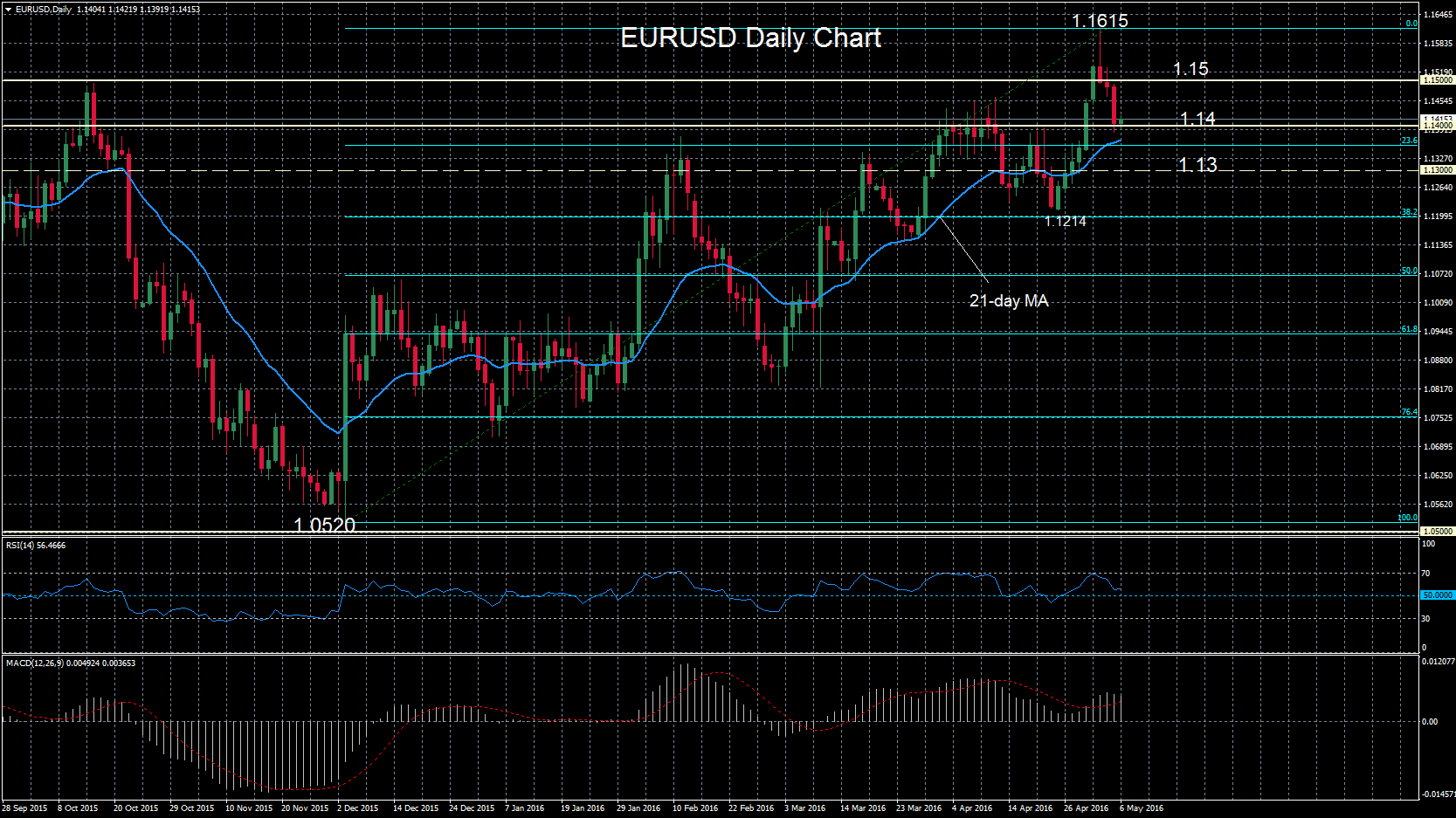

The overall technical picture for EURUSD remains bullish, as the pair staged a rally from 1.0520 to 1.1615 (December to May). The technical indicators – RSI and MACD are in bullish territory, supporting the bullish market structure.

But after hitting the high at 1.1615, prices reversed lower to find support around the 1.1400 area. Clearer signals are needed to see if this fall is a correction of the recent uptrend or if it is a reversal of the upside move. For now prices are above the 21-day moving average and the key 1.14 level. A drop below this and below the 23.6% Fibonacci could increase downside momentum to see a further decline to the key 1.13 level. The 23.6% Fibonacci comes in at 1.1355 and is the retracement of the upleg from 1.0520 1.1615.

To the upside, resistance at 1.1500 would need to be cleared to pave the way for a retest of the May 3 high of 1.1615 and above this we will see a continuation of the uptrend.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.