Interested in more FX key technical levels? Take a look at Swissquote's daily technical outlook.

EUR/USD

Firm in range above the 1.1300 level with higher lows from the Mon's 1.1217 low sustaining the upside focus. Lift above the 1.1362 high needed to target the 1.1400 level and where break will clear the way for retest of the 1.1465 high. Failure to hold the 1.1272 support will leave the way open for return to the 1.1217 low. [PL]

USD/CHF

Setback below the .9700 level slightly breached the .9688 but lack of follow-through keep the downside limited. Bounce see resistance at .9753/67 area and lift over this will return focus to the .9800 level then the 200-day MA at .9837. Break will trigger further recovery. [PL]

USD/JPY

Reversal from the 111.88 intraday high has seen dive through the 110.67 support to reach 108.77 low. Bounce from there to regain the 109.00 level see the 110.00 and 110.67 back as resistance. The break of the 110.00 level return focus to the downside and see risk for retest of the 107.77/63 lows. [PL]

EUR/CHF

Confined within a narrow range though the upside stays in focus following bounce from the 1.0964 low. Above the 1.1000 level will see scope for retest of the 1.1016/23 highs and where clearance will see strength to the 1.1061 resistance. Would take break of the 1.0964 low swing focus lower to the 1.0930/00 area. [PL]

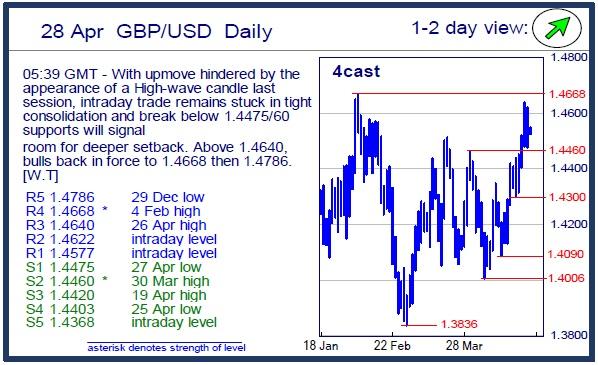

GBP/USD

With upmove hindered by the appearance of a High-wave candle last session, intraday trade remains stuck in tight consolidation and break below 1.4475/60 supports will signal room for deeper setback. Above 1.4640, bulls back in force to 1.4668 then 1.4786. [W.T]

EUR/GBP

Staging recovery from the .7735 low though the upside still limited. Would need lift over the .7800 level and the .7812 resistance to get stronger recovery underway towards the .7855 then the .7900/25 resistance. Below the .7735 low will see scope to target the .7700 level and .7684. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.