EURUSD

The Euro fell back near 1.12 support, on yesterday’s repeated failure to break above 200SMA and sustain gains above 1.13 barrier. The day closed in long red candle that gives bearish signal, with overnight’s trading being shaped in tight Doji and touched strong support at 1.1205, daily 20SMA. Near-term studies are weak and see risk of violation of 20SMA support, to expose key near-term supports at 1.1154, 28 Aug low and 1.1121, daily Ichimoku cloud top, triggers for fresh weakness. Quiet trading is seen likely, ahead of today’s ECB meeting, with initial Sup/Res levels at 1.1205, 20SMA and 1.1284, 200SMA. Daily studies remain bullish and favor fresh upside attempts, while rising daily 20SMA holds.

Res: 1.1278; 1.1284; 1.1318; 1.1331

Sup: 1.1203; 1.1166; 1.1154; 1.1121

GBPUSD

Cable continues to move lower, after taking out key 1.5327 support, with close below psychological 1.53 support, confirming bearish stance. Yesterday’s long-legged Doji, signals hesitation on approach to next support at 1.5246, 50% retracement of 1.4563/1.5928, Apr/June rally, however, overall bearish structure keeps focus at the downside and break lower to expose next targets at 1.5189/68, lows of 05/01 June. Initial resistance lies at 1.5324, yesterday’s high, with 200SMA at 1.5359, expected to ideally cap. Alternative scenario would be triggered on daily close above 200SMA, to signal stronger correction.

Res: 1.5311; 1.5324; 1.5359; 1.5393

Sup: 1.5265; 1.5246; 1.5189; 1.5168

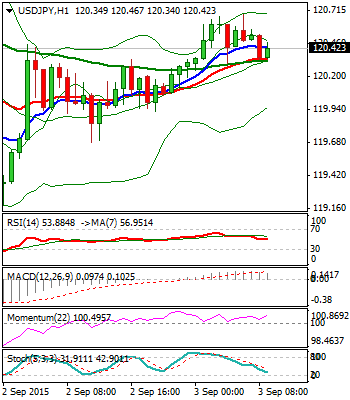

USDJPY

The pair met its initial target, at 120.70, session high and daily Kijun-sen line, also 50% retracement of 125.26/116.13 downleg and came ticks away from of key 200SMA. Fresh rally extended recovery that left higher low at 119.20 zone and ended yesterday’s trading in long bullish candle that gives positive signal, amid generally bearish tone. However, improving near-term studies see room for further upside, with sustained break above 200SMA trigger, being required. Such scenario would open next breakpoint at 121.64, recovery peak of 31 Aug. Otherwise, downside risk would intensify, while the price remains capped by 200SMA.

Res: 120.75; 121.25; 121.64; 122.01

Sup: 120.19; 119.68; 119.52; 119.18

AUDUSD

Aussie trades in near-term consolidative phase, above fresh low at 0.6980, posted yesterday, on a probe below former target, at psychological 0.7000 level. Yesterday’s positive close gives signal of hesitation for clear break below 0.7000 handle, as daily studies are oversold, but no reversal signal being generated yet. Look for extended consolidation under initial barrier at 0.7122, falling daily 10SMA. Break here, to give initial bullish signal and expose next barriers at 0.7204, lower top of 28 Aug and 0.7242, falling daily 20SMA and trigger for stronger corrective rallies. Otherwise, repeated attempts below 0.7000 and sustained break lower, to signal resumption of larger downtrend.

Res: 0.7060; 0.7122; 0.7204; 0.7242

Sup: 0.7000; 0.6980; 0.6933; 0.6870

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.