EURJPY

The pair continues to trade within near-term consolidative range, after repeated failure to sustain break below 137 support zone and daily cloud base. Dip to 136.63, proved to be another false break lower, as the price bounced back to strong resistance at 138 zone, reinforced by daily 100SMA, below which, one-week consolidation was capped. With near-term picture showing directionless mode, expect break of either side of the range, to establish fresh direction. Overall bearish picture, however, keeps focus at the downside, with final push through near-term range floor, expected to fully retrace larger 135.80/141.20 ascend.

Res: 137.50; 137.75; 137.92; 138.00

Sup: 137.05; 136.67; 136.54; 136.00

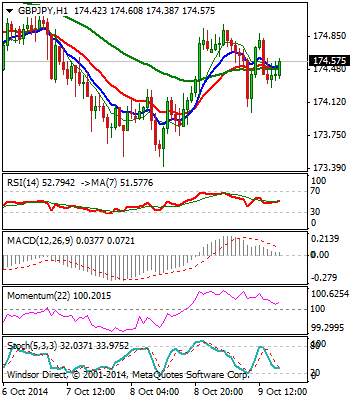

GBPJPY

Near-term corrective rally, off fresh low at 173.41, posted yesterday, remains for now capped at psychological 175 barrier, with hourly bulls losing traction and entering sideways mode. Studies on 4-hour chart remain negatively aligned, which sees downside risk in play, while the price holds below pivotal 175 barrier. Potential break higher to ease immediate bear pressure. On the downside, 174 handle offers immediate support, ahead of dented daily 55SMA at 173.66 and key near-term support at173.41, below which opens 173.28, daily 100SMA and 200SMA, also Fibonacci 76.4% of 169.32/180.67 at 172.00, in extension.

Res: 174.82; 175.00; 175.78; 175.87

Sup: 174.00; 173.66; 173.41; 173.28

EURGBP

The pair holds positive near-term tone, as recovery rally off 0.7765 double-bottom, peaked ahead of psychological 0.7900 barrier and 0.7915, Fibonacci 61.8% of 0.8007/0.7765 descend / daily Kijun-sen line. Corrective action is under way, with initial support at 0.7847, Fibonacci 38.2% of 0.7765/0.7898 ascend, coming under pressure. Further easing should be ideally contained above 0.7835/30 supports, 07 Oct higher base and 50% retracement, to keep near-term bulls in play. Increased risk of lower top formation, could be expected in case of further weakness and violation of 0.7819/16, 03 Oct higher low / Fibonacci 61.8%, as overall bears look for final push towards 0.7755, to mark full retracement of larger 0.7755/0.8813, July 2012-Feb 2013 ascend.

Res: 0.7898; 0.7915; 0.7950; 0.8007

Sup: 0.7847; 0.7816; 0.7800; 0.7765

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.