Markets: Fixed income

On Thursday, global core bonds came under renewed downward pressure, brutally ending a three-day correction. The main item was a more optimistic view of the ECB on the future outlook, but also a strong Spanish bond auction left its traces in the morning session. It confirmed the ongoing risk-on sentiment in markets. Equities at first gained on Mr. Draghi’s comments, but erased the gains in late European trading. US equities afterwards rallied to some solid closing gains. The down-move in the Bund was technically relevant, as the correction occurred when first resistance was under threat. It thus confirms the bearish ST picture. In a daily perspective, German yields went up 4 to 8.3 basis points, steepening the curve. The rise at the shorter end was significant and very visible in the upward shift of the eonia strip curve (see graph below). US Treasuries were also affected by developments in EMU bond markets, but understandably to a lower extent. Initial claims were ignored, but a solid 30- year bond auction brought some temporary and partial solace. Nevertheless it helped the 30-year outperforming the belly of the curve. 30-year yields were 1.9 basis points higher in a daily perspective, while 5 and 10-year yields increased by 2.7 and 3.9 basis points respectively.

Regarding the ECB meeting, the statement was little changed with still downside risks for the economy. However, Mr. Draghi and his colleagues now appear to take a very different view of prospects than they did a month ago, a change that seems quite dramatic relative to the changes in the economic and financial newsflow in the interim. So, whereas in December the ECB discussed a rate cut and seemed close to trigger one, now there was unanimity to keep policy unchanged. Mr. Draghi however made also clear that this change in view shouldn’t be seen as a step towards an exit policy. This is comforting for riskier markets that depend on generous liquidity provision, as was Mr. Draghi’s optimism on structural improvements in financial markets (fragmentation is becoming less extreme) and his view that except for some isolated pockets there was still no exuberance in the main riskier markets. Last week, FOMC discussions on the timing of a possible end of the bond purchase programme sent some shivers through the markets. (For a full review of meeting and press conference: see our flash).

On intra-EMU bond markets, Spanish and Italian spreads narrowed dramatically following a strong Spanish bond sale (see below). The Spanish 10- yr yield spread dropped by 31 bps. The Spanish curve bull steepened with an outperformance of the 5-yr sector (5-yr spread shed 40 bps). In yield terms, Spanish yields approach the 2012 lows from the 3-yr (now 2.74%, low 2.72%) over the 5-yr (3.53%, 3.43%) and 10-yr (4.90%, 4.83%) to the 30-yr (5.61%, 5.75%). We might be up for a test of these levels but a break at first attempt seems unlikely. Therefore, some profit taking on the recent rally can be in the cards today/next week. Italian spreads shed around 20 bps across the curve. Italian yields already fell below their March 2012 lows and are heading towards the all time lows set early 2010. The Italian 3-yr yield trades at 1.84%, compared with the 1.67% low. The Italian yield curve is also steep and longer tenors are further away from these levels. The 5-yr yield trades at 2.83% (versus 2.50%), the 10-yr at 4.16% (3.70%) and the 30-yr at 4.89% (4.57%). The Belgian 10-yr spread shed 7 bps, outperforming Austria and France. The Belgian/French 10-yr yield spread dropped to 6 bps (5 bps Dec low) and the Belgian/German 10-yr yield spread fell to 65 bps (63 bps Dec low). In our recent flash report, we argued that a zero spread versus France and 50 bps versus Germany were feasible levels.

Overnight, Moody’s downgraded Cyprus by three notches from B3 to Caa3, citing the government’s projected debt load from recapitalizing the banking system and the significantly increased likelihood that the country would eventually default or pursue a forced restructuring that might impose losses on creditors. For global markets, Cyprus is less relevant and only a micro problem on the European scale.

The eco calendar is light today with only the US trade balance and UK production data on the agenda. Wells Fargo announces Q4 earnings, Italy will tap the market and Fed’s Plosser (hawk) is scheduled to speak.

In November, the US trade deficit is expected to have narrowed from $42.2B to $41.3B, after widening somewhat in the previous month. In October, both exports and imports dropped significantly, with imports falling to the lowest level since April 2011. For November, some payback in both is expected. Imports of consumer goods might rebound after the decline in October, but we expect a drop in imports of petroleum products, which will partly offset the rebound of imports in consumer goods. Exports will probably rebound only slightly as demand from Europe remains poor. Therefore we believe that the risks are for a bigger than expected deficit.

Yesterday, the Spanish treasury successfully issued a new 2-yr Bono (€3.4B 2.75% Mar2015) and tapped the on the run 5-yr Bono (€1.95B 4.5% Jan2018) and 15-yr Obligacion (€0.47B 5.9% Jul2026) for a combined €5.82B, exceeding the upper bound of the €4-5B target range. Demand was strong, with a total auction bid cover of 2.30. Following the auction, Spanish yield kept declining, which is a positive secondary market reaction. One minor issue might be the relatively low allotted volume for the 15-yr Obligacion. Last year, Spain heavily relied on tapping the front end of the yield curve. The average life of Spanish debt decreased from 6.55 years at the end of 2011 to 6.05 years (Nov 30). If this trend continues this year and Spain fails to attract investors willing to roll down further on the Spanish yield curve, near term refinancing risks will pile up.

Today, the Italian treasury taps the on the run 3-yr BTP (2.75% Dec2015) for €2.75-3.5B and the on the run 5-yr CCTeu (Euribor + 2.5% Jun2017) & off the run 7-yr CCTeu (Euribor + 0.8% Oct2017) for a combined €1-1.5B. The relatively small auction size and short tenor should be easily to digest by investors. The 2015 BTP gave no pre-auction concession and trades at its richest level in ASWterms since the first issuance last December, which is a negative though. This year, Italy enjoys the biggest drop in funding need. The issuance need falls from €225B in 2012 to €180B in 2013. This is primarily due to the lower redemptions (drop from €193B to €155B).

In the US, the $13B 30-yr Bond auction went well. The auction stopped firmly below the 1:00 PM bid side with a better than average bid cover (2.77 versus 2.6). Buy side demand was solid across the board (dealer, direct and indirect). The 30 yr Bond auction concluded the treasury’s mid-month refinancing operation, following a good $32B 3-yr Note auction and an ugly $21B 10-yr Note auction.

In the UK, the Office for National Statistics announced it will maintain its current formula for calculating the retail price index (Carli method). The ONS will develop a new RPI-based analytical series (Jenvons method) but for now it will thus not be used for the RPI. Many market participants expected that the ONS would change the calculation method because it does not meet international standards. UK inflation-linked bonds profited heavily yesterday (yields dropped). If the RPI calculation method would have been changed, coupon payments on these bonds would have been much lower in the future. The inflation linked guilt market anticipated on this by pushing prices lower but was thus wrong footed by the ONS. However, by starting the publication of the RPI according to the Jenvons method, which reports closer to the CPI and meets international standards, the ONS seems to keep the door open for an eventual change in the future.

Overnight, Asian equities cannot profit from solid gains on Wall Street yesterday. Especially Chinese equities drop sharply, after an higher-thanexpected CPI reading. However, profit taking might have been an important motive following a steep rally. Japan outperforms and is up 1% (albeit down from intra-day highs), most likely due to the recent weakening of the yen. Cyprus and South Africa were downgraded overnight, while Fed Kocherlakota sees policy as too tight and expects unemployment rate to drop only to 7% by the end of 2014, which suggest still longer Fed bond buying. However, Kocherlakota represents the dovish aisle of the FOMC and Fed George and Bullard were clearly less keen to continue bond buying when speaking yesterday. The Bund opened near yesterday’s after-market trading levels, unable to profit from the weakening of equities in Asia as an underlying risk-on sentiment and a bearish ST picture may be an offset.

We stick to our Bund negative view, but following the steep decline yesterday and a rather thin calendar today, there might be some preweekend positioning (profit taking shorts?). A strong Italian bond auction may result in a copycat reaction as per Spanish auction yesterday and weigh on the Bund. European equities should open higher catching up on Wall Streets’ gains yesterday, but the slide of Asian equities puts this into question. On the other hand, the S&P is near key resistance (1474, 2012 high). This is a hard nut to crack and we are a reticent to embrace a break ahead of the weekend and given the thin calendar. Results of Wells Fargo might be important.

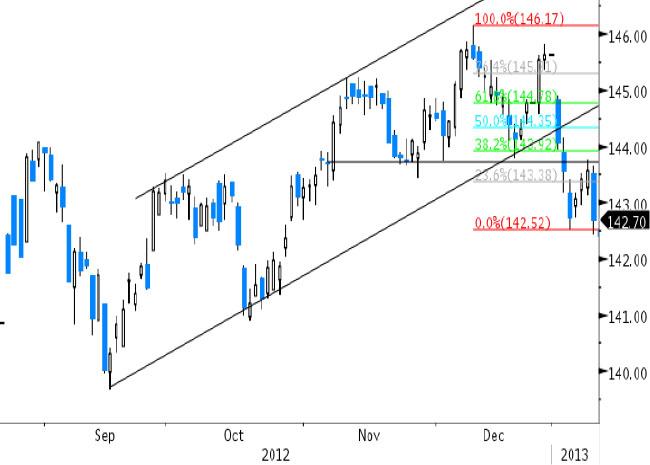

Given all these, sometimes contradicting, short term impetus, we would keep existing short core bond positions in place, but only initiate new shorts in case of return towards our preferred resistances (see below). The technical pictures deteriorated last week with now a double top in place (neckline 143.75 Bund). Entry points for shorts remain 143.75 and 143.92. Supports are at 142.43 (yesterday new low) and 142.27 (1st target double top).

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.