In the last few days to finish out last week the Australian dollar found some much needed support at 0.8950 and rallied back up to just shy of the key 0.90 level before easing lower again. The Australian dollar has seen its sharpest fall in over 12 months as it fell down to a six month low near 0.8900 even though it temporarily found some support at 0.90. The long term key level at 0.90 was called upon to desperately provide some much needed support to the Australian dollar, which it did a little over the last week. It showed some positive signs to finish out a few weeks ago as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory. Several weeks ago it enjoyed a solid week moving up from below 0.9300 to a then three week high around 0.9370 before easing a little lower to finish the week.

The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220.

Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

Australia's economy is expected to pick up pace in early 2015 as consumers become more confident and start spending again. The Westpac/Melbourne Institute Leading Index, which indicates the likely pace of economic activity three to nine months into the future, fell by 0.15 points in August. That would indicate that economic growth will stay at a below average pace for the rest of the year, but Westpac chief economist Bill Evans is more optimistic about the new year. He expects consumer spending in the second half of 2014 to improve and rise further in the new year. "That more positive consumer outlook is expected to strengthen further in the first half of 2015, reaching a 3.5 per cent annualised pace," Mr Evan said. "That is consistent with our slightly more upbeat view on the first half of 2015 than is implied by the index." Westpac's forecast for annualised economic growth for the first half of 2015 is 3.25 per cent, which is more optimistic than the Reserve Bank's most recent forecast of two to three per cent. "Over the last six months the index's growth rate has remained at a below trend growth pace," Mr Evans said. "However, the components of the index which have been driving this below trend pace have evolved."

(Daily chart / 4 hourly chart below)

AUD/USD September 21 at 23:30 GMT 0.8934 H: 0.8935 L: 0.8923

AUD/USD Technical

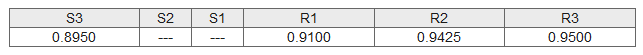

During the early hours of the Asian trading session on Monday, the AUD/USD is trying to rally a little higher after finding some support around 0.8920, after falling heavily over the last week or so. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to near 0.95 again. Current range: trading right around 0.8930.

Further levels in both directions:

- Below: 0.8920.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.