The last couple of weeks has seen the Australian dollar drift lower from resistance just below 0.95 after reaching a six month high in that area. Over the last month or so the 0.93 level has become very significant as it first provided stiff resistance to movement higher and in the last couple of weeks, it has looked poised to offer support. The Australian dollar seems settled above 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

For several months either side of the New Year the Australian dollar established and traded within a narrow range roughly between 0.88 and the previous resistance level at 0.90. Back in January the Australian dollar was able to rally higher pushing through the resistance at 0.90 to a one month high near 0.91, however it quickly returned to more familiar territory below the resistance levels at 0.90 and 0.88. After showing some resilience in early December moving to a one week high above 0.9150, the AUD/USD spent the next two weeks turning around sharply and falling heavily down to a then three month low close to 0.88.

Australia's central bank said economic developments in the past month had done nothing to sway its resolve to keep interest rates steady for a while, noting there had been further signs that low borrowing costs were supporting growth. In the minutes of its April 1 policy meeting, the Reserve Bank of Australia (RBA) again said the local dollar was high by historical standards, and that its recent appreciation meant the exchange rate was now less effective in helping the economy achieve balanced growth. "At recent meetings, the Board had judged that it was prudent to leave the cash rate unchanged and members noted that the cash rate could remain at its current level for some time if the economy was to evolve broadly as expected," the minutes said. "Developments over the past month had not changed that assessment." The RBA kept its cash rate at a record low 2.5 percent, where it has been since August. In all, the central bank has slashed 225 basis points off its benchmark rate since late 2011.

(Daily chart / 4 hourly chart below)

AUD/USD April 22 at 00:50 GMT 0.9336 H: 0.9346 L: 0.9318

AUD/USD Technical

During the early hours of the Asian trading session on Tuesday, the AUD/USD is trying to climb back up to the short term resistance level at 0.9340 after finding solid support around 0.9320 for the last day or so. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.90 again. Current range: trading just below 0.9340 around 0.9335.

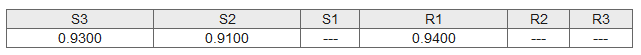

Further levels in both directions:

- Below: 0.9300 and 0.9100.

- Above: 0.9400.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.