Euro’s weekly close level was barely changed, compared to the previous week’s close, despite wide price amplitude during past sessions. Daily chart shows the price action entrenched within 200-pips consolidation, capped for now at 1.3400 zone, with daily technicals being positively aligned. Positive tone also prevails on 4-hour chart that keeps the upside focused, following last week’s sharp fall and quick recovery the reached levels close to the range top. Clearance of key 1.3399/1.3414 barriers is expected to trigger fresh phase higher, as resumption of larger uptrend from 1.2754, 09/07 low. From the other side, bulls may be delayed by weakening hourly studies, with corrective easing seen preceding fresh rally. Initial support lies at 1.3300, 50% of 1.3187/1.3399 range, while violation of range floor at 1.3187 will be bearish.

Res: 1.3342; 1.3379; 1.3399; 1.3414

Sup: 1.3300; 1.3272; 1.3260; 1.3232

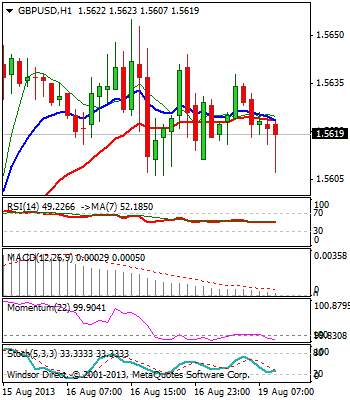

GBPUSD

Cable remains in an uptrend from 1.4812 low, with near-term price action being in a consolidative mode off 1.5655, fresh 2-month high, posted last week. Weekly close above 1.5600 handle and positively aligned near-term studies keep the upside in focus for eventual push through psychological 1.5700 barrier, to open way for full retracement of 1.5751/1.4812 downleg. Previous peak at 1.5573 offers initial support, ahead of psychological 1.5500 level and key near-term support and higher platform at 1.5420.

Res: 1.5655; 1.5700; 1.5721; 1.5751

Sup: 1.5600; 1.5573; 1.5538; 1.5500

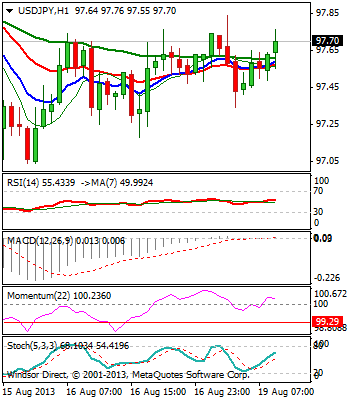

USDJPY

Near-term structure remains weak, as corrective bounce off 97.04, last Friday’s low, remains congested at 97.80, near 50% of 98.64/97.04 downleg. Failure to clear psychological 98.00 barrier as initial resistance, would risk further downside, as a part of broader weakness from 101.52 high that is maintained by bear-trendline, currently standing at 99.20. Break below 97.00 handle would open key near-term support at 95.78, 08/08 low.

Res: 97.84; 98.03; 98.64; 98.75

Sup: 97.34; 97.18; 97.00; 96.40

AUDUSD

The Aussie dollar maintains positive near-term tone and cracks the upper boundary of one-week consolidation range at 0.9220, as a part of larger recovery rally from 0.8846, 05/08 low. Positively aligned studies on lower timeframes keep focus at the upside, with 0.9240, daily Ichimoku cloud base, seen as the next barrier. Break here to complete daily cup ad holder reversal pattern and open key short-term hurdles at 0.9316/43, also 50% of 0.9790/0.8846 descend, for possible stronger recovery of larger downtrend. Alternative scenario sees risk of upside rejection at 0.9220 and double-top formation that requires confirmation on a break below 0.9080/60 supports.

Res: 0.9240; 0.9255; 0.9316; 0.9343

Sup: 0.9167; 0.9140; 0.9123; 0.9072

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.