The last couple of weeks has seen the Australian dollar drift lower from resistance just below 0.95 after reaching a six month high in that area however in the last couple of days it has received solid support from near 0.93 moving it higher slightly. Over the last month or so the 0.93 level has become very significant as it first provided stiff resistance to movement higher and in the last couple of weeks, it has looked poised to offer support. The Australian dollar seems settled above 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

For several months either side of the New Year the Australian dollar established and traded within a narrow range roughly between 0.88 and the previous resistance level at 0.90. Back in January the Australian dollar was able to rally higher pushing through the resistance at 0.90 to a one month high near 0.91, however it quickly returned to more familiar territory below the resistance levels at 0.90 and 0.88. After showing some resilience in early December moving to a one week high above 0.9150, the AUD/USD spent the next two weeks turning around sharply and falling heavily down to a then three month low close to 0.88.

Australia's central bank said economic developments in the past month had done nothing to sway its resolve to keep interest rates steady for a while, noting there had been further signs that low borrowing costs were supporting growth. In the minutes of its April 1 policy meeting, the Reserve Bank of Australia (RBA) again said the local dollar was high by historical standards, and that its recent appreciation meant the exchange rate was now less effective in helping the economy achieve balanced growth. "At recent meetings, the Board had judged that it was prudent to leave the cash rate unchanged and members noted that the cash rate could remain at its current level for some time if the economy was to evolve broadly as expected," the minutes said. "Developments over the past month had not changed that assessment." The RBA kept its cash rate at a record low 2.5 percent, where it has been since August. In all, the central bank has slashed 225 basis points off its benchmark rate since late 2011.

(Daily chart / 4 hourly chart below)

AUD/USD April 23 at 00:20 GMT 0.9365 H: 0.9378 L: 0.9347

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the AUD/USD is continuing to move very little as it consolidates and trades around 0.9365 after finding solid support around 0.9320 for the last couple of days. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.90 again. Current range: trading right around 0.9365.

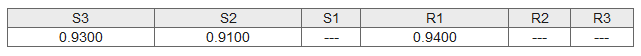

Further levels in both directions:

- Below: 0.9300 and 0.9100.

- Above: 0.9400.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.