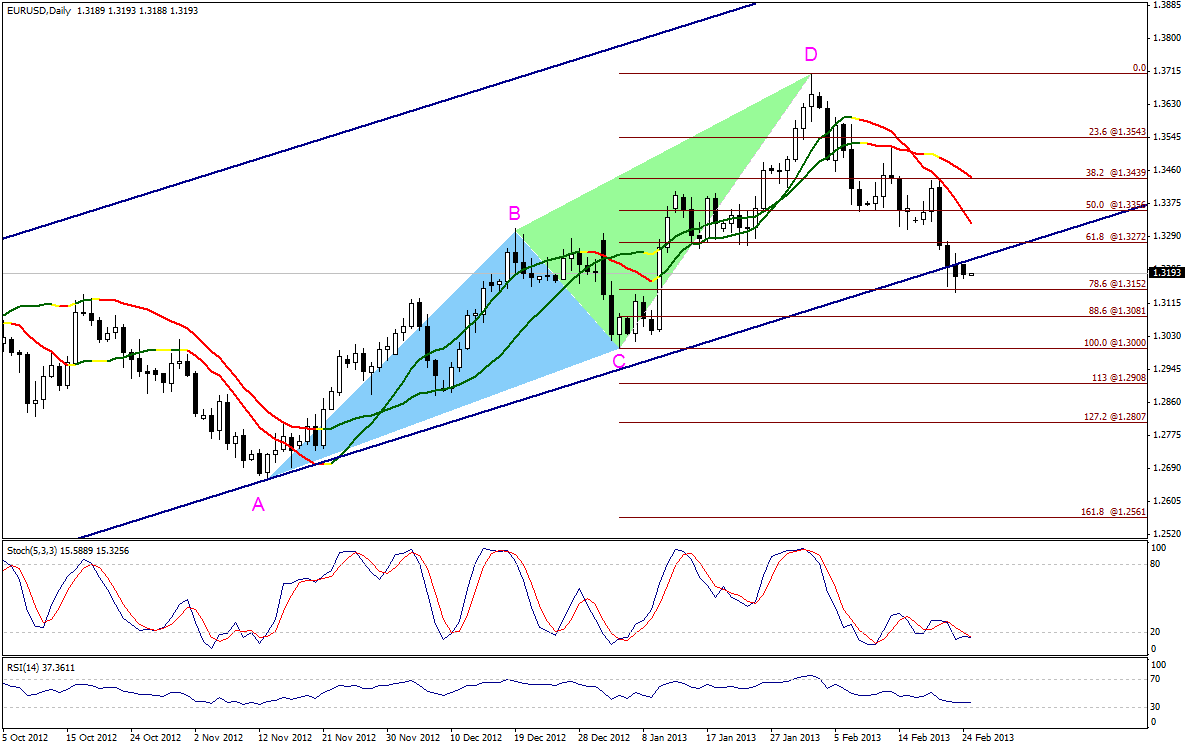

With the kickoff this week the pair holds below key support of the ascending channel -previously breached- and Linear Regression Indicators are trading negatively. The abovementioned support possibility of extending the downside move toward further targets of AB=CD bearish harmonic Pattern. The pair might touch 1.3080 levels during this week and might extend reaching the psychological 1.3000 areas. Stability below 1.3270 keep the possibility of a downside move valid.

The trading range for this week is among the key support at 1.2905 and key resistance at 1.3355.

The general trend over short term basis is to the upside targeting 1.3990 as far as areas of 1.3350 remains intact.

Support 1.3170 1.3120 1.3080 1.3030 1.3000

Resistance 1.3235 1.3275 1.3305 1.3355 1.3405

Recommendation Based on the charts and explanations above, our opinion is selling the pair below 1.3235 targeting 1.3120, 1.3080 then 1.3000 and stop-loss with four-hour closing above 1.3305 might be appropriate this week

GBP/USD

The pair broke 61.8% correction at 1.5180 levels shown on the graph increasing negativity, which might push the pair more to the downside toward 78.6% correction at 1.4760 levels during the upcoming session. Trading below 1.5300 levels with weekly closing is considered negative, but we prefer to see the pair stable below 1.5225 levels to accelerate the downside move. The week kicked off with a sharp bearish gap which makes Risk/Rewards ratio inappropriate for a clear position. The previously mentioned forces us to remain neutral nonetheless our general bearish outlook remains intact.

The trading range for this week is among key support at 1.4760 and key resistance at 1.5475.

The general trend over short term basis is to the downside targeting 1.4225 as far as areas of 1.6875 remains intact.

Support 1.5130 1.5080 1.5000 1.4940 1.4895

Resistance 1.5225 1.5300 1.5385 1.5415 1.5485

Recommendation Based on the charts and explanations above, we remain neutral for now awaiting more confirmations for the next move

USD/JPY

The pair moved to the upside with the beginning of the week, but it wasn’t able to push the pair to stabilize above 94.50 resistance. Meanwhile, the pair is proving stability above Linear Regression Indicators again forcing us to remain neutral in our weekly report. The upside move needs stability above 94.50 levels while bearishness requires stability below Linear Regression Indicators to assist the pair to break out of the ascending channel.

The trading range for this week is among key support at 90.40 and key resistance at 95.50.

The general trend over short term basis is to the upside targeting 100.00 as far as areas of 84.00 remain intact.

Support 94.15 93.65 93.05 92.50 92.05

Resistance 94.55 95.00 95.50 95.85 96.70

Recommendation Based on the charts and explanations above, we remain neutral for now awaiting more confirmations for the next move

USD/CHF

The pair is gradually moving to the upside as positive technical catalysts still dominate the pair and might help push the pair toward 0.9375 a breach of which will confirm a new bullish wave. Momentum indicators offer overbought signals; meanwhile Linear Regression Indicators are positive and trading above 0.9235 with daily closing will extend the upside move this week.

The trading range for this week is among key support at 0.9200 and key resistance at 0.9515.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

Support 0.9280 0.9235 0.9200 0.9170 0.9155

Resistance 0.9375 0.9425 0.9460 0.9490 0.9515

Recommendation Based on the charts and explanations above, our opinion is buying the pair above 0.9280 targeting 0.9375, 0.9460 then 0.9515 and stop-loss with four-hour closing below 0.9200 might be appropriate this week

USD /CAD

The pair rose and trading above 1.0355 levels indicating that the harmonic formation shown on graph might be formed. Momentum indicators offer overbought signals but we will ignore them unless 1.0120 was broken. Stability above 1.0055 keep positivity valid, but as we mentioned earlier stability above 1.0120 levels is important to offset overbought pressures.

The trading range for this week is between the key support at 1.0055 and the key resistance at 1.0440.

The general trend over short term basis is to the downside with steady daily closing below levels 1.0125targeting 0.9400.

Support 1.0205 1.0165 1.0120 1.0085 1.0055

Resistance 1.0290 1.0310 1.0355 1.0420 1.0440

Recommendation Based on the charts and explanations above, our opinion is buying the pair above 1.0205 targeting 1.0290, 1.0310 then 1.0355 and stop-loss with four-hour closing below 1.0120 might be appropriate this week

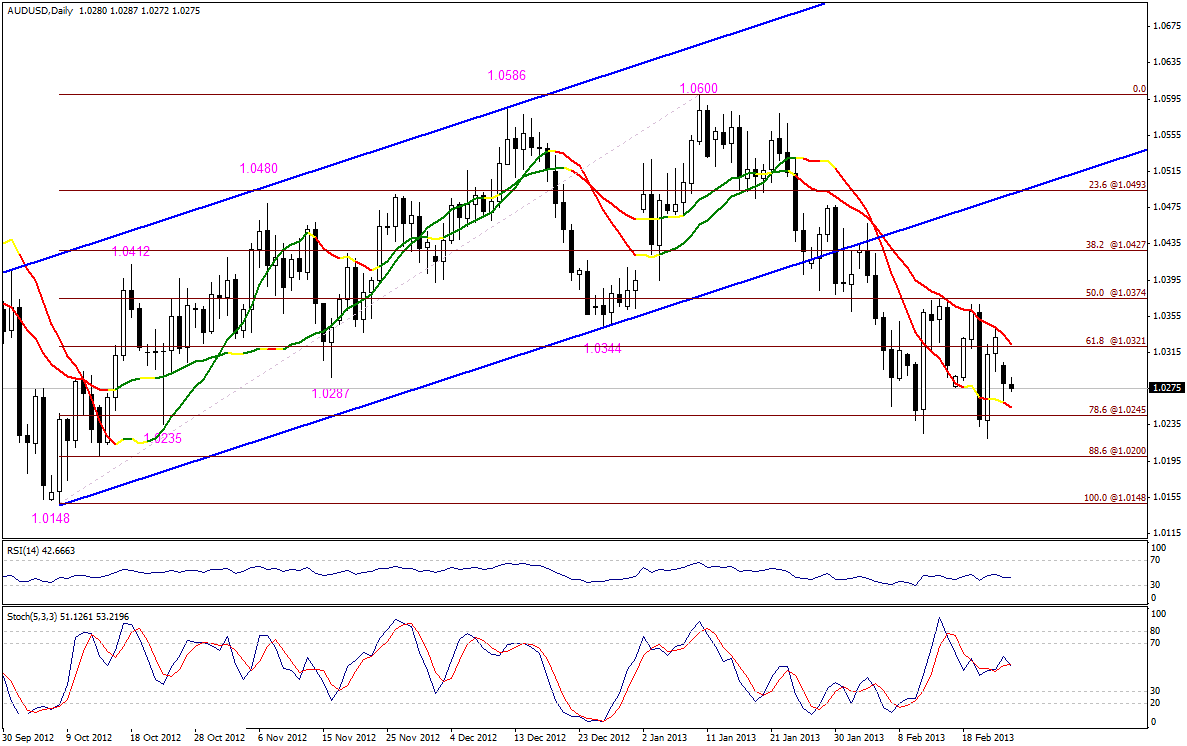

AUD/USD

The pair is trading between 61.8% correction to the upside and 78.6% correction to the downside at 1.0320 and 1.0245 respectively. Meanwhile, we find the pair trading between Linear Regression Indicator 34 and 55. Such case makes Risk/Rewards ratio inappropriate and the trend unclear, forcing us to remain neutral in our weekly report waiting for confirmation signals.

The trading range for this week is among key support at 1.0085 and key resistance at 1.0440.

The general trend over short term basis is to the downside with steady daily closing below levels 1.0710 targeting 0.9400.

Support 1.0245 1.0220 1.0200 1.0165 1.0135

Resistance 1.0320 1.0345 1.0385 1.0400 1.0440

Recommendation Based on the charts and explanations above, we remain neutral for now awaiting more confirmations for the next move

NZD/USD

The downside move remained limited above key support level of the ascending channel. Yet the bearishness took the pair below Linear Regression Indicators; therefore the pair should stabilize above 0.8415 levels to revive the upside move. In general, we will stay positive unless a breakout below 0.8270 is seen.

The trading range for this week might be among key support at 0.8200 and key resistance at 0.8535.

The general trend over short term basis is to the upside with steady daily closing above 0.8130 targeting 0.8845.

Support 0.8355 0.8310 0.8270 0.8225 0.8200

Resistance 0.8385 0.8415 0.8450 0.8480 0.8500

Recommendation Based on the charts and explanations above, our opinion is buying the pair above 0.8355 targeting 0.8415, 0.8480 then 0.8535 and stop-loss with four-hour closing below 0.8270 might be appropriate this week

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.