On Monday, the dollar was well bid. Its rebound was again independent of the published eco data and of the developments on the European and the US bond markets. The prospect of further easing in China supported the dollar against regional currencies (and across the board). Maybe currency traders are prepositioning for strong US eco data later this week, too.

Overnight, the dollar holds about psycho USD/JPY 120

Most Asian equities are still trading in positive territory, but the gains are moderate. The dollar stays well bid too even without no outright supportive news. USD bond yields are little changed. Even so, USD/JPY rose about one yen yesterday and is holding north of the psychological barrier of 120. The dollar is gaining further ground against the euro, too. EUR/USD is trading south of the 1.08 big figure. The Aussie dollar is losing further ground as speculation on an RBA rate cut rises.

Outlook promising for EUR/USD bears

Today, the EMU CPI and the February unemployment rate will be published and we expect upside/downside surprises. The EMU labour market data improved of late, but there was little reaction on the currency market. We see also upside risks for the EMU CPI. In theory, which would be supportive for the euro. However, (currency) markets are currently reluctant to react to positive eco data as the ECB is expected to keep its ultra-easy policy intact at least till September next year. In the US, we see upside risks for the Chicago PMI and the for consumer confidence.

In the current US positive environment, the dollar should be able to profit from stronger US eco data. There is also a very long list of Fed speakers, but most of them already gave their view of late. The Greek negotiations with its creditors are an evergreen and a potential euro.

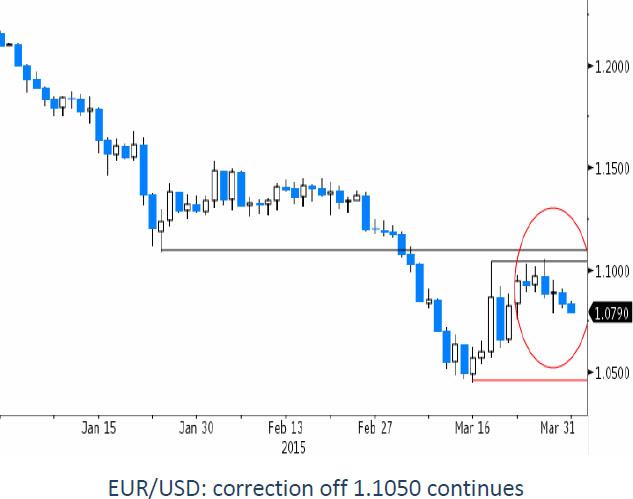

At the end of last week, the EUR/USD rebound lost momentum. Thursday’s rejected test of the 1.1050 area might have been a sign that the euro comeback has run its course. The short-term technical picture looks promising for EUR/USD bears. At the same time, the dollar doesn’t get any substantial interest rate support. We keep a cautious sell-on-upticks approach for the EUR/USD cross rate. Over the next days we will know whether the current rebound is more than end of month/quarter repositioning.

The long-term technical picture for the EUR/USD cross rate is bearish since the pair dropped below the previous cycle low (1.1098). The 1.0500 area was extensively tested, but a sustained break didn’t occur. The dollar started a correction after the Fed March Fed meeting. The 1.1043/98 (post FOMC high/prev. low) resistance area was tested last week, but the test was rejected. A rebound north of 1.1534, still far away, is needed however to question the downtrend.

USD/JPY tested the 121.85/122.03 resistance, but a break didn’t occur. The post-Fed setback didn’t change the USD/JPY picture fundamentally. The pair is till captured in a tight sideways pattern around the 120 pivot (118-122). The downside looks a bit better protected short-term.

Sterling remains in the defensive

On Monday, sterling was in the defensive for most of the session. There were plenty of headlines in the UK press on the elections as the campaign started. The outcome is highly uncertain and weighs on sterling. Especially cable did fight an uphill battle, as the dollar traded strong across the board. The downside in EUR/GBP was blocked even as the euro wasn’t in good shape, suggesting underlying sterling weakness too. Cable closed the session at 1.4810 from 1.4879 on Friday. The cycle low (1.4635) low is again on the radar. EUR/GBP ended the session at 0.7315 from 0.7320 on Friday.

No trigger for a sterling rebound on the horizon

This morning, the UK GFK consumer confidence was stronger than expected. It didn’t help sterling much. Later today, the final release of the UK Q4 GDP will be published. The figure is outdated. The impact on sterling should be limited, except in case of a meaningful downward revision which we don’t expect. So, sterling trading will most probably be at the mercy of global market factors. Dollar strength probably will keep cable under pressure. EUR/GBP might continue to hover in the 0.73 area.

Downside in EUR/GBP looks still blocked

Recently, we advocated to protect EUR/GBP shorts against a temporary countermove and were in no hurry to reinstall EUR/GBP shorts. On Thursday, we got a first sign that the EUR/GBP rally was running out of steam. However, the picture for sterling remains fragile as cable remains in the defensive. We look how the EUR/GBP 0.74 resistance fares. Any decline in EUR/GBP will probably be due to euro weakness rather than a sustained rebound of sterling. For now we keep a neutral/wait-and-see bias on EUR/GBP and look for confirmation that the rebound as run its course.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.