The previous analysis anticipated 0.940 to cap as resistance. Whilst we did briefly break above we're now back below, following a Shooting Star Reversal candle

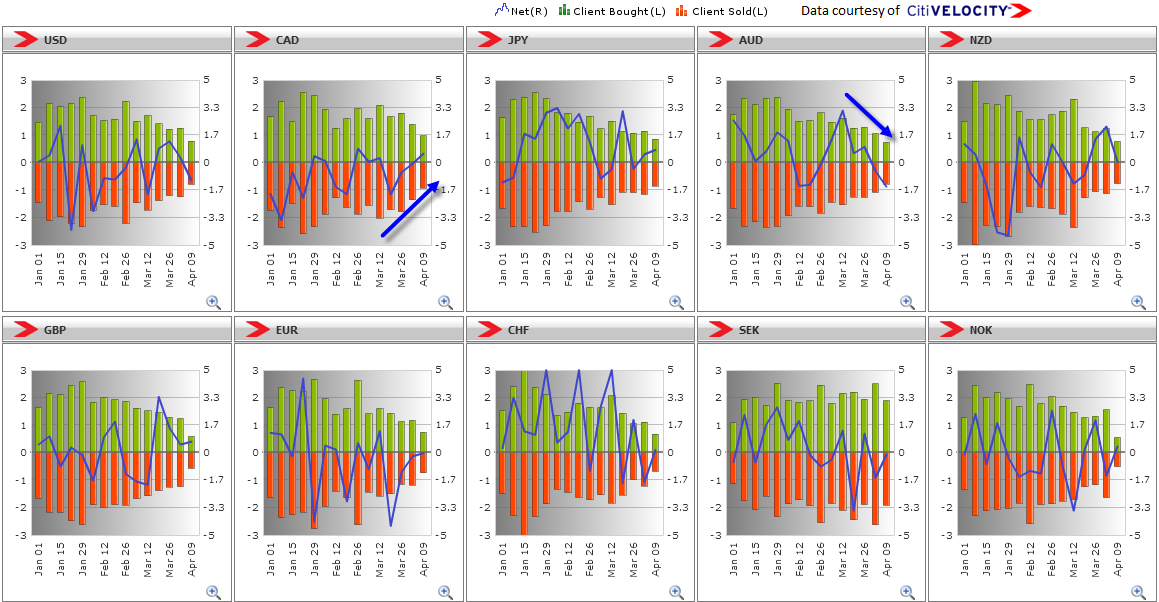

Above is the client flow of CitiGroup G10 currencies. It is end-of-day data so it just help assess volume activity for past price action, as a confirmation more than a predictive tool. However it is interesting to note that selling volume has increased whilst price has continued to rally up to fresh 5-month highs on AUDUSD. This provides me with slightly more confidence we may have reached an interim top, following yesterday's Shooting Star Reversal candle.

The final push up saw a break of the upper channel line. This I can live with as upper channel lines tend to be less reliable than the lower trendline, and besides they are to be used with a pinch of salt at the best of times. They merely provide structure to the analysis.

Following the BOJ minutes both AUD and NZD are selling off sharply and sustaining the heaviest losses among G20 Currencies.

I expect to close the week below 0.940, which in turn may be the beginning of a deeper pullback towards 0.93. However we also need to be open to the possibility of sideways trading and to allow time for a potential topping formation.

A break aback above 0.940 should see a continuation of the bullish trend, with a break above 0.945 opening up 0.950 and 0.955.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD rebounds to 1.0650 on renewed USD weakness

EUR/USD gained traction and rose to the 1.0650 area in the early American session on Tuesday. Disappointing housing data from the US seem to be weighing on the US Dollar, helping the pair stretch higher.

GBP/USD climbs above 1.2450 after US data

GBP/USD extended its recovery from the multi-month low it touched near 1.2400 and turned positive on the day above 1.2450. The modest selling pressure surrounding the US Dollar after dismal housing data supports the pair's rebound.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world supported by a strong US labour market.