There was one out-of-the-ordinary concern. It has been an issue with several Central and Eastern European (CEE) emerging market nations for several years already: foreign currency denominated loans; mostly mortgages but also auto and other loans. Fellow EU member Hungary seems to have resolved the same problem, but it wasn’t cheap nor easy. It took combined parliamentary and Hungarian central bank measures culminating just recently in legislation designed to share the cost of converting 1.43 billion Francs (£710 million) to its legacy currency, Forints and then subsidizing 30.837 billion Forints (£73 million) for consumers who exchange Franc loans for Forint loans.

A similar plan is currently making its way through Poland’s bicameral legislative process. However, NBP Governor Belka warned that the bill would undermine the Zloty creating painful private banking sector capital shortages: “...A sudden conversion would mean a risk of a significant weakening of the zloty, and hence a rise in the costs of foreign exchange-denominated loans.... ...so, we would be shooting ourselves ... in the foot...”

From 2007 through 2008, more than 500,000 Poles applied for Swiss Franc denominated mortgages , taking advantage of lower rates. The Franc has since appreciated greatly against the Zloty causing payments to balloon. The proposed legislation will divide the conversion costs equally between banks and credit holders. The final legislation has not yet been decided on.

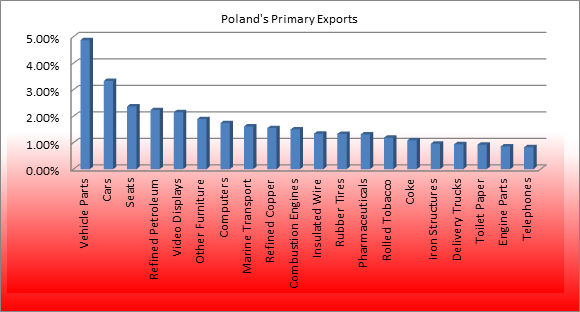

Poland has an industrial economy, manufacturing mostly automobiles and auto parts. Poland does have mineral resources, primarily coal. It is Europe’s second largest coal producer; however, coal is not among its top exports. Other than coal, Poland has small amounts of crude oil and gas as well as sulfur, copper, natural gas, silver lead, salt and amber. Poland trades mainly within the EU and greater Europe.

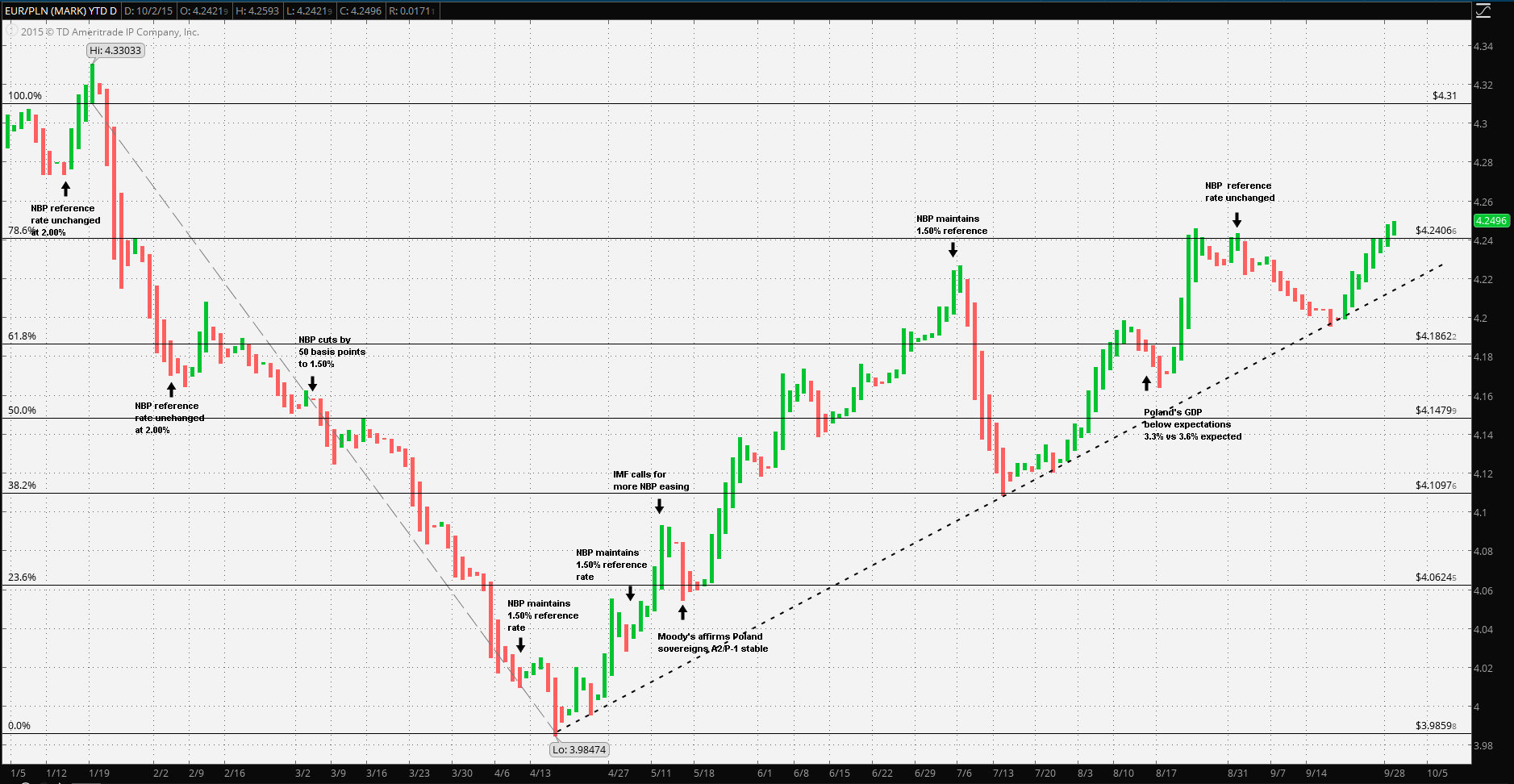

At the January meeting the NBP left its reference rate unchanged at 2.00%. Year over Year GDP was 3.4%, double the 2013 rate of growth, however, prices continued to deflate. Note that this meeting took place before the ECB implemented its expanded QE and one day before the Swiss decoupling from the Euro. At the February meeting the NBP again maintained the reference rate, with CPI at -1.00%, however, while Governor Belka strongly suggested a March rate cut. Indeed, the NBP policy council cut rates more than expected at the March meeting; 50 basis points to 1.5%. Concerns over accelerating deflation seemed to be the motivation; CPI dropped 1.3% in January of 2015. The Zloty’s best against the Euro in 2015 occurred on 21 April a week after the NBP decided against further rate cuts. The Zloty had gained 8.812% from the 29 December nine month high of 4.36985 per Euro.

In spite of IMF calls for the NBP to take more aggressive action against deflation, Governor Belka seemed comfortable with a strengthening Zloty stating, “...We have a free-floating currency, so its rise and fall are natural...” calling further cuts “unnatural and not serious”. The NBP may have been comfortable with its deflation, but not the IMF, calling for greater easing; nor was the market, driving Hungarian short term yields below the same Polish maturities in spite of Poland’s better ratings.

The Zloty finally began to weaken vs the Euro from the 20 April low until the 8 July meeting which coincided with a critical juncture of the Greek-EU impasse and China equity market sell-offs. At that point the Zloty had declined by 6.1% vs the Euro. The Zloty rallied to trend from 9 July through 17 July, then resumed its steady weakening trend. The NBP, once again stood fast at the July meeting, Governor Belka stating: “...The expected stable economic growth, amid recovery in the euro area and a good situation in the domestic labor market, reduce the risk of inflation remaining below the target in the medium term...” If the NBP’s goal was to weaken the Zloty, the chart clearly backs up the NBP’s decisions to that point. Further Poland’s economy was among the best performing in the CEE region.

One other factor which may have contributed to the EUR/PLN trend was a growing chorus in both houses of the Polish government for a Hungarian styled, government supported, foreign currency loan conversioniv, a plan strongly opposed by the government and the NBP.

However, the global economic contraction which had begun in China some months before was beginning to indirectly affect the Polish economy, mainly through its heavily weight trade with Germany. Poland’s July GDP measure was below expectations at 3.3% a 30 basis point decline month over month.

It’s difficult to argue with success. The Narodowy Bank Polski has done a reasonably good job of managing the economy as well as working down the Zloty vs the Euro. Since last March, presently and for the foreseeable future, the ECB will press forward with its asset purchase program. There are ‘hawks’ on the bank’s NBP, but outside of their future inflation concerns, have otherwise gone along with policy. The only fly in the soup is that of the global economic contraction and its effect on Germany and the German auto export industry.

In total, there seems to be little risk of a rate increase. From the steady handed history in 2015, the NBP will more likely maintain rates unless the slowing in GDP accelerates. Past actions prove that when the NBP reacts, it does so strongly.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.