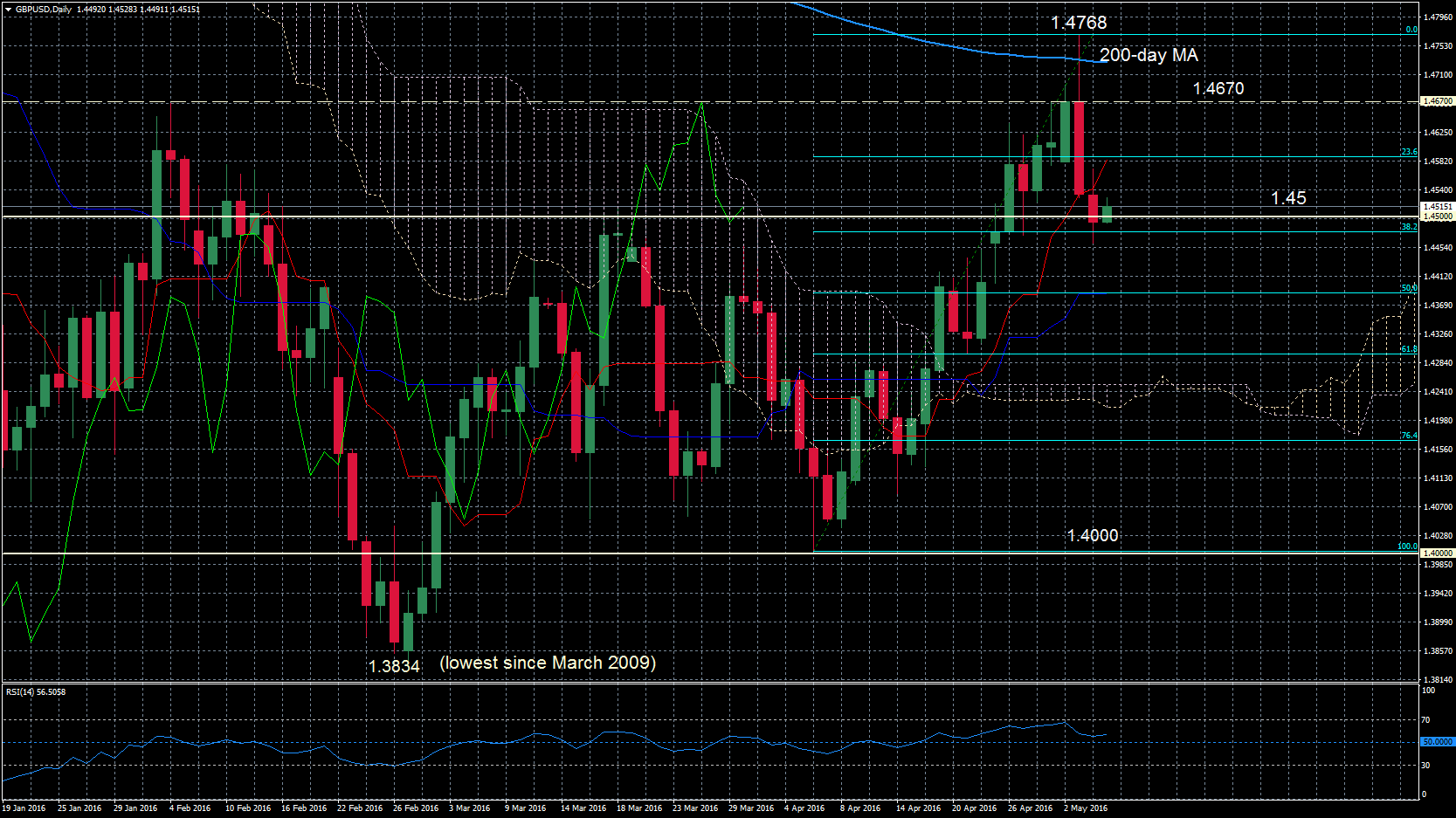

After a steady rise from the key 1.4000 level, GBPUSD reached the 200-day moving average this week but was unable to close above it. This proved to be a strong resistance area and consequently the pair reversed back down. The level at 1.4670 has also proven to be a strong resistance level, which after several tests at this level, prices failed to close above it and fell back down to now test the 1.45 area, an important support level.

In the short-term, GBPUSD maintains its bullish bias. There has not been a clear signal yet that the market has turned bearish. The recent decline in prices could be seen as a correction of the rise from 1.4000 as long as prices hold above the 38.2% Fibonacci level at 1.4477 (which is the retracement level of the upleg from 1.4000 to 1.4768 (February to April).

A move below this support at 1.4477 would shift the bias for more downside moves. However, if the pair bounces back up and rises above 1.4670 and also clears the 200-day moving average and 1.4768 high, then the recent uptrend would resume.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.