant inflows by speculative traders who have pushed the USD up to 12-month highs whilst Euro bears continue to increase their Net Short exposure.

With several key FOMC members all talking this week it could be the ideal time to find out if the Hawkes are coming out of hibernation and drop clues to the timing of interest rate rises. Technically I suspect the USD saw a 6.5yr cycle low back in April and for the bullish theme to continue for the remainder of the year, as traders enjoy extra volatility and directional moves.

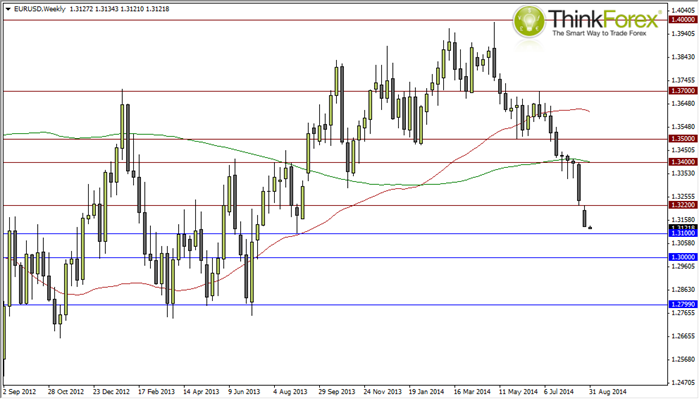

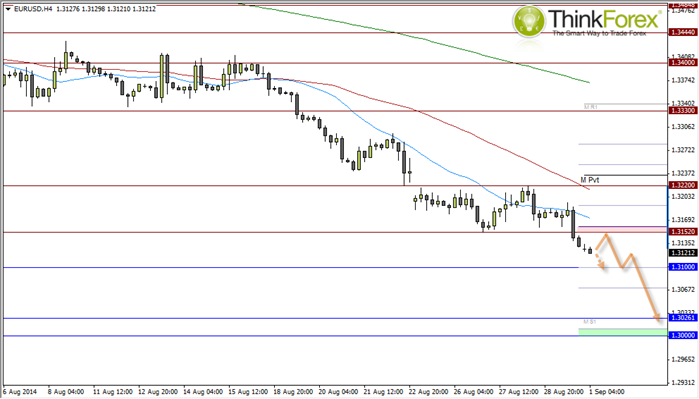

EURUSD continues to unravel at break-neck speed en route to 1.30, although we are likely to find interim support at 1.31 before another leg lower. ECB announce their bid rate with traders wondering if ECB President Draghi will pull the trigger for QE or decrease negative bank rates even further.

Any rally towards 1.315 resistance is likely to attract bearish trend traders for their 1.31 target. We are currently mid-way between this range and a direct move down is not out of the questions if early Asia trading is anything to go by.

We may get a sizeable bounce around 1.31 but only a break above 1.3322 swing high would bring into question the bearish trend. A break above 1.322 could see bulls targting 1.333 but I do not see this as a likely scenario - instead seeking bearish setups to target 1.31 and 1.30 over the coming week/s.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'