The World Bank ranks it as an upper middle income economy and as ‘newly industrialized’. According to the CIA’s World Fact Book, RSA has well developed financial system including the largest stock exchange on the continent. It has modern communications and transportation infrastructure but is lacking in electricity distribution plagued with frequent outages. Once completed, two additional coal fired power plants could add 3% to economic growth, but again, there have delays. RSA has limited oil but, according to U.S. EIA, considerable shale gas resources. Most power is generated from its own extensive coal resources, accounting for 72%, followed by 22% from oil, 3% nuclear and 3% from renewables. Also, RSA has a large ‘synthetic fuel’ industry converting both gas to liquid and coal to diesel and gasoline. To gauge South Africa’s growth potential, it’s interesting to note that RSA consumes 30% of total primary energy on the African continent.

RSA ranks 25th in land area with over 471,000 mi2 and 25th in population at over 54 million. PPP-GDP is over €653 billion resulting in per capita PPP-GDP of €11,905 by 2015 estimates. Income distribution is poor, noted by its Gini coefficient of over 63. Unemployment is very high at officially, 25%. In general poverty and inequality is a central issue in South Africa and recently has led to instability, strikes, and general unrest.

The primary purpose of the South African Reserve Bank is “to achieve and maintain price stability in the interest of balanced and sustainable economic growth”. On inflation, SARB has done reasonably well measuring CPI at 4.0% and PPI at 3.1%. Policy implementations is carried out through weekly seven day repurchase auctions with commercial banks and also end of day facilities through repos or reverse repos. The current repo rate is 5.75%. The prime lending rate is 9.25%. South Africa current holds over €41 billion in official reserve assets and €35.6 billion in convertible currency reserves. The present governor of SARB is Mr. Lesetja Kganyago.

South Africa is a leading global exporter of mineral resources. It’s strategic, industrial mineral exports account for 60% of all exports. RSA produces 77% of the world’s platinum, 55% of its chromium and 45% of total palladium produced. Other mineral exports include zirconium, manganese, aluminum, iron ore and nickel to name just a few. Lastly South Africa produces 5% of the world’s polished diamonds. Hence South Africa’s growth is heavily dependent on the major industrial economies.

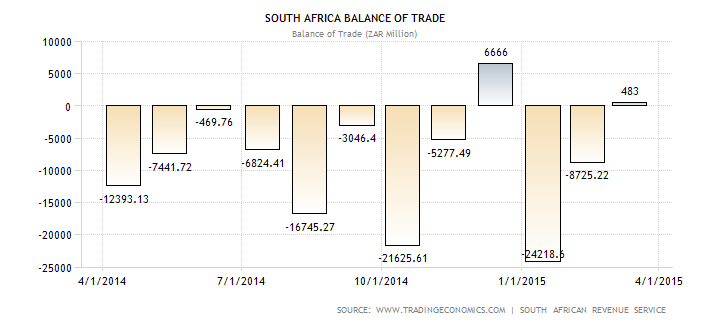

South Africa’s major export partners are China, US, Japan, Germany, India and the U.K. totaling over €91 billion. RSA recorded a trade surplus in March 2015 with exports increasing 19.3%, including an increase of nearly 38% in precious metals and stones, machinery, electronics, base metals, vehicles and mineral products.

RSA’s major import partners are China, Germany, U.S., Saudi Arabia, India and Japan. Imported products include fuel, machinery, mechanical appliances, motor vehicles, auto parts, communications equipment, pharmaceuticals, and foodstuffs. Nuclear reactors are also listed as ‘imported’ but most likely for replacement in existing power plants. Currently 1.5% of electric power is nuclear generated.

The comparison currency is the United States Dollar. In brief, the economic recovery in the US has been inconsistent and recent data is indicating a slowing of already moderate growth. If the U.S. economy is indeed slowing, it will delay the Federal Reserve’s planned target rate increase beyond September.

_20150511120159.png)

The chart pattern for USD/ZAR is about as neat as they come. A simple application of a Fibonacci retracement study demonstrates both trend line resistances over a 52 week period starting from the low of 10.27301 ZAR per USD to the high of 12.52495 ZAR per USD on 13 March. Fibonacci support is currently 11.8254 ZAR per USD and resistance at 12.2904 per USD.

Undoubtedly, South Africa has the mineral resources to be the leading economy on the African continent. Unfortunately, it’s a goal difficult to achieve when export demand is uncertain. Further, unemployment, frequent mining strikes, a poor electrical distribution infrastructure and an extremely uneven income distribution has already created public unrest and has also directly blunted organic growth. Because of its mineral resources, Republic of South Africa has extraordinary growth potential, but because of a lack of unity and direction, it will be difficult for it to prosper should global economies continue to experience slow growth. There will be a time to go long USD/ZAR, but for the time being, its best to let it ‘bottom out’ until the major, resource hungry industrial giants need the mineral resources of South Africa.

As it stands now, it would not be too far from reasonable to expect that slowing demand for strategic industrial minerals will have a direct negative effect on South Africa and the South African Rand.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold price shines amid fears of fresh escalation in Middle East tensions

Gold price rebounds to $2,380 in Thursday’s European session after posting losses on Wednesday. The precious metal holds gains amid fears that Middle East tensions could worsen and spread beyond Gaza if Israel responds brutally to Iran.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.