Other issues causing growth concerns for BOK Governor Lee Ju-yeol is the very weakened Japanese Yen, down 11.648%, from ₩10.2352, 14 August 2014, finding support at a 52 week low on 5 June of ₩9.043 to the Yen. Further, China is outsourcing less and producing domestically more intermediate or finished goods that had previously been imported. The BOK actions were not unexpected as it were, more than half of analyst surveyed forecasting a rate reduction.

South Korea has a £1.195 trillion pound economy, ranking it 13th by IMF PPP-GDP rankings; £22759.5 per capita. Korea has mineral resources, coal, tungsten, graphite, molybdenum and lead. Over 23% of the labor force is in the industrial sector and over 69% in services. The largest component of GDP is household spending, 50.6%; government spending follows at almost 15% and fixed capital investment makes up almost 30%. South Korea’s unemployment rate is about 3.7% and sovereigns are well rated at A+, stable by S&P. The 10 year bond is currently yielding 2.50%.

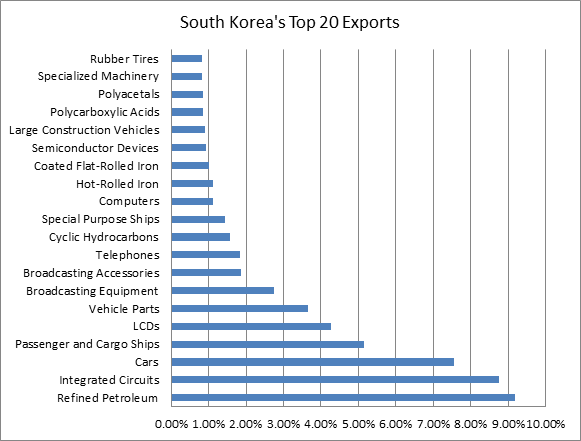

South Korea is a major energy importer, 97% of its needs supplied from outside sources. Energy imports include crude oil, coal. LNG is shipped in as no pipelines serve the country; nuclear supplies 25% of the country’s power demands.

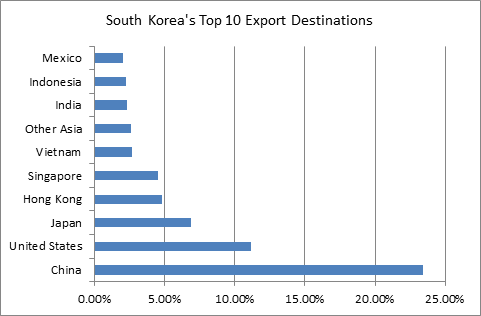

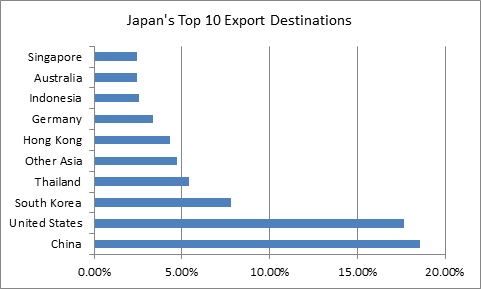

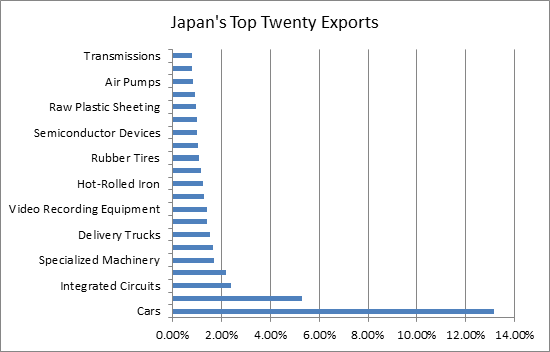

South Korea has an export dependent economy. The question becomes that of the economic health of export markets and that of competing Japanese exports. Clearly, Korea and Japan compete in export products and in export markets. So a weaker Won will make Korea’s product more competitive.

What event’s transpired which enabled the Yen to devalue relative to the Won? A few days after reaching its 52 week high of ₩10.2352 to the Yen and one month after initiating a £23 billion stimulus program, the BOK reduced the 7 day repurchase rate to 2.25% from 2.50% citing slow domestic growth, moderate global recovery and concerns about US monetary policy. There might have also been concerns over the Bank of Japan’s response to a -1.7% Q2 GDP contraction; -6.8 annualized

Towards the end of August, 2014 both South Korea and Japan export demand were contracting, particularly, exports to China. However, it needs to be noted that the Japanese economy was also adversely affected by a scheduled sales tax increase. The market was expecting something as the Won Strengthened to ₩9.7417, a decline of 4.78%iii and Korea’s current account surplus widened to £56 billion, a record high. Revisions to Japanese Q2 only confirmed the worse, now indicating an annualized -7.1% growth rate. By the end of September, Japanese factory output, consumer spending and real wages were contracting. During the same period, South Korea experienced a bounce in exports to the US and China, mostly in memory chips and petrochemicals, but domestic consumption remained weak. By the end of October, 2014 the Japanese government startled markets by announcing their intent to expand the current bond purchasing program. The announcement occurred only days after the BOK cut the 7 day repurchase rate another 25 basis points to 2.00%, after the tally of September exports to China, once again, declined. It was all downhill for JPY/KRW to the end of the year. South Korea ended the year measuring 2.7% growth for the year; below expectations. In March, the Bank of Korea once again cut the benchmark repurchase rate 25 basis points to another record low of 1.75%

JPY/KRW steadied in the first few months of 2015, trading in a range of ₩9.4703 support to ₩9.6088 resistance until the middle of May. At this time Asian currencies weakened on US Federal Reserve comments and a strengthening US Dollar. Japan’s GDP report on May 19 indicated two consecutive quarters of positive GDP growth, but the Yen continued to weaken against the Won. A week later BOK Governor Lee continued to express concerns over growth and indicated a further rate cut were not out of the question. The extraordinarily weak yen was beginning to show measurable results leading to the 52 week low of ₩9.043 to the Yen.

The unfortunate timing of the MERS outbreak further dampened consumer spending causing the BOK to reduce the repurchase rate another 25 basis points to 1.25%, its fifth consecutive record low in a year. The long back and forth between regional central banks ended with New Zealand cutting its cash rate 25 basis points and BOJ Governor Haruhiko Kuroda suggesting that further weakening in the Yen was unlikely.

Once again the key to any reversal would be increased demand especially from China, although demand from the US would be just as helpful. Since BOJ Governor Kuroda has opined on a stronger Yen, it’s reasonable to assume that further Yen easing is unlikely allowing for the Won to weaken, especially since the BOK still has room to cut rates again if need be.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.