The Australian dollar hasn’t had a great last week as it has dropped sharply and fallen to a new multi-year low near 0.85, although in the last couple of days it has enjoyed some solid support from 0.85. To start this new week it rallied back above 0.8650 again before falling lower in the last few days. In the week prior the Australian dollar was able to rally higher and bounce off multi year lows around 0.8550 and in doing so has moved back within the previously well established trading range between 0.8650 and 0.88. Earlier last week the Australian dollar ran into the resistance level at 0.88 again which stood tall and sent prices lower again. A few weeks ago it fell sharply from above the resistance level at 0.88 back down to the support level of 0.8650 before crashing further to a new multi-year high near 0.8550. During the last couple of months the Australian dollar has done well to stop the bleeding and trade within this range after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650 and a then eight month low in the process. The resistance level at 0.88 remains a factor and is continuing to place downwards pressure on price, however more recently all eyes have turned on to the support level at 0.8650 to see if the Australian dollar can hold on and stay within reach again.

Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory. The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

Australia’s dollar is likely to drop in line with commodity export prices, central bank Deputy Governor Philip Lowe said, as the currency hit a four-year low. “If the exchange rate is to play its important stabilizing role, it needs to go down when the terms of trade and investment are declining,” Lowe said in a speech in Sydney late yesterday. “We have seen some adjustment, but if our assessment of the fundamentals is correct we would expect to see more in time.” While the Australian dollar has fallen more than 8 percent in the past three months, it remains elevated as the nation’s key interest rate of 2.5 percent attracts investors away from the U.S., Japan and Europe where benchmarks are at or near zero. The yield difference has helped the Aussie resist a fall in the terms of trade, or export prices relative to import prices, that normally guide its trajectory.

(Daily chart / 4 hourly chart below)

AUD/USD November 26 at 21:45 GMT 0.8549 H: 0.8565 L: 0.8480

AUD/USD Technical

During the early hours of the Asian trading session on Thursday, the AUD/USD is enjoying rallying back up to 0.8550 after finding some support at 0.85. Current range: trading right around 0.8530.

Further levels in both directions:

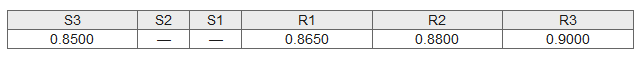

- Below: 0.8500.

- Above: 0.8650, 0.8800, and 0.9000.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.