Comparing the FOMC market outlook with Treasury futures is an interesting exercise. Both are looking forward and both anticipating the probable trend of US Treasury market rates. In particular, both are anticipating the probability of future inflation. At the time of the December increase, the Fed had clearly indicated at least four increases of the overnight lending target rate.

_20160201103337.png)

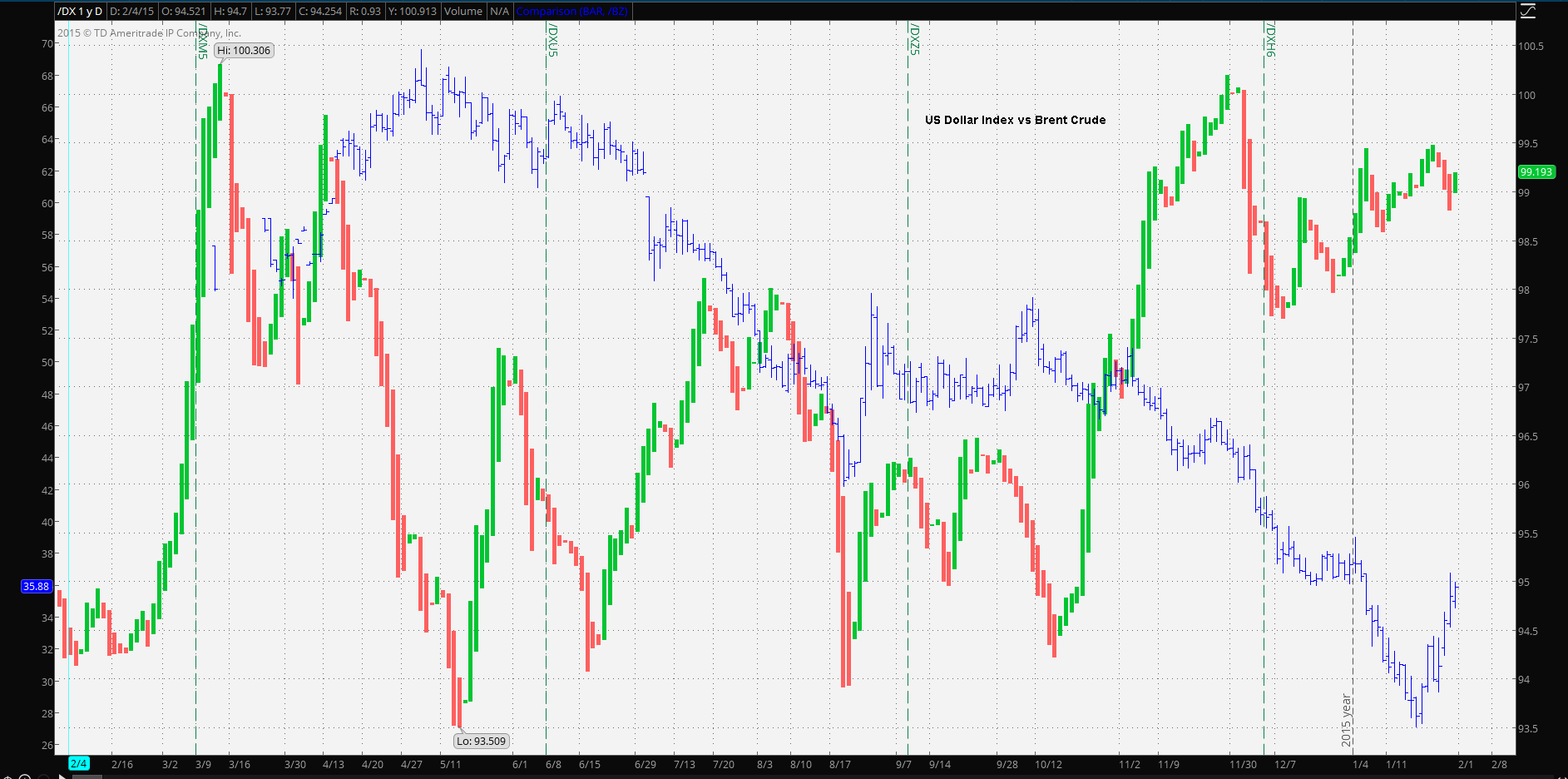

The Grid tracks the daily futures price range over the previous three months of US Treasury futures trading: the 30 Day Fed Funds, the 2 Year Treasury Note, the 10 Year Treasury Note and the 30 Year Treasury Bond. Clearly, the 30 Day short term rate market agreed with the December Fed action and this is pretty much technical. However, 2 Year Note futures initially sold off and when the front month rolled over into 2016, 2 Year Note futures began to gain; similarly for the 10 Year Notes futures and the 30 Year Bond futures. Keep in mind that as futures (or options) approach expiration, the derivative approaches intrinsic value. So the chart is demonstrating divergence between the Fed’s outlook and the broader market outlook. Both cannot be correct; eventually the market and Fed (at some point in the future) must converge. Hence it begs the question: which outlook is correct? Is the market telling the Fed they’ve got it wrong, or vice versa? It’s an interesting puzzle. The Fed sets the target rate by decree. However, if markets set rates by the efficient market hypothesis does this mean that the Fed knows something the market doesn’t?

Most, if not all of today’s market trading, is determined by models and algorithms. It’s also reasonable to assume that broadband communications make it possible for any large institutions to trade in every major global market with the same ease as trading in the local market. The time difference for an order ‘fill’, if placed on the FTSE and the NYSE and sent at the same time, may be measured in milliseconds. Further, FX and futures markets trade with virtual continuity from the Monday morning New Zealand open until the Friday Chicago close. If one wishes to be philosophical, a high volume, very liquid and very deep market price of a particular asset is a form of global consensus thinking by virtue of modern technology.

What clues in the Fed January statement alerted markets to the fact that the Fed might be having second thoughts on the domestic US economy and particularly in achieving their 2.0% inflation target?

In the opening paragraph of the 16 December statement: “...Information received... ...suggests that economic activity has been expanding at a moderate pace... ...Inflation has continued to run below the Committee's 2 percent longer-run objective... ...Market-based measures of inflation compensation remain low...”

This changes in the 27 January statement: “...Information received ... ...suggests that labor market conditions improved further even as economic growth slowed... ...Inflation has continued to run below the Committee's 2 percent longer-run objective... ...Market-based measures of inflation compensation declined further...”

Hence, economic activity changed from ‘expanding at a moderate pace’ to ‘slowed’ and inflation compensation went from ‘low’ to ‘declined further’; (i.e. from low to lower).

In the 16 December statement: “... taking into account domestic and international developments, the Committee sees the risks to the outlook for both economic activity and the labor market as balanced...”

When it comes to the global economy, the 27 January statement noted that: “...The Committee is closely monitoring global economic and financial developments and is assessing their implications for the labor market and inflation, and for the balance of risks to the outlook...”

In the 16 December statement the global risks to the US economy were ‘balanced’. In the 27 January statement the global risks to the US economy are being ‘closely monitored’ and their implications are being ‘assessed’.

Lastly, in the 16 December statement the FOMC had determined that: “... Inflation is expected to rise... ... over the medium term as the transitory effects of declines in energy and import prices dissipate...”

In the 27 January statement, the FOMC had determined that “...Inflation is expected to remain low in the near term, in part because of the further declines in energy prices... ...but to rise... ... over the medium term as the transitory effects of declines in energy and import prices dissipate...”

It seems that the FOMC is implying that the projected rise of inflation in the medium term will be preceded by a period of low inflation. Is the Fed concerned that energy prices have not yet bottomed?

FOMC statements are formulaic in the sense it has a basic construct and must be gleaned for small changes from statement to statement. An institution like the Federal Reserve simply wouldn’t risk any radical departure from their usual way of relaying information to markets. It is for markets to then decide on what actions to pursue in the wake of an FOMC decision. Hence, it’s reasonable to conclude that during the period from 16 December 2015 through 27 January 2016, global markets were well ahead of the Fed.

Since global events may have put the Fed ‘on the back foot’ it’s likely that the US Dollar will strengthen by default as other central banks signal more easing and the Fed remains on hold.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.