The Euro continues to trade in a sideways mode, capped for now under 1.2977/85 barriers, with corrective pullbacks being contained above 1.29, round-figure support / Fibonacci 61.8% of 1.2858/1.2977 corrective rally. Neutral near-term studies see scope for further consolidation, while overall negative tone, renewed with yesterday’s close in red, suggests fresh leg lower after completion of near-term consolidative phase. Strong barriers at 1.2977/85, as well as psychological 1.3000 resistance, keep the upside limited for now and only break above the latter would revive near-term bears for stronger bounce, which would sideline attempts towards short-term targets at 1.2786, Fibonacci 61.8% of 1.2042/1.3992 and 1.2750 higher base.

Res: 1.2958; 1.2977; 1.2987; 1.3000

Sup: 1.2920; 1.2900; 1.2882; 1.2858

GBPUSD

Cable’s near-term price action remains in consolidative mode, with immediate tone showing signs of weakness, as the price action moves towards the consolidation floor at 1.62 zone, after yesterday’s close in red. Recovery peak at 1.6275, has so far limited the upside action, keeping psychological 1.63 barrier and previous week’s closing level and the upper limit of 08 Sep opening gap, intact. Near-term studies are neutral and unless 1.63 hurdle is taken out, which would allow for stronger recovery and confirm near-term bottom, risk will remain at the downside, as overall picture remains negative.

Res: 1.6249; 1.6275; 1.6300; 1.6338

Sup: 1.6200; 1.6184; 1.6155; 1.6123

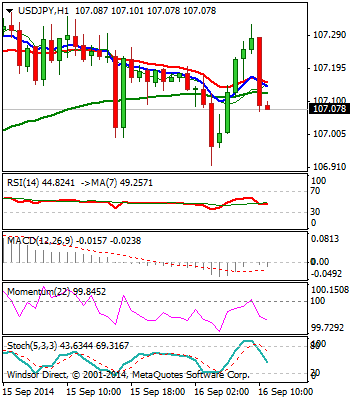

USDJPY

The pair remains positive overall, with near-term price action moving in consolidative mode, which was signaled by yesterday’s Doji candle. Important 107 support holds for now, despite brief probe below overnight, keeping immediate focus at the upside, for test of initial target at 107.50, ahead of 108.28, Fibonacci 161.8% projection of the upleg from 100.81. Extended dips, however, should be contained at 106.50/35 zone, to keep bulls unharmed.

Res: 107.38; 107.50; 108.00; 108.28

Sup: 106.92; 106.50; 106.35; 106.00

AUDUSD

The pair maintains negative tone, with near-term corrective action off fresh low at 0.8982, being capped at 0.9050, by descending hourly 55SMA. Fresh weakness below 0.90 handle, confirms bears are in play, for fresh extension towards the next target at 0.8889, 02 Mar higher low, with full retracement of 0.8658/0.9503 ascend, being in play. Only fresh strength above 0.9050 would sideline immediate bears for stronger corrective attempt.

Res: 0.9000; 0.9020; 0.9050; 0.9071

Sup: 0.8980; 0.8950; 0.8923; 0.8900

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.