Recent comments by ECB Vice President Constancio has pointed out that compared to other central bank policies, the ECB “has the scope” to ease further if necessary: “...the total amount we have purchased represents 5.3 percent of the GDP... ...what the Fed has done represents almost 25 percent of the U.S. GDP, what the Bank of Japan has done represents 64 percent of the Japanese GDP and what the U.K. has done 21 percent of the UK’s GDP... ...So we are very far from what the major central banks have done... ...[therefore] there is scope, if the necessity is there...” There are many ways to interpret the statement. It might have been a simple matter of factual observation, it may have been a suggestion that the ECB can defend the Euro much more aggressively or perhaps signaling that more aggressive ECB asset purchases is in the works. On 23 September, ECB President Draghi reiterated Mr. Constancio’s statements in testimony to the EU parliament.

So the question becomes that of ‘what-if’. Will the ripples out of the Asia-Pacific economic region ‘negatively’ impact the Euro?

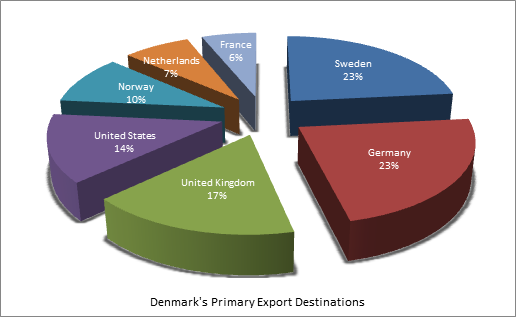

Over 57% of all Danish exports are concentrated in its top 7 trade partners. Its #1 trading partner is Sweden, accounting for 13.25% of all Danish exports and about 24.4% of the top 7 destinations. Next is Eurozone member Germany, which accounts for 23.66% of those top export destinations. Third in line is the United Kingdom, accounting for 16.65% of the top tier, followed by the United States at 13.5% of the top tier; Norway, almost 10% of the top tier; Netherlands, 7.43% of top tier and lastly France at 6.11% of top tier. The whole point of the matter is that Sweden, the U.K., the US and Norway, comprising 36% of Denmark’s top export destinations, trade with their own currency. Additionally, Germany, the U.K. and the United States are currently the top performing advanced global economies; the U.S. and U.K. having relatively strong currencies. Germany, Norway, Netherlands and France being Eurozone members will hardly affect trade due to currency valuation since a Danish Krone is a virtual Euro.

Thus a weak Euro is a weak Danish Krone and an advantage for Denmark’s export economy, both inside and outside of the EU.

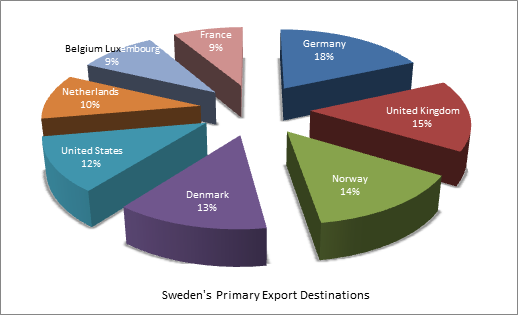

Just over 53% of Sweden’s exports are concentrated in its top 8 trade partners, Denmark ranking 4th with almost 7% of all exports and nearly 13% of the top tier. Of the top eight, 4 are Eurozone members, Germany, Netherlands, Belgium-Luxembourg, France plus Euro pegged Denmark; 60% of the top tier export destinations. A large portion of Swedish exports to its primary trading partners is refined petroleum, a commodity which currently lacks pricing power. A stronger Krona, or equivalently, a weaker Euro, will negatively affect Sweden’s mostly European centric, export economy.

The price/event chart demonstrates a sharp strengthening of the Swedish Krona vs the Danish Krone from a 9 month, 13 February high of 1.29087 to a 12 March low of 1.22309; a 5.42% advance. Within that span, Riksbank lowered its policy rates twice; in February, from -0.75% to -0.85% and then to -1.00% about a month later. These cuts were most likely in response to the DNB attempting to discourage ‘safe haven inflows’ by its Krone defense, possibly driving capital into the Crown. (The DNB went so far as to request the Danish government to postpone Treasury bill sales). Riksbank, concerned about a deflating Crown, initiated its own QE asset purchase program, acquiring short through medium term Swedish sovereign bonds. SEK weakened against the majors but not against DKK.

It’s possible that in his recent testimony, Mr. Draghi signaled that should the global economic contraction gain momentum, the ECB has the leverage to act. Riksbank does not have as much leverage as does the EU; its benchmark rates are already well negative. Had Riksbank reduced its benchmark rates at its last meeting and the global economy continues to worsen, it only would put the bank in a more difficult position.

The weight of weakening seems to fall on the side of the Euro, hence the Danish Krone. Hence, it would seem reasonable that the Swedish Crown continue to strengthen against the Danish Krone as long as the ECB continues to provide liquidity and signal that it is well prepared to intervene further, should it be necessary. Lastly, although Riksbank has proven itself to defend the Crown vigorously, will lower deposit rates have decisive impact vs the Euro, hence the Krone?

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.