Throughout most of last week the Australian dollar dropped sharply back through the support level at 0.8650 and 0.86 before finishing the week rallying higher and creeping back above the 0.8650 level. To start this new week it has rallied back above 0.8650 again before falling lower in recent hours. In the week prior the Australian dollar was able to rally higher and bounce off multi year lows around 0.8550 and in doing so has moved back within the previously well established trading range between 0.8650 and 0.88. Earlier last week the Australian dollar ran into the resistance level at 0.88 again which stood tall and sent prices lower again. A few weeks ago it fell sharply from above the resistance level at 0.88 back down to the support level of 0.8650 before crashing further to a new multi-year high near 0.8550. During the last couple of months the Australian dollar has done well to stop the bleeding and trade within this range after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650 and a then eight month low in the process. The resistance level at 0.88 remains a factor and is continuing to place downwards pressure on price, however more recently all eyes have turned on to the support level at 0.8650 to see if the Australian dollar can hold on and stay within reach again.

Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory. The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

Abundant supply is driving commodity prices lower, but the good news is that Chinese demand for Australian resources will continue as its economy evolves, the Reserve Bank says. A dramatic increase in commodity exports from Australia and other countries has increased global supply, pushing commodity prices down, RBA head of economic analysis Alexandra Heath said. Her comments to the NSW Mining Industry and Suppliers Conference in Sydney on Friday came after the iron ore spot price this week fell to a fresh five year low of around $US70 per tonne. “Much of the fall in iron ore and coal prices we have seen over the past year or so is the result of increasing global supply, but recently there has also been some easing in demand associated with slower growth in Chinese steel production,” Dr Heath said. “The resulting fall in Australia’s terms of trade is expected to weigh on household income.” But while demand from China was slowing, it would continue to have a “huge appetite” for commodities of many kinds, she said. Dr Heath said China’s urbanisation process had some way further to run, meaning demand for commodities to build housing, infrastructure, utilities and public buildings.

(Daily chart / 4 hourly chart below)

AUD/USD November 24 at 21:45 GMT 0.8615 H: 0.8700 L: 0.8602

AUD/USD Technical

During the early hours of the Asian trading session on Tuesday, the AUD/USD is trying to rally a little higher off the 0.86 level after dropping sharply in the last 12 hours or so. Current range: trading right around 0.8615.

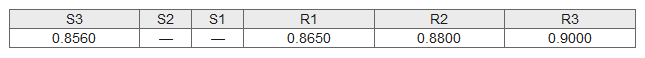

Further levels in both directions:

- Below: 0.8560.

- Above: 0.8650, 0.8800, and 0.9000.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.