Next Report will be published on Monday 9th of May 2016

On Tuesday, the repositioning out of the dollar initially continued. USD/JPY dropped to the mid 105 area. EUR/USD jumped north of 1.16. The move was technical in nature as investors reacted to the break of key technical levels.

There was little economic news. Finally, the dollar sell-off exhausted and the dollar fully retraced the earlier losses. Fed’s Lockhart keeping the door open for a June rate hike maybe helped the intraday reversal. EUR/USD closed the session at 1.1496 (from 1.1534). USD/JPY rebounded to close the day at 106.50 (from 106.41).

Overnight, risk sentiment in Asia remains negative, with regional indices recording slight to modest losses. Japanese markets are still closed for the Golden week holidays. However, USD/JPY rebounds further in line with the overall performance of the dollar. Oil traded off the recent highs with Brent back at $45 p/b. However, the link between oil and the dollar was not tight of late. EUR/USD lost a few more ticks overnight and trades at .1485. After yesterday’s technical move, the US and EMU data might decide on the next USD move.

Ahead of Ascension Day, the eco calendar heats up. The euro zone services PMI picked up marginally in April to 53.2. We see risks for a slightly stronger outcome after a better than expected manufacturing PMI. EMU retail sales are no mover for euro trading. In the US, hiring is expected to remain on track with the ADP employment report expected to show a 195 000 increase in April. We see risks for an upward surprise following a month of very strong claims data. The US non-manufacturing ISM is expected to increase for a second straight month, rising from 54.5 to 54.8. Also here we see upside risks. Finally, the trade balance is expected to show a significant narrowing in the deficit from $47.1 billion to $41.3 billion, mainly due to a sharp drop in imports.

In a daily perspective, we look out whether the decline of the dollar has run its course. The jury is still out, but yesterday’s intraday reversal of the dollar, looks a bit like a ST exhaustion move . The dollar might enter calmer waters if the ADP report and the non-manufacturing ISM meet market expectations or print better than expected, which is our expectation. Of course a new disappointment might restart the USD sell-off. We assume a consolidation or even slight further USD gains, with the payrolls to decide on the next big move.

Technically, EUR/USD finally broke above the 1.1495 MT range top mirroring broad-based USD weakness. This break was an important technical warning for further dollar losses and opened the way for a retest of the key 1.1712 (2015 high). We maintain the view that the US economy is strong enough to allow the Fed to implement the two pre-announced rate hikes later this year. This is not discounted in the interest rate markets and the currency market. However, for now there is no trigger for the market to really change course. Friday’s payrolls are the next milestone. The soft Fed approach, pockets of risk aversion and the Treasury report on currencies pushed USD/JPY to a new correction low at 106.14 on Friday and this level was again broken this morning. The inaction of the BOJ keeps the downside in USD/JPY fragile. Verbal interventions from Japan to stop the rise of the yen are likely, but we doubt they will change the trend.

USD/JPY remains some kind of a falling knife.

Sterling hammered after poor manufacturing PMI

On Tuesday, sterling was initially driven by the sharp swings in the dollar. In this move cable was also squeezed sharply higher. The pair set a multi-month top around 1.4770. EUR/GBP initially traded relatively stable in the mid 0.78 area.

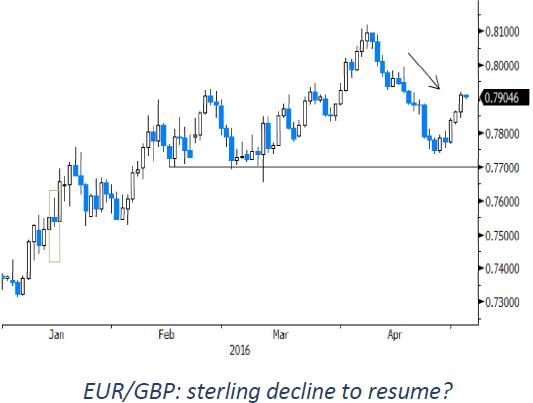

However, the UK manufacturing PMI unexpectedly dropped in contraction territory (49.2) while a marginal improvement to 51.2 was expected. The report triggered a protracted intraday sterling downtrend, both against the dollar and the euro . EUR/GBP filled offers above 0.79 and closed the session at 0.7909 (from 0.7861). The decline of cable was even more impressive as the dollar rebounded later on. The pair closed the session at 1.4535 (from 1.4673).

Today, UK April construction PMI is expected to decline slightly from 54.2 to 54.0. This report is not so important from a market point of view. However, recently, there were already signs of a loss of momentum in the sector.

Additional negative news could trigger further sterling losses. Of course, the focus will be on the services PMI expected tomorrow. That said, we see risk for sterling to remain weak or even decline further short-term.

The technical picture of EUR/GBP improved as the pair broke above the mid 0.79 area. A counter move occurred over the previous weeks and threatened to deteriorate the picture. However the sterling rebound has apparently run its course. Sterling sentiment will remain fragile as long as the referendum outcome isn’t clear. More sterling gains might be difficult from current levels.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.