Rates

Yesterday, global core bonds showed intraday volatility, but by the end of trading, daily changes were modest and technically irrelevant. In yield terms, the German 2- and 5-yr were up marginally, while the 10- and 30-yr yields were 1-1.5 bps lower. German bonds tested the downside on a stronger German PMI, but couldn’t force a break lower. Afterwards the Bund climbed higher, helped later on by surprisingly weak US New Home sales. However, also this rally faltered. The US 5-yr Note auction was a little mixed (see below). US yields were ultimately down by up to 1.6 bps, the curve flattening. Bond investors are clearly in a wait-and-see mode since the start of the week.

Today, the eco calendar contains the German IFO business climate indicator, US durable goods orders and weekly jobless claims. ECB’s Draghi attends a conference on central banking and Spain, Italy and the US will tap the market (see below). Earnings season remains in full swing. After trading yesterday, Facebook and Apple reported strong results.

The German IFO business climate indicator weakened somewhat in March due to an easing in the expectations component, while the current assessment index improved further. For April, a further, albeit limited drop is expected in the headline index, from 110.7 to 110.4. We believe that the risks are for a downward surprise due to continued tensions in Ukraine, while also export orders might have weakened. Nevertheless, we expect to see a further improvement in the current assessment index. In the US, durable goods orders are forecast to show another strong reading in March, led by a rebound in transportation orders.

The consensus is looking for an increase in the headline reading by 2.0% M/M, while durables ex transportation are forecast to show a more limited increase, by 0.6% M/M. We have no reasons to distance ourselves from the consensus.

Finally, US initial jobless claims have dropped to new cyclical lows recently, which might have been due to distortions in seasonal adjustment factors around Easter. For the week ending the 19th of April, the consensus is looking for an uptick from 304 000 to 315 000. We believe that the risks might be for an upward surprise due to distortions in seasonal factors.

The Spanish treasury taps the on the run 3-yr Bono (2.1% Apr2017), 5-yr Bono (2.75% Apr2019) and 10-yr Obligacion (3.8% Apr2024) for a total amount of €4.5-5.5B. The bonds didn’t cheapen going into the auction. Nevertheless, demand on PIIGS auctions remains underpinned by an iron-strong sentiment towards peripheral debt stemming from investors’ hunting for yield. In the case of Spain, it’s also interesting to see that foreign holdings of Spanish government bonds picked up significantly of late. Spain is also well funded with more than half of this year’s issuance already completed. The Italian debt agency sells zero-coupon bonds (€3-3.5B) and inflation-linked bonds (€0.75-1.5B). The next BTP auction is scheduled for next week (Apr 29). The US $35B 5-yr Note auction was a little mixed. The bid cover was solid (2.79 versus 2.65 average over the past year), and the buy side takedown figures were decent, but the auction still stopped with a 0.6 bps tail. The bidding details were fairly close to average in all three categories (dealer, direct and indirect). Today, the Treasury concludes its end-month financing operation with a $29B 7-yr Note auction. Currently, the WI is trading around 2.29%.

Overnight, Asian equity markets trade again mixed with a Japanese underperformance. After WS closure, both Facebook and Apple posted better earnings. US equity futures trade with gains, but there is no reaction in the US Note future. The RBNZ as expected raised its base interest rate for a second straight month.

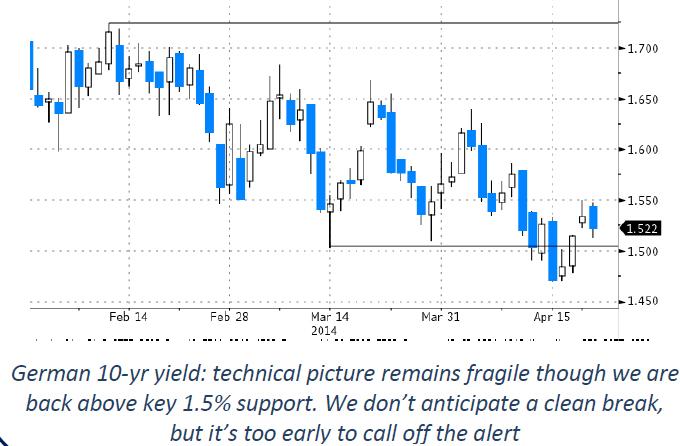

Today, the eco calendar is again interesting with German IFO and US durable goods. We especially look out for the US durables following strong retail sales and industrial production data last week. Are they finally able to influence markets or do we have to wait for next week’s big releases (FOMC, ISM, ADP, Q1 GDP, NFP)? Earnings results and tensions in Ukraine are important for risk sentiment on equity markets. Last week, this was an important driver for bond markets, though the past two days, there was some disconnection. Will this change if the US equities go for an attack on the all-time highs? ECB President Draghi is a wildcard, though we expect him to keep a low profile. There are no new inflation numbers available yet and the next ECB meeting rapidly approaches. Finally, technical elements should be considered as well. The technical picture of the German 10-yr yield remains fragile though we moved back north of 1.50% support since Thursday. Overall, we don’t anticipate a clean break below 1.50%. In the US, the test of the downside of the 2.6%/2.8% failed and we’re comfortably back in the middle of that channel.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.