Due to this uncertainty, capital flight has increased in Greece. Greek savers are withdrawing money at an alarming rate as a potential exit from the Eurozone looms large. Below is a pie chart of who owns the large amount of Greek debt.

Aside from Greece’s on-going negotiations, the ECB will be implementing their new QE programme next month which should boost growth and stave-off deflation. This should lower the Euro and help firms boost profits thereby creating employment. However, structural reforms need to take place in order for QE to be effective.

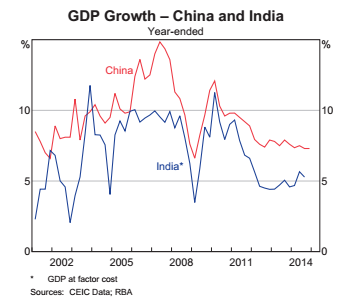

After 18-months of holding the rate constant at 2.5%, and with the recent a slowdown in consumer spending, the RBA cut interest rates to 2.25. In addition, due to China’s slowdown (shown in the graph) there has been a declining demand for commodities. The RBA have also reiterated that the Aussie Dollar remains very high and thus a rate cut should devalue the Aussie Dollar.

Unemployment still remains a concern for the RBA and currently sits at 12.5%. A rate cut should lift business investment and thus increase employment. In addition, a declining Aussie dollar and lower oil prices should help firms profit and help inflation.

The only concern the RBA have are house prices - with a lower cash rate there will be more buyers in the market. Thus there is a likely to be a mismatch between demand and supply resulting in higher property prices.

Recommended Content

Editors’ Picks

AUD/USD recovers to near 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to near 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.