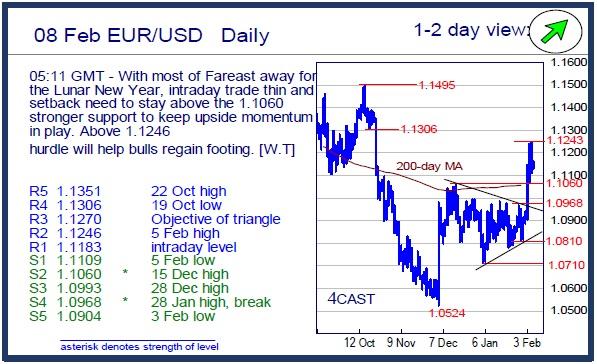

EUR/USD Daily

With most of Fareast away for the Lunar New Year, intraday trade thin and setback need to stay above the 1.1060 stronger support to keep upside momentum in play. Above 1.1246 hurdle will help bulls regain footing. [W.T]

EUR/CHF Daily

Sharp decline last trading session, spurred by the bearish tone of Shooting-star set last Thursday and with 1.1062/50 supports taken out, risk of deeper pullback is not ruled out, with lower support seen at 1.1030 ahead of 1.0982 . [W.T]

USD/CHF Daily

Extended decline seen last Friday checked by the 0.9881 support with the appearance of a High-wave candle reducing downside pressure and shifting trade into intraday consolidation. Lift above 0.9990 hurdle will expose stronger rebound. [W.T]

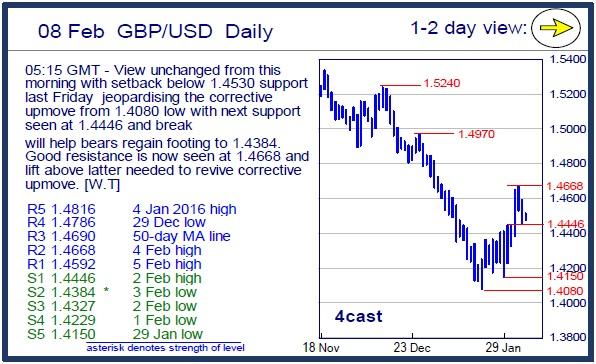

GBP/USD Daily

View unchanged from this morning with setback below 1.4530 support last Friday jeopardising the corrective upmove from 1.4080 low with next support seen at 1.4446 and break will help bears regain footing to 1.4384. Good resistance is now seen at 1.4668 and lift above latter needed to revive corrective upmove. [W.T]

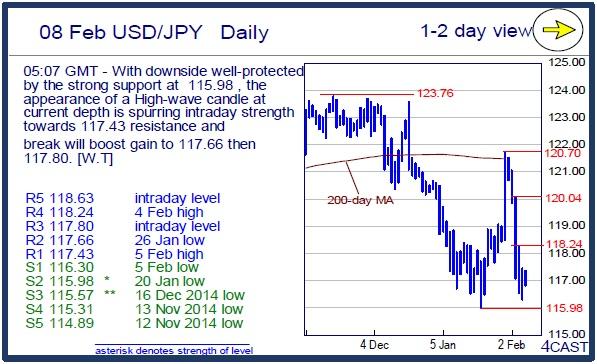

USD/JPY Daily

With downside well-protected by the strong support at 115.98 , the appearance of a High-wave candle at current depth is spurring intraday strength towards 117.43 resistance and break will boost gain to 117.66 then 117.80. [W.T]

EUR/GBP Daily

Upmove stalled by the appearance of a High-wave candle last session with intraday retreat and ability to push below .7666 support will expose further setback to .7592. Bulls will have to clear last Friday's high of .7716 to regain footing towards strong barrier at .7756. [W.T]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.