EUR/USD Daily

Settling back from the 1.1387 high but the downside seen limited with support starting at 1.1274 and 1.1246. Would take break of the latter to trigger stronger pullback to the 1.1200 level and 1.1161 support. Higher low sought for renewed strength later to target the 1.1400 level then 1.1460/95 highs. [PL]

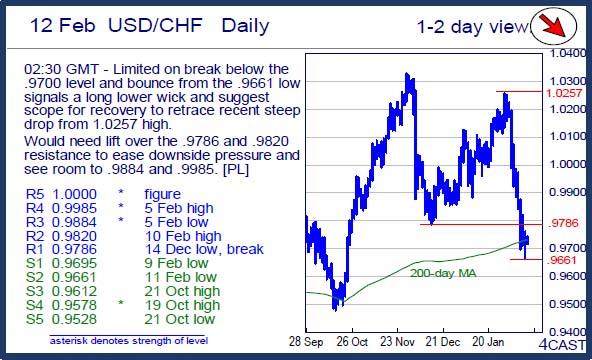

USD/CHF Daily

Limited on break below the .9700 level and bounce from the .9661 low signals a long lower wick and suggest scope for recovery to retrace recent steep drop from 1.0257 high. Would need lift over the .9786 and .9820 resistance to ease downside pressure and see room to .9884 and .9985. [PL]

USD/JPY Daily

Higher in consolidation following bounce from the 110.99 low though the upside still limited with resistance starting at 113.20. Break here is needed to swing focus higher to the 114.21 and 115.50 resistance. Support now at 111.57 then the 110.99 low, failure to hold this will see further weakness to target the 110.00 level. [PL]

EUR/CHF Daily

Steadied at the 1.0950 low to consolidate the drop from 1.1200 high. However, the upside still limited and see lift over 1.1043 high needed to trigger stronger recovery to the 1.1100 level. Break of the 1.0940 support will see room for deeper pullback to the 1.0900 level and 1.0870 support. [PL]

GBP/USD Daily

Intraday trade tight in consolidation , enforced by the neutral stance seen on daily tools and break above 1.4578 resistance will expose gain towards the recent corrective high of 1.4668. On the downside, drop below 1.4352 support will help bears regain downside footing with the 1.4150 support targeted. [W.T]

EUR/GBP Daily

Settling back from the .7900 level and dips see support now at .7756 and .7713. Would take break of the latter to trigger stronger corrective pullback to the .7666/61 area. Higher low sought for renewed strength later, above the .7900 level will see extension to .7927/55 area then the .8000 level. Beyond this see 11-mth base objective at .8050. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.