In the last 24 hours the Australian dollar has surged higher however it has run into resistance right around 0.7950 before easing slightly lower in recent hours. After a solid start to last week, the Australian dollar eased back towards the key 0.7850 level where it has received some support to close out last week and to begin this week before its recent surge higher. In its early week surge last week, it moved to a three month high just shy of 0.81. Throughout most of the last few weeks the Australian dollar enjoyed a strong surge higher to the three month high at 0.8075. To start last week the Australian dollar looked poised to break through the long standing resistance level at 0.7850 even though this level has stood up tall for several months now. A couple of weeks ago the Australian dollar fell sharply but landed on the previous key level at 0.77 which has offered considerable support since that time. A few weeks ago saw the Australian dollar enjoy a solid week moving off support around 0.76 to reach a three week high just shy of the resistance level at 0.7850. In doing so, it moved through the key resistance level at 0.77.

Since the beginning of March the Australian dollar has relied heavily on support at the 0.76 level. Below 0.76 its next obvious support level is down at 0.7550 and it will hoping to be propped up by it. Back in early March the Australian dollar made a statement and broke down strongly through the key 0.77 level which then provided significant resistance for the following few days. It was also able to enjoy some short term support around 0.7550 which propped it up and allowed it to rally strongly back up to above 0.79. Throughout February the Australian dollar made repeated attempts to move up strongly to the resistance level at 0.7850 however it was rejected every time and sent back easing lower, which is why this level remains significant presently. Just prior to that towards the end of February the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900. In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200.

Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

Australia’s central bank cut interest rates for the second time this year on Tuesday, seeking to buttress the economy against sliding mining investment while heading off a harmful increase in the local dollar. The currency did initially drop after the Reserve Bank of Australia (RBA) trimmed its cash rate a quarter point to a fresh all time trough of 2.0 percent. Yet it soon rallied as investors wondered whether the easing cycle might now be over. Indeed, the statement announcing the move noted some improvement in the economy while omitting a mention that further action could prove necessary. “The Board judged that the inflation outlook provided the opportunity for monetary policy to be eased further, so as to reinforce recent encouraging trends in household demand,” said RBA Governor Glenn Stevens. He also offered a nod to recent better data. “The available information suggests improved trends in household demand over the past six months and stronger growth in employment.” As a result, interbank futures dipped from July onward as the market pared back the prospects of rates going under 2 percent.

(Daily chart / 4 hourly chart below)

AUD/USD May 5 at 23:50 GMT 0.7929 H: 0.7956 L: 0.7787

AUD/USD Technical

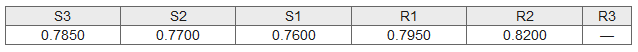

During the early hours of the Asian trading session on Wednesday, the AUD/USD is easing slightly after running into resistance at 0.7950. Current range: trading right below 0.7950 around 0.7930.

Further levels in both directions:

- Below: 0.7850, 0.7700, and 0.7600.

- Above: 0.7950 and 0.8200.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.