Near-term tone is positively aligned and sees the upside targets at 1.3000/1.3040 zone, round figure / 50%/61.8% retracement of 1.3153/1.2858 downleg in focus, as the price ticked higher, approaching initial 1.30 barrier. These levels are seen as turning points and sustained break would signal stronger recovery action in the near-term. Broken-bull-trendline off Nov 2012 low, now offer support and would keep afloat bulls, developing on lower timeframes charts. On the other side, overall picture remains negative, with downside risk towards 1.2786/50 targets, expected to remain in play, as long as 1.3153 lower top and breakpoint stays intact.

Res: 1.2977; 1.2993; 1.3000; 1.3040

Sup: 1.2930; 1.2900; 1.2882; 1.2858

GBPUSD

Cable regained strength in near-term action off 1.6159, yesterday’s correction low and cracked important 1.63 barrier. Bulls are coming in play on lower timeframes, which supports attempts through 1.63 hurdle, clear break of which is required to resume recovery rally off 1.6050, low of 10 Sep. However extension above 1.6340 is needed to fill the gap of 08 Sep and confirm recovery action, which will also neutralize bearish engulfing pattern, developing on the daily chart, which requires extension below yesterday’s low at 1.6159, to confirm reversal.

Res: 1.6309; 1.6338; 1.6416; 1.6463

Sup: 1.6247; 1.6210; 1.6184; 1.6159

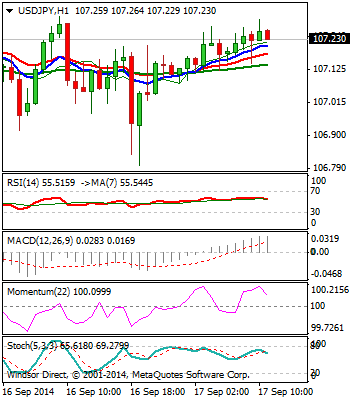

USDJPY

The pair remains positive and regains levels above 107, with near-term price action continuing to move in consolidative mode, off fresh high at 107.38. This keeps immediate focus at the initial target at 107.50, to signal an end of consolidative phase and open 108.28, Fibonacci 161.8% projection of the upleg from 100.81. Extended dips, are expected to hold above 106.50/35 support zone, to keep bulls intact, as the pair is looking for extension towards 108/110 zone in the near term.

Res: 107.38; 107.50; 108.00; 108.28

Sup: 106.79; 106.50; 106.35; 106.00

AUDUSD

The pair holds overall negative tone, with near-term corrective action off fresh low at 0.8982, accelerating after clearance of initial 0.9050 barrier. Hourly studies improved on a probe above 0.91 barrier and see room for further recovery action, as the rally cracked pivotal 0.9100/26, 50%/61.8% retracement of 0.9216/0.8982 zone. Sustained break above the latter to confirm hourly double-bottom formation, revive bulls on still weak 4-hour studies and spark further recovery, which would expose 200SMA at 0.9181. Alternatively, false break through 0.91 barrier, would re-focus 0.9050, now acting as support and risk return to the lows below 0.90 handle.

Res: 0.9110; 0.9126; 0.9160; 0.9181

Sup: 0.9059; 0.9050; 0.9000; 0.8980

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold manages to hold above $2,300

Gold struggles to stage a rebound following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% ahead of US data, not allowing XAU/USD to gain traction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.