Looking at yield differentials alone we can assume over the longer-term the bearish trend should prevail. Whilst Kiwi has had the worst month out of many recently, this may begin to change as it approaches key levels of S/R against the majors.

The Kiwi Dollar has been unravelling against the Major crosses for the past 5 weeks. The original trigger came when weak Dairy prices were followed by increased geo-political risks, and then poor CPI q/q. Investors continued to close their carry trades and book profits which only accelerated when RBNZ gave a Dovish statement following their rate hike to signal there is not likely to be any further rate increases this year.

At time of writing the Kiwi Dollar is clinging onto key support against JPY and coming very close to breaking below 0.84 against the Greenback. However take note that bearish momentum has reduced, the Greenback appears technically due a pullback (which would support NZDUSD) and if we see Geo political risks reduce then we can expect this to help support NZDJPY.

Whilst I am not one to 'bottom fish' there is an argument that the Kiwi Dollar is oversold, and that we may soon see money flow back into the Kiwi to take advantage of Yields (which remain the highest among G10 currencies).

With poor data continuing to come out of the Eurozone and bearing then we may be able to use EURNZD as a proxy for overall Kiwi Strength.

Technically

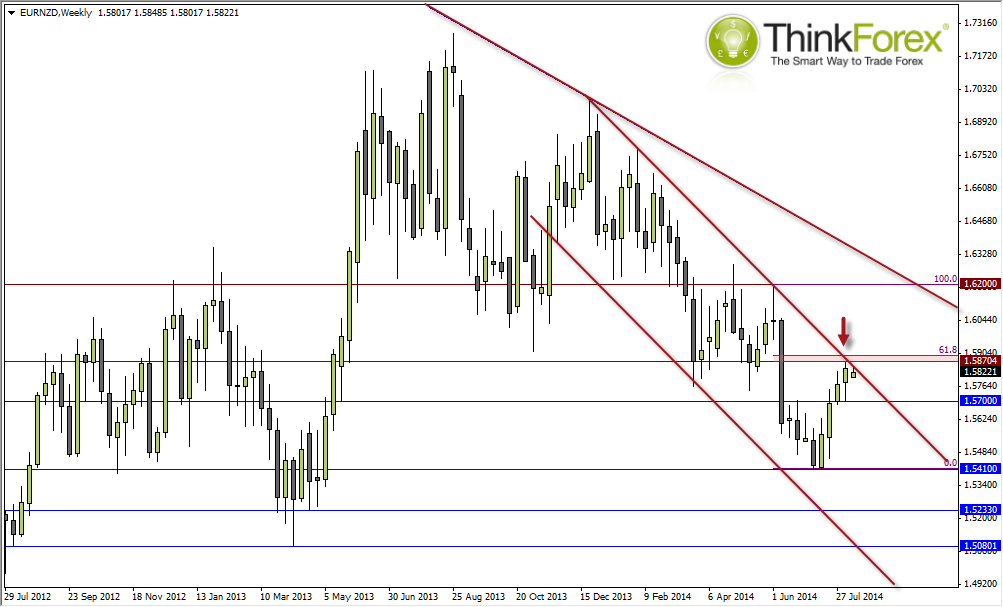

- Hanging Man Reversal stalls beneath several technical levels (Upper bearish channel; 61.8% retracement; Horizontal Resistance).

- Intraday price action has become more volatile below this resistance zone to suggest a potential topping pattern. Look out for an ending diagonal/triple top etc.

- The bearish trendline/Channel is never an exact science so allow for breathing room. However a relatively good reward to risk ratio may be achieved assuming the predominant bearish trend remains valid.

- Initial target is 1.5584, followed by 1.54 and beyond

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.